Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mrs Angie Simon owns properties in and around Windhoek that are leased out under her solely owned enterprise. Her property portfolio includes both the

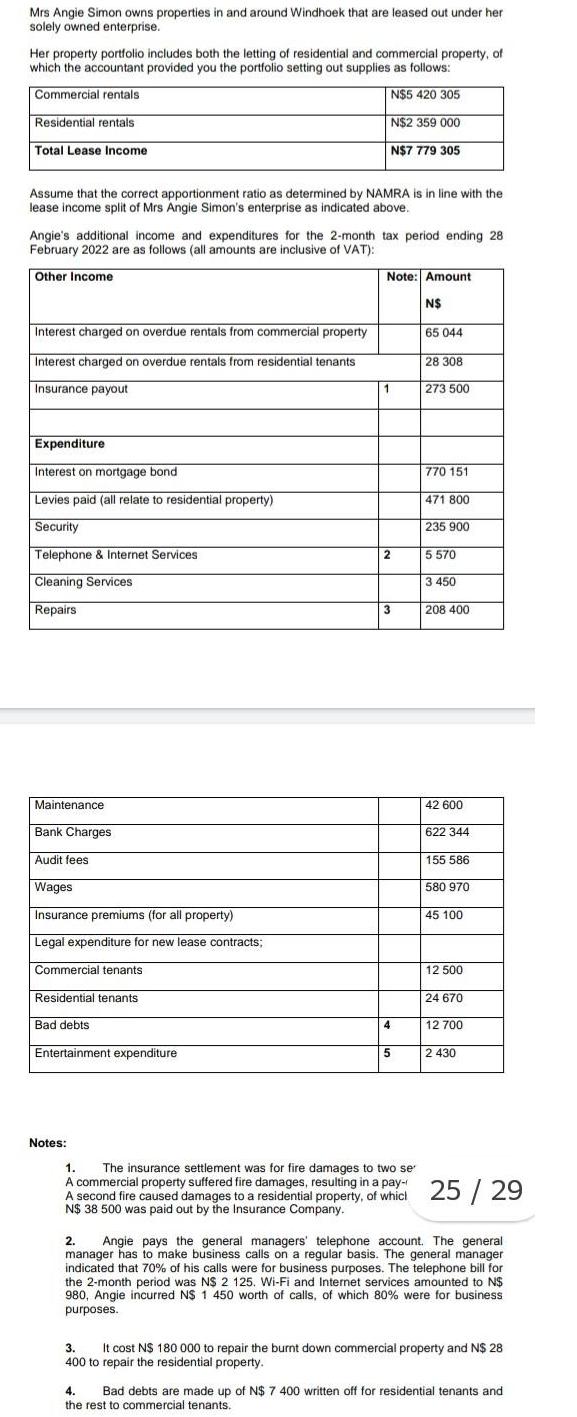

Mrs Angie Simon owns properties in and around Windhoek that are leased out under her solely owned enterprise. Her property portfolio includes both the letting of residential and commercial property, of which the accountant provided you the portfolio setting out supplies as follows: Commercial rentals N$5 420 305 Residential rentals N$2 359 000 Total Lease Income N$7 779 305 Assume that the correct apportionment ratio as determined by NAMRA is in line with the lease income split of Mrs Angie Simon's enterprise as indicated above. Angie's additional income and expenditures for the 2-month tax period ending 28 February 2022 are as follows (all amounts are inclusive of VAT): Other Income Interest charged on overdue rentals from commercial property Interest charged on overdue rentals from residential tenants Insurance payout Expenditure Interest on mortgage bond Levies paid (all relate to residential property) Security Telephone & Internet Services Cleaning Services Repairs Maintenance Bank Charges Audit fees Wages Insurance premiums (for all property) Legal expenditure for new lease contracts; Commercial tenants Residential tenants Bad debts Entertainment expenditure Notes: Note: Amount N$ 1 2 3 4 5 65 044 28 308 273 500 770 151 471 800 235 900 5 570 3 450 208 400 42 600 622 344 155 586 580 970 45 100 12 500 24 670 12 700 2 430 1. The insurance settlement was for fire damages to two se A commercial pay- suffered fire A second fire caused damages to a residential property, of which 25 / 29 N$ 38 500 was paid out by the Insurance Company. 2. Angie pays the general managers' telephone account. The general manager has to make business calls on a regular basis. The general manager indicated that 70% of his calls were for business purposes. The telephone bill for the 2-month period was N$ 2 125. Wi-Fi and Internet services amounted to N$ 980, Angie incurred N$ 1 450 worth of calls, of which 80% were for business purposes. 3. It cost N$ 180 000 to repair the burnt down commercial property and N$ 28 400 to repair the residential property. 4. Bad debts are made up of N$ 7 400 written off for residential tenants and the rest to commercial tenants. 5. Angie Simon takes the Auditors and the lawyer to lunch from time to time. REQUIRED: Calculate the VAT payable/refundable by or to Mrs Angie Simon's enterprise for the 2-month period ending 28 February 2022. (30 marks)

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

VAT PayableRefundable Input VAT Output VAT Input VAT Insurance payout 1 N 273 500 x 15 N 41 025 Tele...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started