Question

Mrs. Ani invested 100,000,000 on January 1, 2021. On January 1 May 2021, Mrs. Ani withdrew her funds amounting to 60,000,000 from the funds that

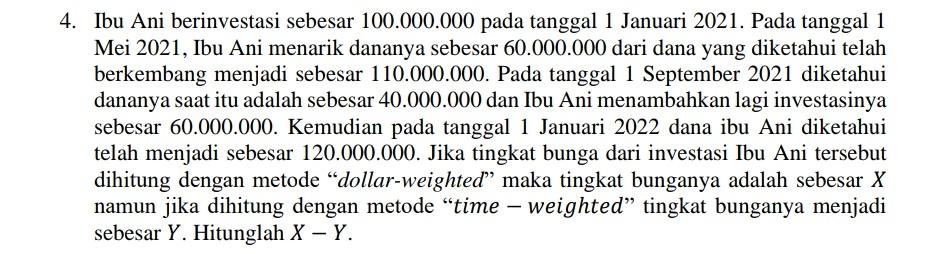

Mrs. Ani invested 100,000,000 on January 1, 2021. On January 1 May 2021, Mrs. Ani withdrew her funds amounting to 60,000,000 from the funds that were known to have been grew to 110,000,000. On September 1, 2021 it is known the fund at that time was 40,000,000 and Mrs. Ani added another investment of 60,000,000. Then on January 1, 2022, Ani's mother's funds were discovered has become 120,000,000. If the interest rate on Mrs. Ani's investment calculated using the dollar-weighted method, the interest rate is X but if it is calculated using the -weighted method, the interest rate becomes of Y . Calculate of X - Y .

4. Ibu Ani berinvestasi sebesar 100.000.000 pada tanggal 1 Januari 2021. Pada tanggal 1 Mei 2021, Ibu Ani menarik dananya sebesar 60.000.000 dari dana yang diketahui telah berkembang menjadi sebesar 110.000.000. Pada tanggal 1 September 2021 diketahui dananya saat itu adalah sebesar 40.000.000 dan Ibu Ani menambahkan lagi investasinya sebesar 60.000.000. Kemudian pada tanggal 1 Januari 2022 dana ibu Ani diketahui telah menjadi sebesar 120.000.000. Jika tingkat bunga dari investasi Ibu Ani tersebut dihitung dengan metode "dollar-weighted" maka tingkat bunganya adalah sebesar X namun jika dihitung dengan metode "time - weighted" tingkat bunganya menjadi sebesar Y. Hitunglah X - YStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started