Question

Mrs. Goodey has $15000 and wants to build a portfolio that has a rate of return of % by investing in just two securities or

The risk-free rate is 4.97% . The correlation coefficients is ρ12 = 0.85. The risk-free rate has a standard deviation of zero and a correlation of zero with all the securities.

Which portfolio is the efficient portfolio (the one with the smallest risk)? In your answer give the composition of the portfolio and the weights?

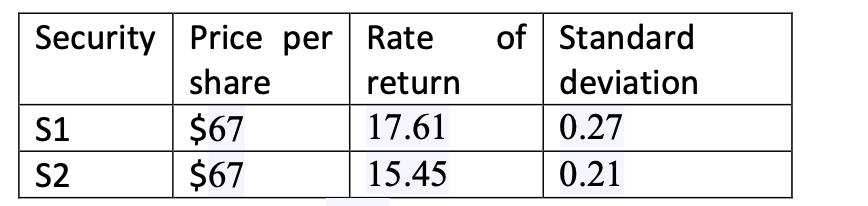

Security Price per Rate share S1 S2 $67 $67 return 17.61 15.45 of Standard deviation 0.27 0.21

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To determine the efficient portfolio with the smallest risk we need to calculate the portfolio risk ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M Wahlen, Stephen P Baginskl, Mark T Bradshaw

7th Edition

9780324789423, 324789416, 978-0324789416

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App