Question

MRS Ltd. acquired new equipment for purchase price Tk 3500000 at the beginning of the accounting year. Carrying cost was Tk.50000, testing cost was

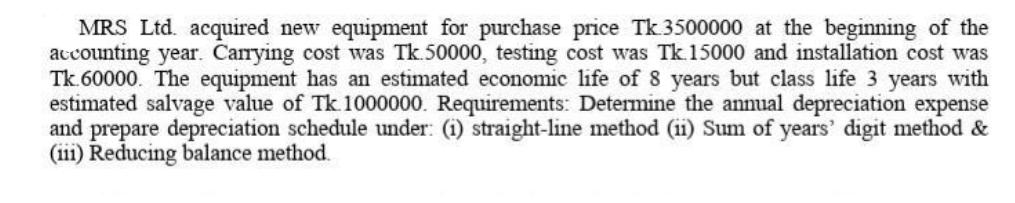

MRS Ltd. acquired new equipment for purchase price Tk 3500000 at the beginning of the accounting year. Carrying cost was Tk.50000, testing cost was Tk. 15000 and installation cost was Tk 60000. The equipment has an estimated economic life of 8 years but class life 3 years with estimated salvage value of Tk 1000000. Requirements: Determine the annual depreciation expense and prepare depreciation schedule under: (i) straight-line method (ii) Sum of years' digit method & (iii) Reducing balance method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure I can help you with that Lets calculate the annual depreciation expense and prepare the depreci...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Accounting

Authors: Timothy Doupnik, Hector Perera

3rd Edition

978-0078110955, 0078110955

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App