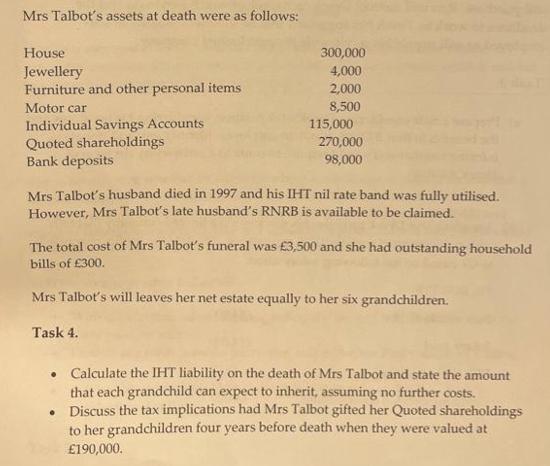

Mrs Talbot's assets at death were as follows: House Jewellery Furniture and other personal items Motor car Individual Savings Accounts Quoted shareholdings Bank deposits

Mrs Talbot's assets at death were as follows: House Jewellery Furniture and other personal items Motor car Individual Savings Accounts Quoted shareholdings Bank deposits 300,000 4,000 2,000 8,500 115,000 270,000 98,000 Mrs Talbot's husband died in 1997 and his IHT nil rate band was fully utilised. However, Mrs Talbot's late husband's RNRB is available to be claimed. Task 4. The total cost of Mrs Talbot's funeral was 3,500 and she had outstanding household bills of 300. Mrs Talbot's will leaves her net estate equally to her six grandchildren. Calculate the IHT liability on the death of Mrs Talbot and state the amount that each grandchild can expect to inherit, assuming no further costs. Discuss the tax implications had Mrs Talbot gifted her Quoted shareholdings to her grandchildren four years before death when they were valued at 190,000.

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the IHT liability on the death of Mrs Talbot and state the amount that each grandchild c...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started