Answered step by step

Verified Expert Solution

Question

1 Approved Answer

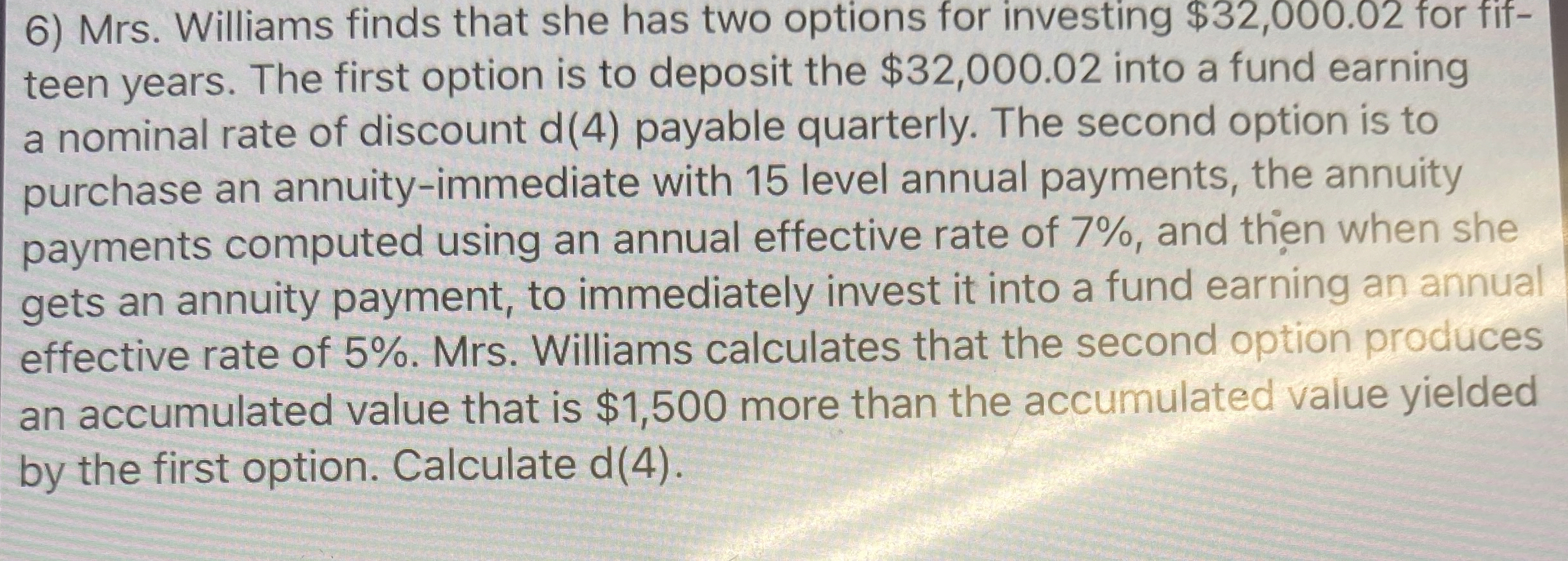

Mrs . Williams finds that she has two options for investing $ 3 2 , 0 0 0 . 0 2 for fif - teen

Mrs Williams finds that she has two options for investing $ for fif

teen years. The first option is to deposit the $ into a fund earning

a nominal rate of discount payable quarterly. The second option is to

purchase an annuityimmediate with level annual payments, the annuity

payments computed using an annual effective rate of and then when she

gets an annuity payment, to immediately invest it into a fund earning an annual

effective rate of Mrs Williams calculates that the second option produces

an accumulated value that is $ more than the accumulated value yielded

by the first option. Calculate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started