Answered step by step

Verified Expert Solution

Question

1 Approved Answer

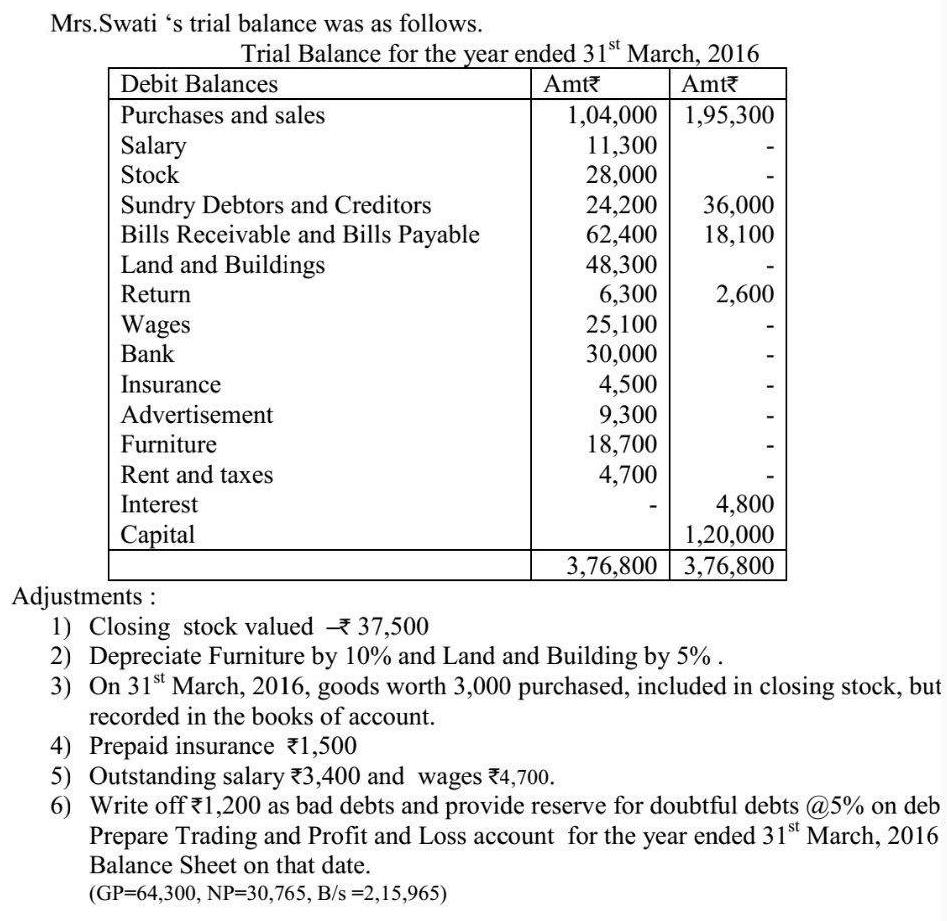

Mrs.Swati 's trial balance was as follows. Trial Balance for the year ended 31 March, 2016 Debit Balances Amt Amt 1,04,000 1,95,300 11,300 28,000

Mrs.Swati 's trial balance was as follows. Trial Balance for the year ended 31" March, 2016 Debit Balances Amt Amt 1,04,000 1,95,300 11,300 28,000 24,200 62,400 48,300 6,300 25,100 30,000 4,500 9,300 18,700 4,700 Purchases and sales Salary Stock Sundry Debtors and Creditors Bills Receivable and Bills Payable Land and Buildings 36,000 18,100 Return 2,600 Wages Bank Insurance Advertisement Furniture Rent and taxes 4,800 1,20,000 3,76,800 3,76,800 Interest Capital Adjustments : 1) Closing stock valued 37,500 2) Depreciate Furniture by 10% and Land and Building by 5% . 3) On 31 March, 2016, goods worth 3,000 purchased, included in closing stock, but recorded in the books of account. 4) Prepaid insurance 1,500 5) Outstanding salary 3,400 and wages 4,700. 6) Write off 1,200 as bad debts and provide reserve for doubtful debts @5% on deb Prepare Trading and Profit and Loss account for the year ended 31 March, 2016 Balance Sheet on that date. (GP=64,300, NP=30,765, B/s =2,15,965)

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Solution ABC Corporation Balance Sheet December 31 2019 ASSETS Current Assets Bank 30000 Accounts Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started