Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Alma Serah is planning to leverage equity capital with debt during the years 2022, 2023 and 2024. She is keen to know whether

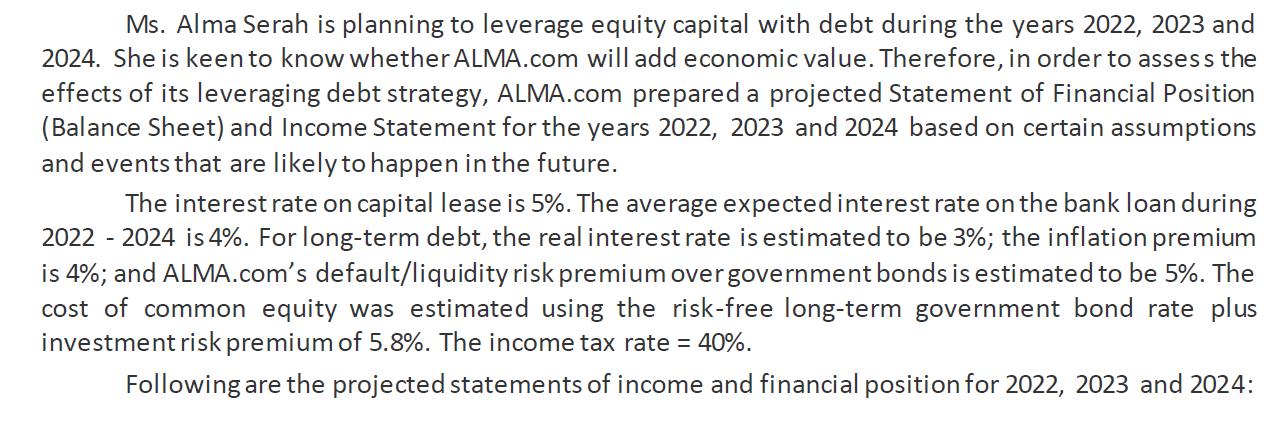

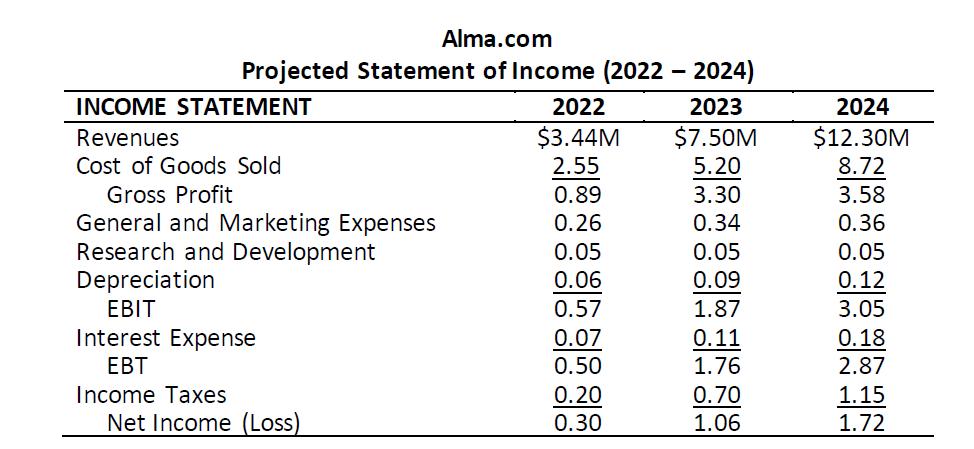

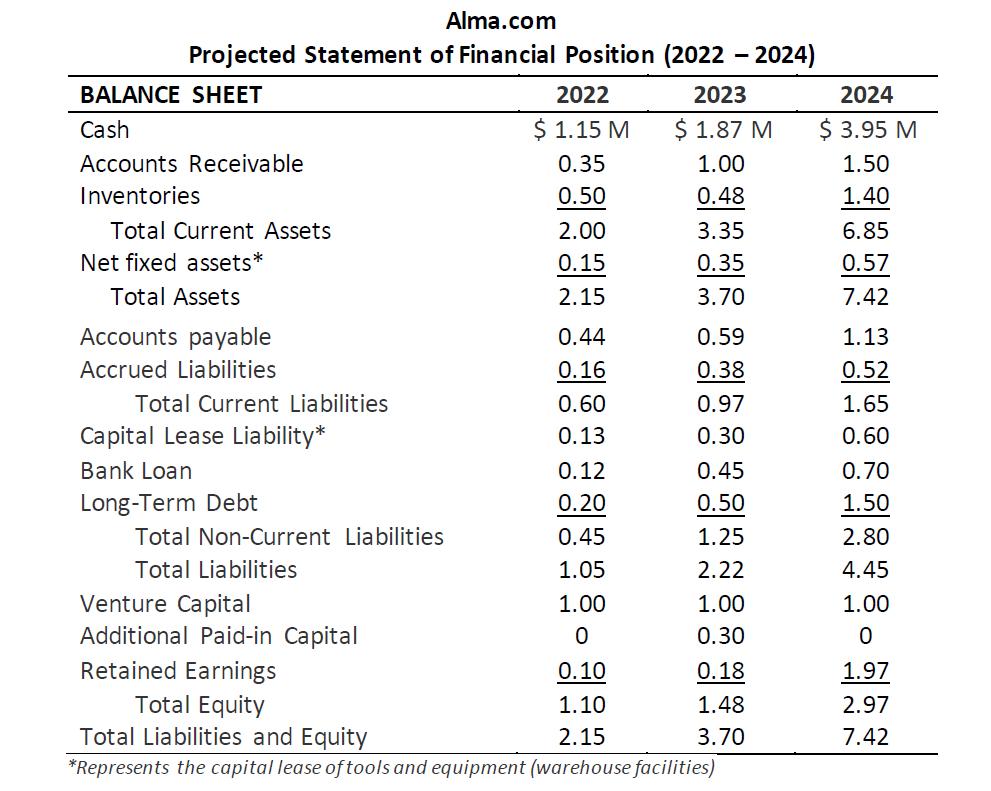

Ms. Alma Serah is planning to leverage equity capital with debt during the years 2022, 2023 and 2024. She is keen to know whether ALMA.com will add economic value. Therefore, in order to assess the effects of its leveraging debt strategy, ALMA.com prepared a projected Statement of Financial Position (Balance Sheet) and Income Statement for the years 2022, 2023 and 2024 based on certain assumptions and events that are likely to happen in the future. The interest rate on capital lease is 5%. The average expected interest rate on the bank loan during 2022 - 2024 is 4%. For long-term debt, the real interest rate is estimated to be 3%; the inflation premium is 4%; and ALMA.com's default/liquidity risk premium over government bonds is estimated to be 5%. The cost of common equity was estimated using the risk-free long-term government bond rate plus investment risk premium of 5.8%. The income tax rate = 40%. Following are the projected statements of income and financial position for 2022, 2023 and 2024: INCOME STATEMENT Revenues Cost of Goods Sold Gross Profit General and Marketing Expenses Research and Development Depreciation EBIT Alma.com Projected Statement of Income (2022 - 2024) Interest Expense EBT Income Taxes Net Income (Loss) 2022 $3.44M 2.55 0.89 0.26 0.05 0.06 0.57 0.07 0.50 0.20 0.30 2023 $7.50M 5.20 3.30 0.34 0.05 0.09 1.87 0.11 1.76 0.70 1.06 2024 $12.30M 8.72 3.58 0.36 0.05 0.12 3.05 0.18 2.87 1.15 1.72 Alma.com Projected Statement of Financial Position (2022 - 2024) BALANCE SHEET Cash Accounts Receivable Inventories Total Current Assets Net fixed assets* Total Assets Accounts payable Accrued Liabilities Total Current Liabilities Capital Lease Liability* Bank Loan Long-Term Debt Total Non-Current Liabilities Total Liabilities 2022 $ 1.15 M 0.35 0.50 2.00 0.15 2.15 Venture Capital Additional Paid-in Capital Retained Earnings Total Equity 0.44 0.16 0.60 0.13 0.12 0.20 2023 $ 1.87 M 1.00 0.48 3.35 0.35 3.70 0.59 0.38 0.97 0.30 0.45 0.50 0.45 1.05 1.00 0 0.10 1.10 Total Liabilities and Equity 2.15 *Represents the capital lease of tools and equipment (warehouse facilities) 1.25 2.22 1.00 0.30 0.18 1.48 3.70 2024 $ 3.95 M 1.50 1.40 6.85 0.57 7.42 1.13 0.52 1.65 0.60 0.70 1.50 2.80 4.45 1.00 0 1.97 2.97 7.42 h. Determine the financial structure weights from ALMA.com's 2024 statement of financial position for the three interest-bearing debt components and the common equity. i. Calculate ALMA.com's weighted average cost of capital (WACC) j. Estimate ALMA.com's economic value added (EVA). Did ALMA.com expect to build or destroy economic value in 2024? [Hint: Consider whether ALMA.com is adding economic value in terms of its net operating profit after taxes (NOPAT)* and its weighted average cost of capital (WACC). k. Alma.com investors have been approached by an outside investor who wants to invest $3.0M in the venture at the end of 2020. What percentage of ownership in the venture should ALMA.com investors give up to the outside investor for a $3.0M new investment? Alma.com financial analysts predict that Operating Cash Flows are expected to be $0.21M in 2021, $0.55M in 2022, $0.60M in 2023 and $0.76M in 2024. The analysts further predict that the company's cash flows are expected to grow at 1% annual rate indefinitely beyond 2024. [Hint: Use Projected Free Cash Flow]. Ms. Alma Serah is planning to leverage equity capital with debt during the years 2022, 2023 and 2024. She is keen to know whether ALMA.com will add economic value. Therefore, in order to assess the effects of its leveraging debt strategy, ALMA.com prepared a projected Statement of Financial Position (Balance Sheet) and Income Statement for the years 2022, 2023 and 2024 based on certain assumptions and events that are likely to happen in the future. The interest rate on capital lease is 5%. The average expected interest rate on the bank loan during 2022 - 2024 is 4%. For long-term debt, the real interest rate is estimated to be 3%; the inflation premium is 4%; and ALMA.com's default/liquidity risk premium over government bonds is estimated to be 5%. The cost of common equity was estimated using the risk-free long-term government bond rate plus investment risk premium of 5.8%. The income tax rate = 40%. Following are the projected statements of income and financial position for 2022, 2023 and 2024: INCOME STATEMENT Revenues Cost of Goods Sold Gross Profit General and Marketing Expenses Research and Development Depreciation EBIT Alma.com Projected Statement of Income (2022 - 2024) Interest Expense EBT Income Taxes Net Income (Loss) 2022 $3.44M 2.55 0.89 0.26 0.05 0.06 0.57 0.07 0.50 0.20 0.30 2023 $7.50M 5.20 3.30 0.34 0.05 0.09 1.87 0.11 1.76 0.70 1.06 2024 $12.30M 8.72 3.58 0.36 0.05 0.12 3.05 0.18 2.87 1.15 1.72 Alma.com Projected Statement of Financial Position (2022 - 2024) BALANCE SHEET Cash Accounts Receivable Inventories Total Current Assets Net fixed assets* Total Assets Accounts payable Accrued Liabilities Total Current Liabilities Capital Lease Liability* Bank Loan Long-Term Debt Total Non-Current Liabilities Total Liabilities 2022 $ 1.15 M 0.35 0.50 2.00 0.15 2.15 Venture Capital Additional Paid-in Capital Retained Earnings Total Equity 0.44 0.16 0.60 0.13 0.12 0.20 2023 $ 1.87 M 1.00 0.48 3.35 0.35 3.70 0.59 0.38 0.97 0.30 0.45 0.50 0.45 1.05 1.00 0 0.10 1.10 Total Liabilities and Equity 2.15 *Represents the capital lease of tools and equipment (warehouse facilities) 1.25 2.22 1.00 0.30 0.18 1.48 3.70 2024 $ 3.95 M 1.50 1.40 6.85 0.57 7.42 1.13 0.52 1.65 0.60 0.70 1.50 2.80 4.45 1.00 0 1.97 2.97 7.42 h. Determine the financial structure weights from ALMA.com's 2024 statement of financial position for the three interest-bearing debt components and the common equity. i. Calculate ALMA.com's weighted average cost of capital (WACC) j. Estimate ALMA.com's economic value added (EVA). Did ALMA.com expect to build or destroy economic value in 2024? [Hint: Consider whether ALMA.com is adding economic value in terms of its net operating profit after taxes (NOPAT)* and its weighted average cost of capital (WACC). k. Alma.com investors have been approached by an outside investor who wants to invest $3.0M in the venture at the end of 2020. What percentage of ownership in the venture should ALMA.com investors give up to the outside investor for a $3.0M new investment? Alma.com financial analysts predict that Operating Cash Flows are expected to be $0.21M in 2021, $0.55M in 2022, $0.60M in 2023 and $0.76M in 2024. The analysts further predict that the company's cash flows are expected to grow at 1% annual rate indefinitely beyond 2024. [Hint: Use Projected Free Cash Flow].

Step by Step Solution

★★★★★

3.55 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To address the questions outlined in the provided material we will need to execute several financial calculations and evaluations Lets start with the first task h Determine the financial structure wei...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started