Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Bloggs has total assets of $100,000 of which 25% consists of her house, and 75% is invested in riskless T-bills. The 25% allocation

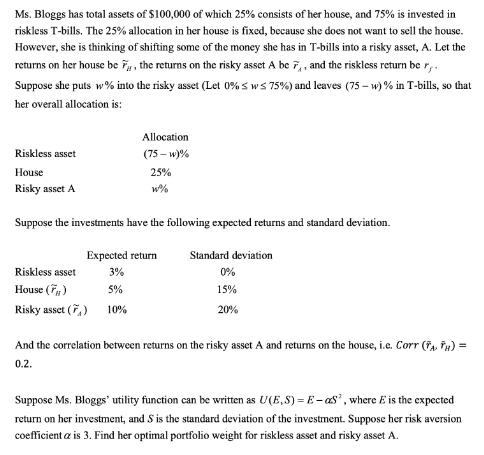

Ms. Bloggs has total assets of $100,000 of which 25% consists of her house, and 75% is invested in riskless T-bills. The 25% allocation in her house is fixed, because she does not want to sell the house. However, she is thinking of shifting some of the money she has in T-bills into a risky asset, A. Let the returns on her house be F, the returns on the risky asset A be 7, and the riskless return be r,. Suppose she puts w% into the risky asset (Let 0% Sws 75%) and leaves (75-w) % in T-bills, so that her overall allocation is: Riskless asset House Risky asset A Suppose the investments have the following expected returns and standard deviation. Expected return Standard deviation 3% Riskless asset House (F) Risky asset (7) Allocation (75-w)% 25% w% 5% 10% 0% 15% 20% And the correlation between returns on the risky asset A and returns on the house, i.e. Corr (FFH) = 0.2. Suppose Ms. Bloggs' utility function can be written as U(E,S) - E-as, where E is the expected return on her investment, and S is the standard deviation of the investment. Suppose her risk aversion coefficienta is 3. Find her optimal portfolio weight for riskless asset and risky asset A. Ms. Bloggs has total assets of $100,000 of which 25% consists of her house, and 75% is invested in riskless T-bills. The 25% allocation in her house is fixed, because she does not want to sell the house. However, she is thinking of shifting some of the money she has in T-bills into a risky asset, A. Let the returns on her house be F, the returns on the risky asset A be 7, and the riskless return be r,. Suppose she puts w% into the risky asset (Let 0% 5 w 75%) and leaves (75-w) % in T-bills, so that her overall allocation is: Riskless asset House Risky asset A Suppose the investments have the following expected returns and standard deviation. Expected return Standard deviation 3% Riskless asset House (F) Risky asset (7) Allocation (75-w)% 25% w% 5% 10% 0% 15% 20% And the correlation between returns on the risky asset A and returns on the house, i.e. Corr (FFH) = 0.2. Suppose Ms. Bloggs' utility function can be written as U(E, S)= E-as, where E is the expected return on her investment, and S is the standard deviation of the investment. Suppose her risk aversion coefficienta is 3. Find her optimal portfolio weight for riskless asset and risky asset A.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Ms Bloggs total assets are 100000 25 of her assets are allocated to her house 25000 Initial...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started