Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms Chanda has analyzed a stock for a one-year holding period. The stock is currently (today) priced at K100 per share and will pay a

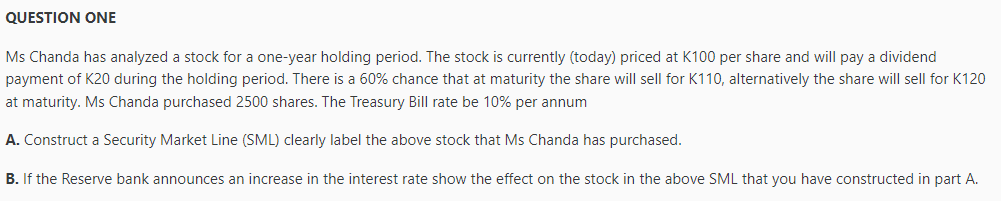

Ms Chanda has analyzed a stock for a one-year holding period. The stock is currently (today) priced at K100 per share and will pay a dividend payment of K20 during the holding period. There is a 60% chance that at maturity the share will sell for K110, alternatively the share will sell for K120 at maturity. Ms Chanda purchased 2500 shares. The Treasury Bill rate be 10% per annum A. Construct a Security Market Line (SML) clearly label the above stock that Ms Chanda has purchased. B. If the Reserve bank announces an increase in the interest rate show the effect on the stock in the above SML that you have constructed in part A

Ms Chanda has analyzed a stock for a one-year holding period. The stock is currently (today) priced at K100 per share and will pay a dividend payment of K20 during the holding period. There is a 60% chance that at maturity the share will sell for K110, alternatively the share will sell for K120 at maturity. Ms Chanda purchased 2500 shares. The Treasury Bill rate be 10% per annum A. Construct a Security Market Line (SML) clearly label the above stock that Ms Chanda has purchased. B. If the Reserve bank announces an increase in the interest rate show the effect on the stock in the above SML that you have constructed in part A Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started