Answered step by step

Verified Expert Solution

Question

1 Approved Answer

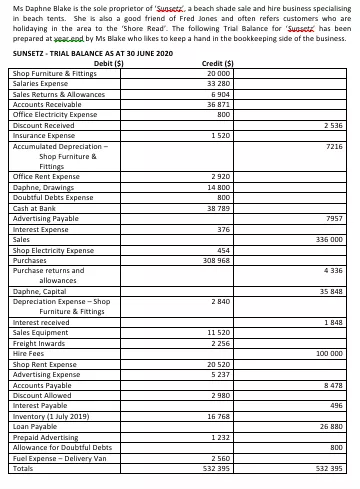

? Ms Daphne Blake is the sole proprietor of 'Suasetz, a beach shade sale and hire business specialising in beach tents. She is also a

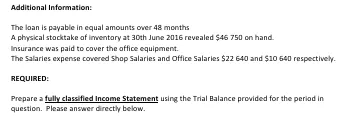

Ms Daphne Blake is the sole proprietor of 'Suasetz, a beach shade sale and hire business specialising in beach tents. She is also a good friend of Fred Jones and often refers customers who are holidaying in the area to the 'Shore Read. The following Trial Balance for 'Suosez has been prepared at yeacead by Ms Blake who likes to keep a hand in the bookkeeping side of the business. SUNSETZ-TRIAL BALANCE AS AT 30 JUNE 2020 Debit (5) Shop Furniture & Fittings Salaries Expense Sales Returns & Allowances Accounts Receivable Office Electricity Expense Discount Received Insurance Expense Accumulated Depreciation - Shop Furniture & Fittings Office Rent Expense Daphne, Drawings Doubtful Debts Expense Cash at Bank Advertising Payable Interest Expense Sales Shop Electricity Expense Purchases Purchase returns and allowances Daphne, Capital Depreciation Expense - Shop Furniture & Fittings Interest received Sales Equipment Freight Inwards Hire Fees Shop Rent Expense Advertising Expense Accounts Payable Discount Allowed Interest Payable Inventory (1 July 2019) Loan Payable Prepaid Advertising Allowance for Doubtful Debts Fuel Expense-Delivery Van Totals Credit ($) 20 000 33 280 6 904 36 871 800 1520 2920 14 800 800 38 789 376 454 308 968 2 840 11 520 2 256 20 520 237 5 2980 16 768 1 232 2560 532 395 2 536 7216 7957 336 000 4336 35 848 1 848 100 000 8 478 496 26 880 800 532 395 Additional Information: The loan is payable in equal amounts over 48 months A physical stocktake of inventory at 30th June 2016 revealed $46 750 on hand. Insurance was paid to cover the office equipment. The Salaries expense covered Shop Salaries and Office Salaries $22 640 and $10 640 respectively. REQUIRED: Prepare a fully classified Income Statement using the Trial Balance provided for the period in question. Please answer directly below.

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Income Statement A financial statement which shows profitability of company over a period of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started