Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Dora McLean operates an unincorporated business. During the taxation year ending December 31, 2018, the business had net business income of $95,000 Dora

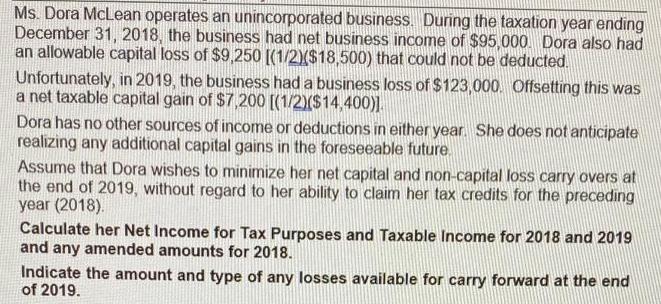

Ms. Dora McLean operates an unincorporated business. During the taxation year ending December 31, 2018, the business had net business income of $95,000 Dora also had an allowable capital loss of $9,250 [(1/2)($18,500) that could not be deducted. Unfortunately, in 2019, the business had a business loss of $123,000. Offsetting this was a net taxable capital gain of $7,200 [(1/2)($14,400)]. Dora has no other sources of income or deductions in either year. She does not anticipate realizing any additional capital gains in the foreseeable future. Assume that Dora wishes to minimize her net capital and non-capital loss carry overs at the end of 2019, without regard to her ability to claim her tax credits for the preceding year (2018). Calculate her Net Income for Tax Purposes and Taxable Income for 2018 and 2019 and any amended amounts for 2018. Indicate the amount and type of any losses available for carry forward at the end of 2019.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer and Explanation For 2018 Dora had Net Income For Tax Purposes and Taxable Income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started