Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calculate the Total Income, Net Income, and Taxable Income. Ms. Eleanor Victoria's husband died two years ago. After her husband died, she moved from her

Calculate the Total Income, Net Income, and Taxable Income.

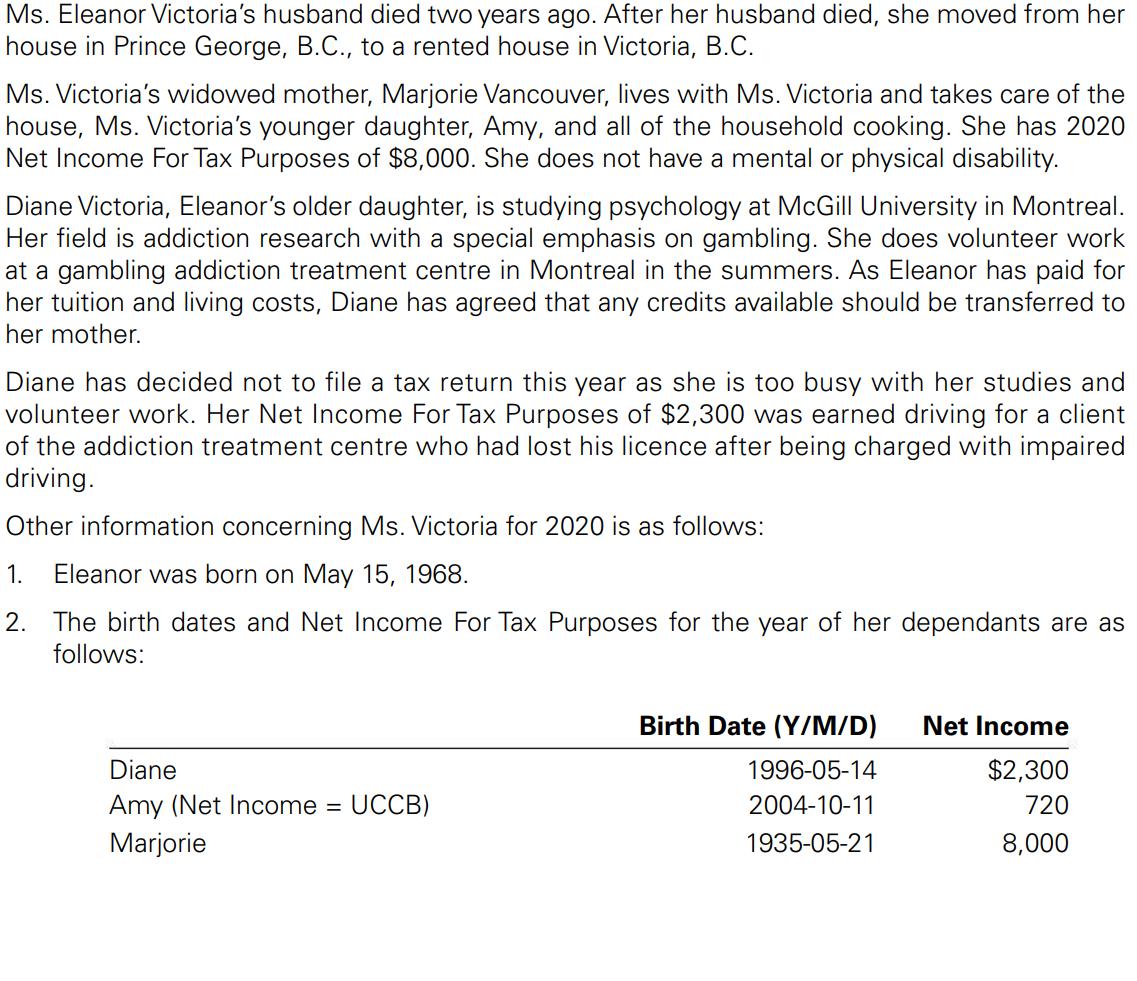

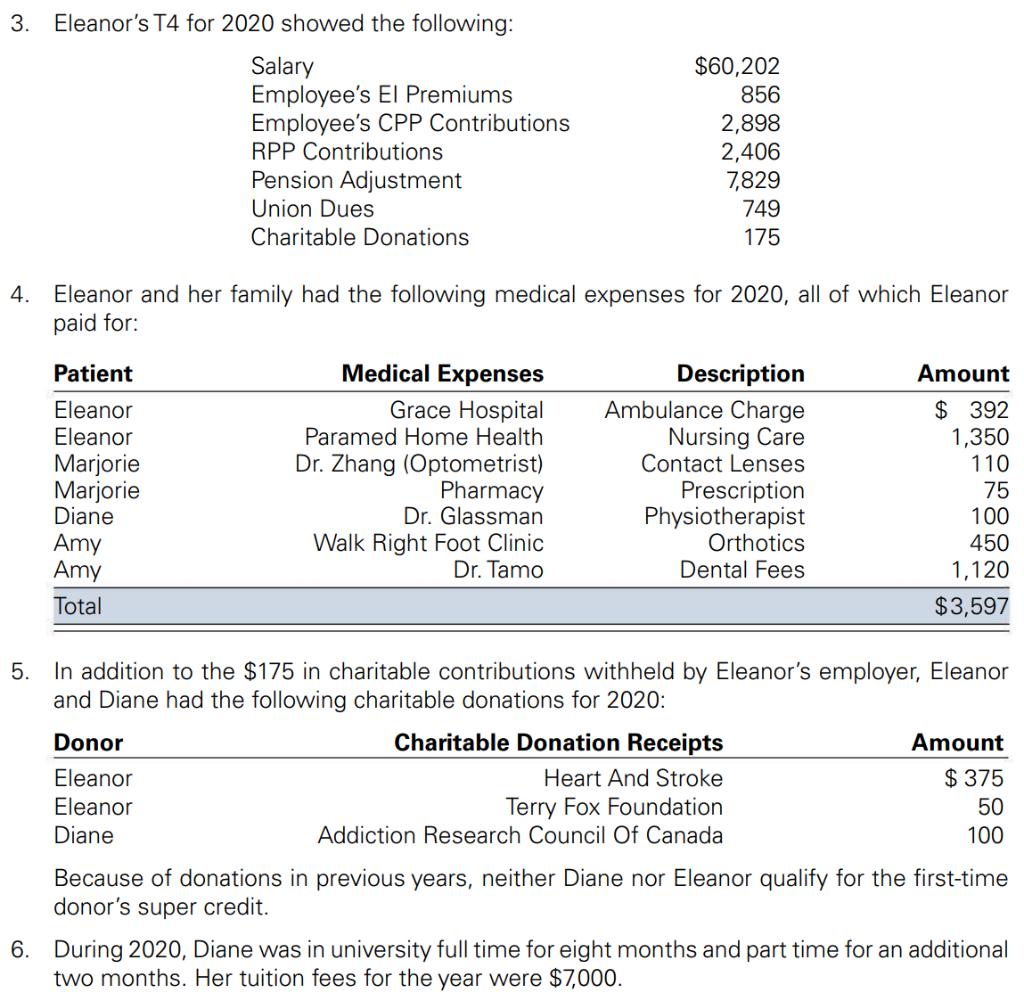

Ms. Eleanor Victoria's husband died two years ago. After her husband died, she moved from her house in Prince George, B.C., to a rented house in Victoria, B.C. Ms. Victoria's widowed mother, Marjorie Vancouver, lives with Ms. Victoria and takes care of the house, Ms. Victoria's younger daughter, Amy, and all of the household cooking. She has 2020 Net Income For Tax Purposes of $8,000. She does not have a mental or physical disability. Diane Victoria, Eleanor's older daughter, is studying psychology at McGill University in Montreal. Her field is addiction research with a special emphasis on gambling. She does volunteer work at a gambling addiction treatment centre in Montreal in the summers. As Eleanor has paid for her tuition and living costs, Diane has agreed that any credits available should be transferred to her mother. Diane has decided not to file a tax return this year as she is too busy with her studies and volunteer work. Her Net Income For Tax Purposes of $2,300 was earned driving for a client of the addiction treatment centre who had lost his licence after being charged with impaired driving. Other information concerning Ms. Victoria for 2020 is as follows: 1. Eleanor was born on May 15, 1968. 2. The birth dates and Net Income For Tax Purposes for the year of her dependants are as follows: Diane Amy (Net Income Marjorie = UCCB) Birth Date (Y/M/D) Net Income 1996-05-14 $2,300 2004-10-11 720 1935-05-21 8,000

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Question The minimum federal tax payable by Eleanors for 2020 is 2763 Assumptions and notes used to consider in computing federal tax have been provid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started