Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Jessie Wing found a position in retail sales in September 2021. During the remainder of that year, she received gross employment income of

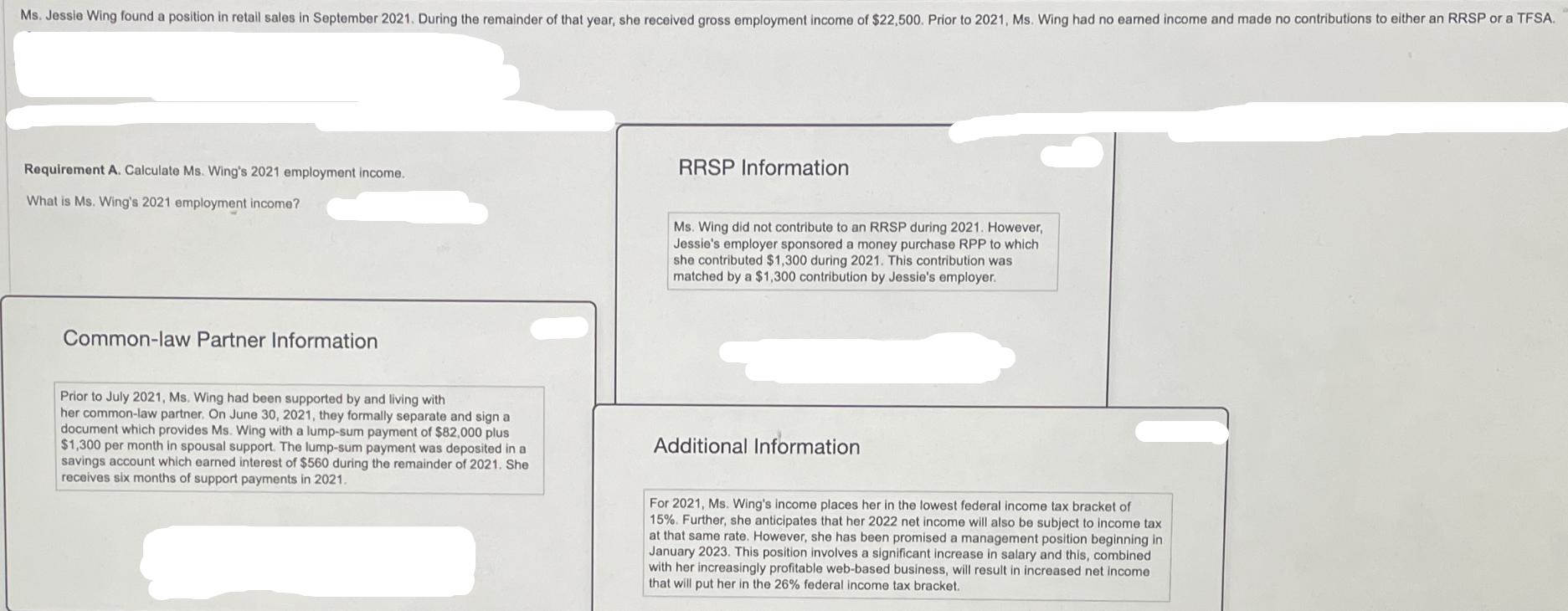

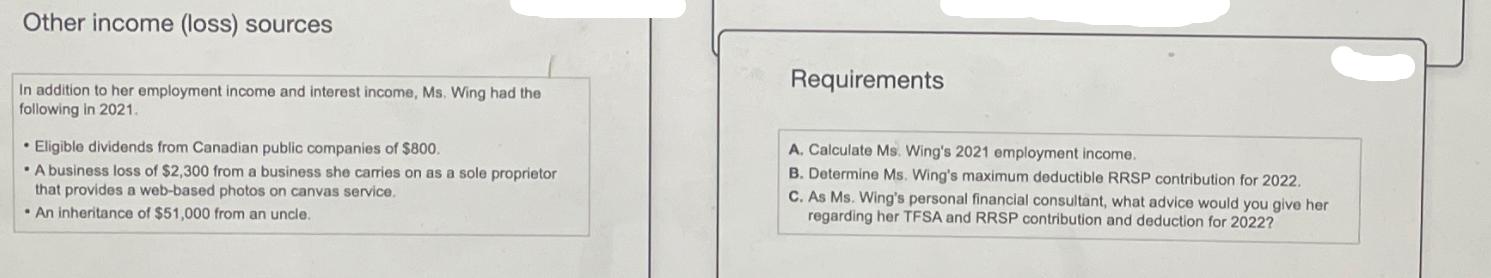

Ms. Jessie Wing found a position in retail sales in September 2021. During the remainder of that year, she received gross employment income of $22,500. Prior to 2021, Ms. Wing had no earned income and made no contributions to either an RRSP or a TFSA. Requirement A. Calculate Ms. Wing's 2021 employment income. What is Ms. Wing's 2021 employment income? RRSP Information Ms. Wing did not contribute to an RRSP during 2021. However, Jessie's employer sponsored a money purchase RPP to which she contributed $1,300 during 2021. This contribution was matched by a $1,300 contribution by Jessie's employer. Common-law Partner Information Prior to July 2021, Ms. Wing had been supported by and living with her common-law partner. On June 30, 2021, they formally separate and sign a document which provides Ms. Wing with a lump-sum payment of $82,000 plus $1,300 per month in spousal support. The lump-sum payment was deposited in a savings account which earned interest of $560 during the remainder of 2021. She receives six months of support payments in 2021. Additional Information. For 2021, Ms. Wing's income places her in the lowest federal income tax bracket of 15%. Further, she anticipates that her 2022 net income will also be subject to income tax at that same rate. However, she has been promised a management position beginning in January 2023. This position involves a significant increase in salary and this, combined with her increasingly profitable web-based business, will result in increased net income that will put her in the 26% federal income tax bracket. Other income (loss) sources In addition to her employment income and interest income, Ms. Wing had the following in 2021. Eligible dividends from Canadian public companies of $800. A business loss of $2,300 from a business she carries on as a sole proprietor that provides a web-based photos on canvas service. An inheritance of $51,000 from an uncle. Requirements A. Calculate Ms. Wing's 2021 employment income. B. Determine Ms. Wing's maximum deductible RRSP contribution for 2022. C. As Ms. Wing's personal financial consultant, what advice would you give her regarding her TFSA and RRSP contribution and deduction for 2022?

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

A To calculate Ms Wings 2021 employment income we need to consider her gross employment income and any additional income sources Ms Wings gross employ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started