Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Liza, a Malaysian citizen, has a history of the following transactions involving properties: 1. In 2011, Ms. Liza was forced to dispose of

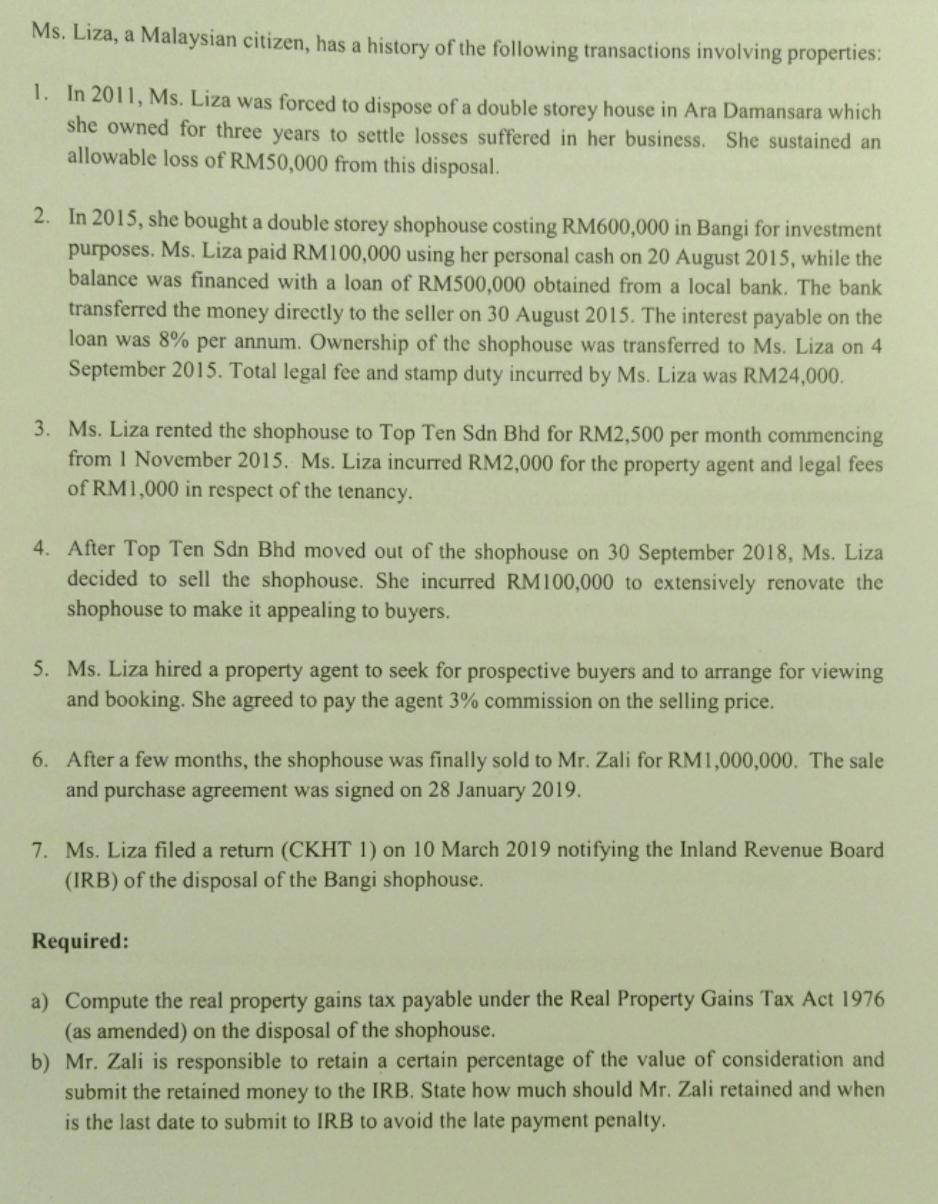

Ms. Liza, a Malaysian citizen, has a history of the following transactions involving properties: 1. In 2011, Ms. Liza was forced to dispose of a double storey house in Ara Damansara which she owned for three years to settle losses suffered in her business. She sustained an allowable loss of RM50,000 from this disposal. 2. In 2015, she bought a double storey shophouse costing RM600,000 in Bangi for investment purposes. Ms. Liza paid RM100,000 using her personal cash on 20 August 2015, while the balance was financed with a loan of RM500,000 obtained from a local bank. The bank transferred the money directly to the seller on 30 August 2015. The interest payable on the loan was 8% per annum. Ownership of the shophouse was transferred to Ms. Liza on 4 September 2015. Total legal fee and stamp duty incurred by Ms. Liza was RM24,000. 3. Ms. Liza rented the shophouse to Top Ten Sdn Bhd for RM2,500 per month commencing from 1 November 2015. Ms. Liza incurred RM2,000 for the property agent and legal fees of RM1,000 in respect of the tenancy. 4. After Top Ten Sdn Bhd moved out of the shophouse on 30 September 2018, Ms. Liza decided to sell the shophouse. She incurred RM100,000 to extensively renovate the shophouse to make it appealing to buyers. 5. Ms. Liza hired a property agent to seek for prospective buyers and to arrange for viewing and booking. She agreed to pay the agent 3% commission on the selling price. 6. After a few months, the shophouse was finally sold to Mr. Zali for RM1,000,000. The sale and purchase agreement was signed on 28 January 2019. 7. Ms. Liza filed a return (CKHT 1) on 10 March 2019 notifying the Inland Revenue Board (IRB) of the disposal of the Bangi shophouse. Required: a) Compute the real property gains tax payable under the Real Property Gains Tax Act 1976 (as amended) on the disposal of the shophouse. b) Mr. Zali is responsible to retain a certain percentage of the value of consideration and submit the retained money to the IRB. State how much should Mr. Zali retained and when is the last date to submit to IRB to avoid the late payment penalty.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a The real property gains tax payable under the Real Property Gai...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started