Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Marcy Van Horne's salary for 2021 is $126,000. Other Information: 1. Ms. Van Horne received a performance bonus of $25,000, one-half of which

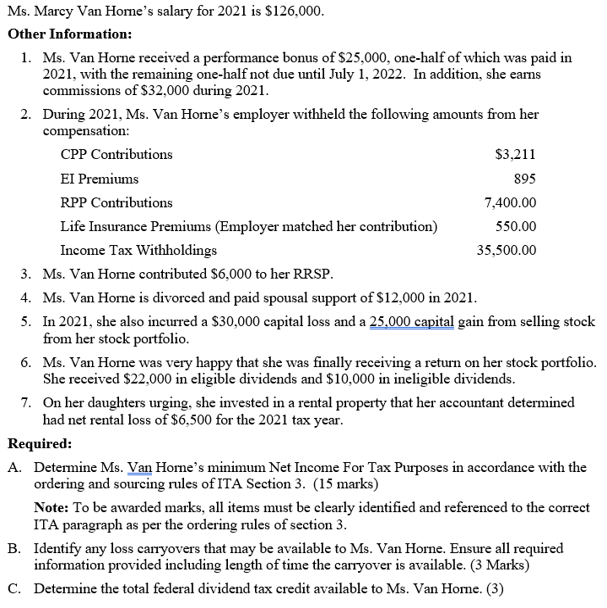

Ms. Marcy Van Horne's salary for 2021 is $126,000. Other Information: 1. Ms. Van Horne received a performance bonus of $25,000, one-half of which was paid in 2021, with the remaining one-half not due until July 1, 2022. In addition, she earns commissions of $32,000 during 2021. 2. During 2021, Ms. Van Horne's employer withheld the following amounts from her compensation: CPP Contributions EI Premiums RPP Contributions Life Insurance Premiums (Employer matched her contribution) Income Tax Withholdings 3. Ms. Van Horne contributed $6,000 to her RRSP. 4. Ms. Van Horne is divorced and paid spousal support of $12,000 in 2021. $3,211 895 7,400.00 550.00 35,500.00 5. In 2021, she also incurred a $30,000 capital loss and a 25,000 capital gain from selling stock from her stock portfolio. 6. Ms. Van Horne was very happy that she was finally receiving a return on her stock portfolio. She received $22,000 in eligible dividends and $10,000 in ineligible dividends. 7. On her daughters urging, she invested in a rental property that her accountant determined had net rental loss of $6,500 for the 2021 tax year. Required: A. Determine Ms. Van Horne's minimum Net Income For Tax Purposes in accordance with the ordering and sourcing rules of ITA Section 3. (15 marks) Note: To be awarded marks, all items must be clearly identified and referenced to the correct ITA paragraph as per the ordering rules of section 3. B. Identify any loss carryovers that may be available to Ms. Van Horne. Ensure all required information provided including length of time the carryover is available. (3 Marks) C. Determine the total federal dividend tax credit available to Ms. Van Horne. (3)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Determining Ms Van Hornes Minimum Net Income For Tax Purposes Step 1 Calculate Ms Van Hornes total ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started