Question

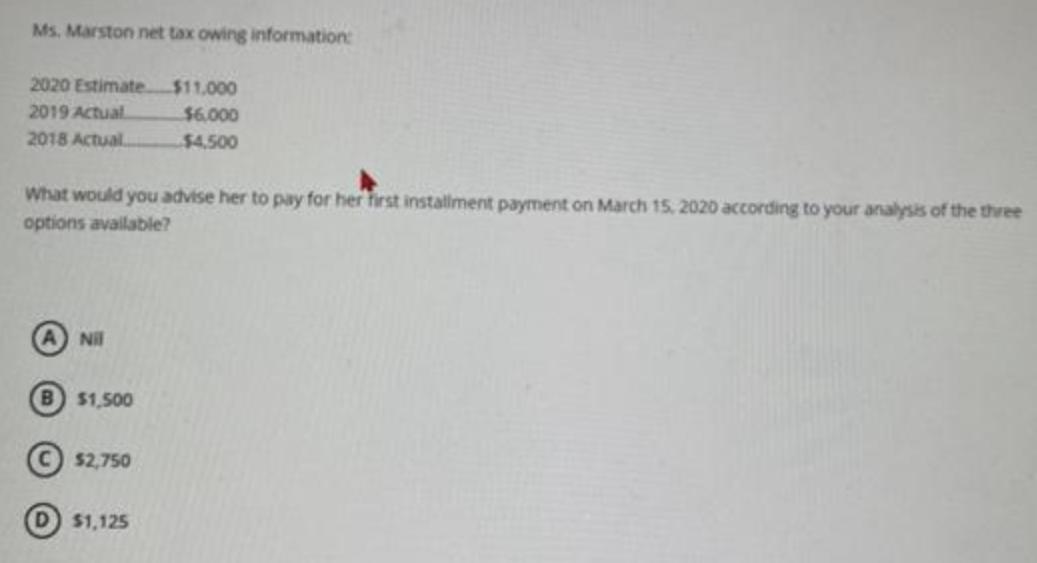

Ms. Marston net tax owing information: 2020 Estimate. $11.000 2019 Actual $6.000 2018 Actual. $4500 What would you advise her to pay for her

Ms. Marston net tax owing information: 2020 Estimate. $11.000 2019 Actual $6.000 2018 Actual. $4500 What would you advise her to pay for her first installment payment on March 15, 2020 according to your analysis of the three options avalable? Ni B $1,500 $2,750 D $1,125

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The first installmen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business and Society Ethics Sustainability and Stakeholder Management

Authors: Archie B. Carroll, Ann K. Buchholtz

9th edition

1285734297, 1285734293, 9781285974712 , 978-1285734293

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App