Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Mimi Zhou (SIN 527-000-061) was born in Vancouver on October 8, 1978. She and her family live at 9002 Meadowlark Close, Canmore, AB

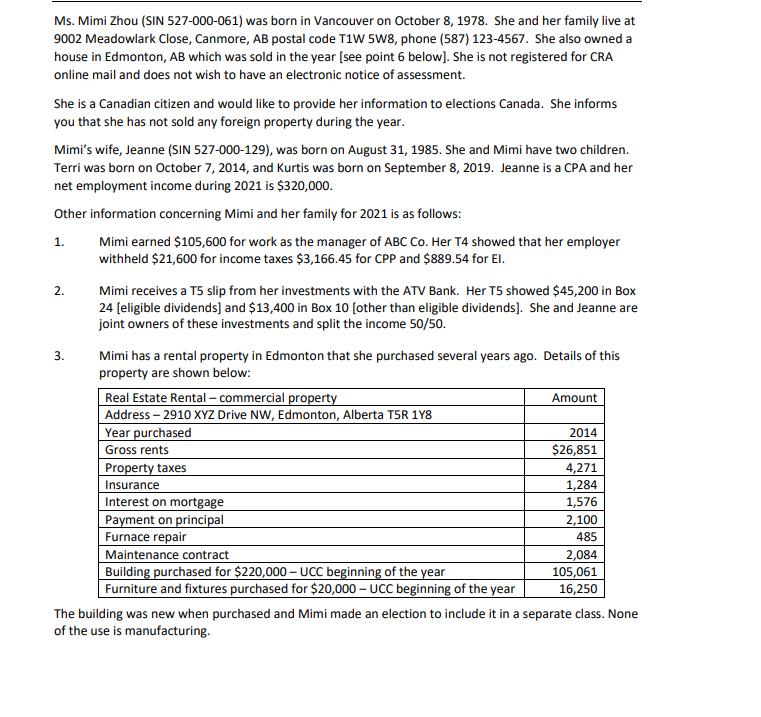

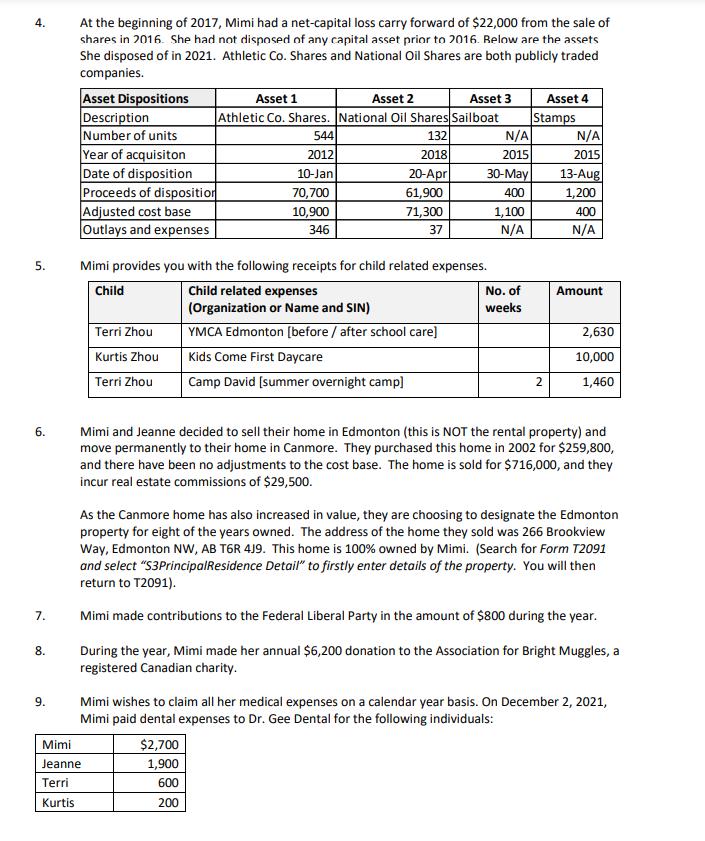

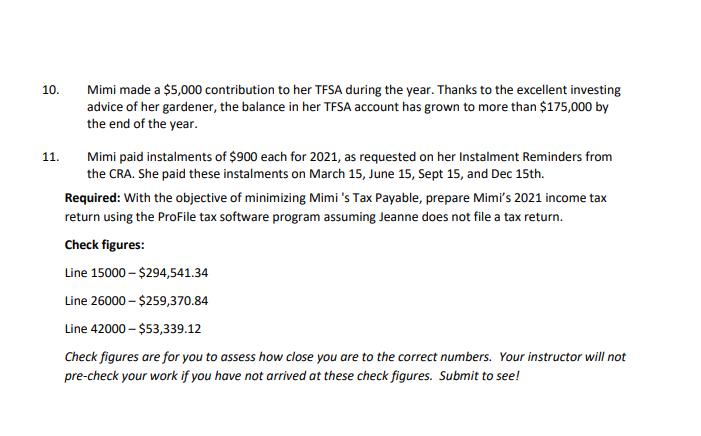

Ms. Mimi Zhou (SIN 527-000-061) was born in Vancouver on October 8, 1978. She and her family live at 9002 Meadowlark Close, Canmore, AB postal code T1W 5W8, phone (587) 123-4567. She also owned a house in Edmonton, AB which was sold in the year [see point 6 below]. She is not registered for CRA online mail and does not wish to have an electronic notice of assessment. She is a Canadian citizen and would like to provide her information to elections Canada. She informs you that she has not sold any foreign property during the year. Mimi's wife, Jeanne (SIN 527-000-129), was born on August 31, 1985. She and Mimi have two children. Terri was born on October 7, 2014, and Kurtis was born on September 8, 2019. Jeanne is a CPA and her net employment income during 2021 is $320,000. Other information concerning Mimi and her family for 2021 is as follows: Mimi earned $105,600 for work as the manager of ABC Co. Her T4 showed that her employer withheld $21,600 for income taxes $3,166.45 for CPP and $889.54 for El. 1. 2. 3. Mimi receives a T5 slip from her investments with the ATV Bank. Her T5 showed $45,200 in Box 24 [eligible dividends] and $13,400 in Box 10 [other than eligible dividends]. She and Jeanne are joint owners of these investments and split the income 50/50. Mimi has a rental property in Edmonton that she purchased several years ago. Details of this property are shown below: Real Estate Rental-commercial property Address - 2910 XYZ Drive NW, Edmonton, Alberta T5R 1Y8 Year purchased Gross rents Property taxes Insurance Interest on mortgage Payment on principal Furnace repair Maintenance contract Building purchased for $220,000-UCC beginning of the year Furniture and fixtures purchased for $20,000 - UCC beginning of the year Amount 2014 $26,851 4,271 1,284 1,576 2,100 485 2,084 105,061 16,250 The building was new when purchased and Mimi made an election to include it in a separate class. None of the use is manufacturing. 4. 5. 6. 7. 8. 9. At the beginning of 2017, Mimi had a net-capital loss carry forward of $22,000 from the sale of shares in 2016. She had not disposed of any capital asset prior to 2016. Below are the assets She disposed of in 2021. Athletic Co. Shares and National Oil Shares are both publicly traded companies. Asset Dispositions Description Number of units Year of acquisiton Date of disposition Proceeds of disposition Adjusted cost base Outlays and expenses Mimi Jeanne Terri Kurtis Terri Zhou Kurtis Zhou Terri Zhou Asset 1 Asset 2 Asset 3 Athletic Co. Shares. National Oil Shares Sailboat 132 2018 544 2012 10-Jan 70,700 10,900 346 Mimi provides you with the following receipts for child related expenses. Child Child related expenses (Organization or Name and SIN) YMCA Edmonton [before/after school care] Kids Come First Daycare Camp David [summer overnight camp] 20-Apr 61,900 71,300 37 $2,700 1,900 600 200 N/A 2015 30-May 400 1,100 N/A No. of weeks Asset 4 Stamps 2 N/A 2015 13-Aug 1,200 400 N/A Amount Mimi and Jeanne decided to sell their home in Edmonton (this is NOT the rental property) and move permanently to their home in Canmore. They purchased this home in 2002 for $259,800, and there have been no adjustments to the cost base. The home is sold for $716,000, and they incur real estate commissions of $29,500. 2,630 10,000 1,460 As the Canmore home has also increased in value, they are choosing to designate the Edmonton property for eight of the years owned. The address of the home they sold was 266 Brookview Way, Edmonton NW, AB T6R 4J9. This home is 100% owned by Mimi. (Search for Form T2091 and select "S3PrincipalResidence Detail" to firstly enter details of the property. You will then return to T2091). Mimi made contributions to the Federal Liberal Party in the amount of $800 during the year. During the year, Mimi made her annual $6,200 donation to the Association for Bright Muggles, a registered Canadian charity. Mimi wishes to claim all her medical expenses on a calendar year basis. On December 2, 2021, Mimi paid dental expenses to Dr. Gee Dental for the following individuals: 10. 11. Mimi made a $5,000 contribution to her TFSA during the year. Thanks to the excellent investing advice of her gardener, the balance in her TFSA account has grown to more than $175,000 by the end of the year. Mimi paid instalments of $900 each for 2021, as requested on her Instalment Reminders from the CRA. She paid these instalments on March 15, June 15, Sept 15, and Dec 15th. Required: With the objective of minimizing Mimi 's Tax Payable, prepare Mimi's 2021 income tax return using the ProFile tax software program assuming Jeanne does not file a tax return. Check figures: Line 15000-$294,541.34 Line 26000-$259,370.84 Line 42000-$53,339.12 Check figures are for you to assess how close you are to the correct numbers. Your instructor will not pre-check your work if you have not arrived at these check figures. Submit to see!

Step by Step Solution

★★★★★

3.32 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations for each relevant question on Mimi Zhous 2021 tax return 1 Employment Income Line 10100 Given 105600 2 Eligible D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started