Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Prince wants to create a scholarship in honor of her parents at the law school from which she received her degree. She could

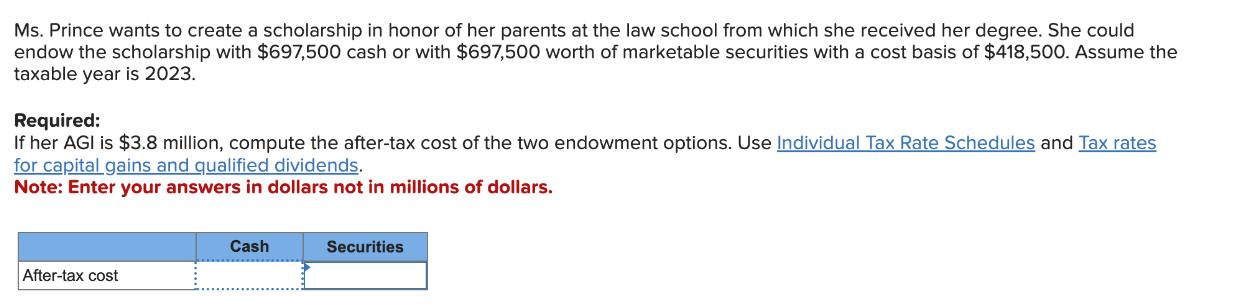

Ms. Prince wants to create a scholarship in honor of her parents at the law school from which she received her degree. She could endow the scholarship with $697,500 cash or with $697,500 worth of marketable securities with a cost basis of $418,500. Assume the taxable year is 2023. Required: If her AGI is $3.8 million, compute the after-tax cost of the two endowment options. Use Individual Tax Rate Schedules and Tax rates for capital gains and qualified dividends. Note: Enter your answers in dollars not in millions of dollars. Cash Securities After-tax cost _

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To compute the aftertax cost of the two endowment options we need to calculate the taxes owed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d518293403_968060.pdf

180 KBs PDF File

663d518293403_968060.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started