Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Sarah is considering the purchase of a new piece of equipment that has a net initial investment with a present value of 4,000,000.

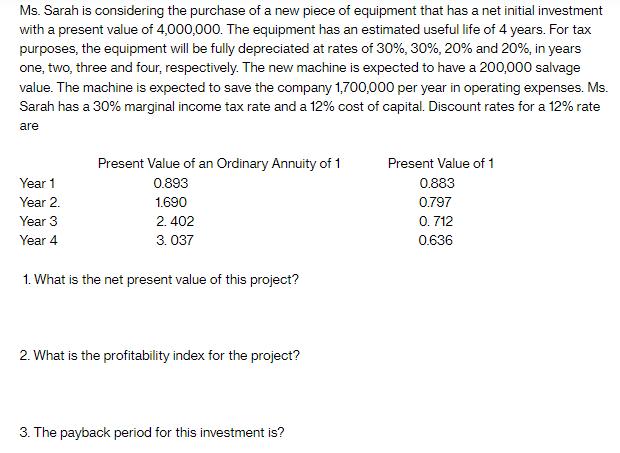

Ms. Sarah is considering the purchase of a new piece of equipment that has a net initial investment with a present value of 4,000,000. The equipment has an estimated useful life of 4 years. For tax purposes, the equipment will be fully depreciated at rates of 30%, 30%, 20% and 20%, in years one, two, three and four, respectively. The new machine is expected to have a 200,000 salvage value. The machine is expected to save the company 1,700,000 per year in operating expenses. Ms. Sarah has a 30% marginal income tax rate and a 12% cost of capital. Discount rates for a 12% rate are Year 1 Year 2. Year 3 Year 4 Present Value of an Ordinary Annuity of 1 0.893 1.690 2.402 3.037 1. What is the net present value of this project? 2. What is the profitability index for the project? 3. The payback period for this investment is? Present Value of 1 0.883 0.797 0.712 0.636

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV profitability index PI and payback period for this investment well follow these steps Step 1 Calculate the cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started