Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Shikha, an Indian resident, is very happy as her partnership firm is working very well and she gets a good amount of profit

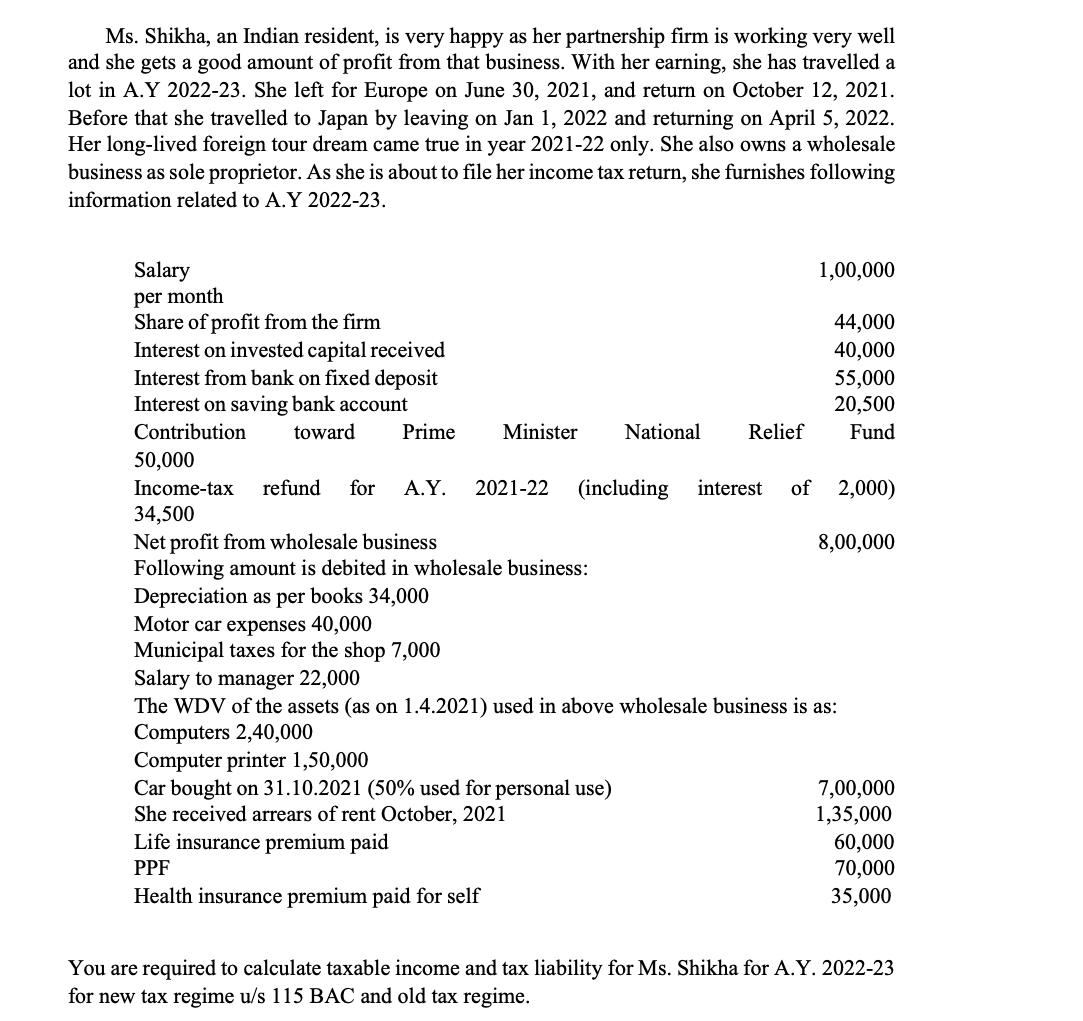

Ms. Shikha, an Indian resident, is very happy as her partnership firm is working very well and she gets a good amount of profit from that business. With her earning, she has travelled a lot in A.Y 2022-23. She left for Europe on June 30, 2021, and return on October 12, 2021. Before that she travelled to Japan by leaving on Jan 1, 2022 and returning on April 5, 2022. Her long-lived foreign tour dream came true in year 2021-22 only. She also owns a wholesale business as sole proprietor. As she is about to file her income tax return, she furnishes following information related to A.Y 2022-23. Salary per month Share of profit from the firm Interest on invested capital received Interest from bank on fixed deposit Interest on saving bank account Contribution toward Prime Minister National Depreciation as per books 34,000 Motor car expenses 40,000 Relief 1,00,000 44,000 40,000 55,000 20,500 Fund 50,000 Income-tax refund for A.Y. 2021-22 (including interest of 2,000) 34,500 Net profit from wholesale business Following amount is debited in wholesale business: 8,00,000 Municipal taxes for the shop 7,000 Salary to manager 22,000 The WDV of the assets (as on 1.4.2021) used in above wholesale business is as: Computers 2,40,000 Computer printer 1,50,000 Car bought on 31.10.2021 (50% used for personal use) She received arrears of rent October, 2021 Life insurance premium paid PPF Health insurance premium paid for self 7,00,000 1,35,000 60,000 70,000 35,000 You are required to calculate taxable income and tax liability for Ms. Shikha for A.Y. 2022-23 for new tax regime u/s 115 BAC and old tax regime.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Ms Shikha has stayed in India for Date from Date to No of days 01042021 30062021 91 12102021 01012022 82 Total no of days 173 Thus total no of days Ms Shikha has stayed in India is 173 days which is l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started