Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Smith owns shares of the Toronto Dominion Bank (a public corporation) which she purchased some time ago for $550,000. On December 1, 2019,

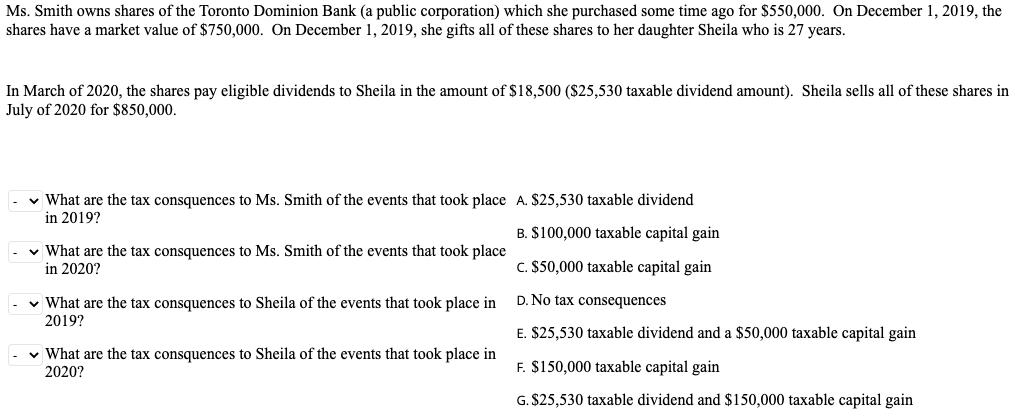

Ms. Smith owns shares of the Toronto Dominion Bank (a public corporation) which she purchased some time ago for $550,000. On December 1, 2019, the shares have a market value of $750,000. On December 1, 2019, she gifts all of these shares to her daughter Sheila who is 27 years. In March of 2020, the shares pay eligible dividends to Sheila in the amount of $18,500 ($25,530 taxable dividend amount). Sheila sells all of these shares in July of 2020 for $850,000. v What are the tax consquences to Ms. Smith of the events that took place A. $25,530 taxable dividend in 2019? B. $100,000 taxable capital gain v What are the tax consquences to Ms. Smith of the events that took place in 2020? C. $50,000 taxable capital gain D. No tax consequences v What are the tax consquences to Sheila of the events that took place in 2019? E. $25,530 taxable dividend and a $50,000 taxable capital gain v What are the tax consquences to Sheila of the events that took place in 2020? F. $150,000 taxable capital gain G. $25,530 taxable dividend and $150,000 taxable capital gain

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Particulars TC TC towards Ms Smith for the events that happened in 2019 C No TC TC towards Ms Smith for the events that happened in 2020 C No TC TC to...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started