Answered step by step

Verified Expert Solution

Question

1 Approved Answer

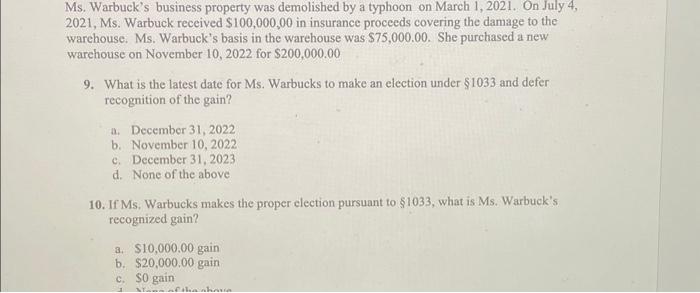

Ms. Warbuck's business property was demolished by a typhoon on March 1, 2021. On July 4, 2021, Ms. Warbuck received $100,000,00 in insurance proceeds covering

Ms. Warbuck's business property was demolished by a typhoon on March 1, 2021. On July 4, 2021, Ms. Warbuck received $100,000,00 in insurance proceeds covering the damage to the warehouse. Ms. Warbuck's basis in the warehouse was $75,000.00. She purchased a new warehouse on November 10, 2022 for $200,000.00 9. What is the latest date for Ms. Warbucks to make an election under 1033 and defer recognition of the gain? a. December 31, 2022 b. November 10, 2022 c. December 31, 2023 d. None of the above 10. If Ms. Warbucks makes the proper election pursuant to 1033, what is Ms. Warbuck's recognized gain? a. $10,000.00 gain b. $20,000.00 gain c. $0 gain d None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started