Ms Watanabe is trying to take advantage of the large difference of interest rates between the US and Japan. She is planning to borrow

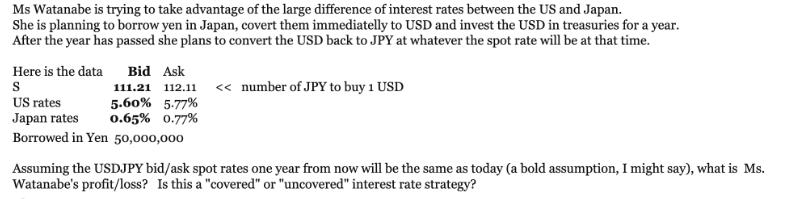

Ms Watanabe is trying to take advantage of the large difference of interest rates between the US and Japan. She is planning to borrow yen in Japan, covert them immediatelly to USD and invest the USD in treasuries for a year. After the year has passed she plans to convert the USD back to JPY at whatever the spot rate will be at that time. Here is the data S US rates Japan rates Borrowed in Yen 50,000,000 Bid Ask 111.21 112.11 < < number of JPY to buy 1 USD 5.60% 5.77% 0.65% 0.77% Assuming the USDJPY bid/ask spot rates one year from now will be the same as today (a bold assumption, I might say), what is Ms. Watanabe's profit/loss? Is this a "covered" or "uncovered" interest rate strategy?

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Ms Watanabes profitloss can be calculated by considering the interest rate differential an...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started