Question

Ms. Wong owned two homes from 2016 to 2018. She had purchased Home A in 2011 for $260,000. In 2016, she purchased Home B

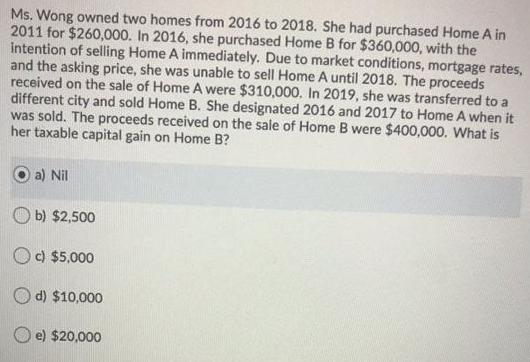

Ms. Wong owned two homes from 2016 to 2018. She had purchased Home A in 2011 for $260,000. In 2016, she purchased Home B for $360,000, with the intention of selling Home A immediately. Due to market conditions, mortgage rates, and the asking price, she was unable to sell Home A until 2018. The proceeds received on the sale of Home A were $310,000, In 2019, she was transferred to a different city and sold Home B. She designated 2016 and 2017 to Home A when it was sold. The proceeds received on the sale of Home B were $400,000. What is her taxable capital gain on Home B? a) Nil O b) $2,500 Od $5,000 O d) $10,000 O e) $20,000

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Computation of Taxable Capital Gain of Home B in the hands of M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of corporate finance

Authors: Robert Parrino, David S. Kidwell, Thomas W. Bates

2nd Edition

978-0470933268, 470933267, 470876441, 978-0470876442

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App