Question

M&T Plumbing Company decided to sell plumbing supplies and special tools. During the month of June, the company completed the following transactional data, June 1:

M&T Plumbing Company decided to sell plumbing supplies and special tools. During the month of June, the company completed the following transactional data,

June 1: Purchased 300 units of inventory for $1,800 from Buckably, Co., on terms 5/5, 3/10, n/30

5: Purchased 200 units of inventory from Gorglaby on terms 4/5, n/30. The total invoice was for $1,600, which included a $100 freight charge.

7: Returned 50 units of inventory to Buckably, Co. from June 1st purchase (cost $300).

9: Paid Gorglaby.

10: Sold 175 units of goods to PlumbPlus for $2,450 on terms 5/10, n/30. M&T Plumbing cost of the goods was $1,050.

11: Paid Buckably.

15: Received 15 units with a retail price of $210 of goods back from customer PlumbPlus. The goods cost $90.

20: Received payment from PlumbPlus, settling the amount due in full.

28: Sold 200 units of goods to Plumcking, Inc., for cash of $2,800 (cost $1,342).

28: Paid cash for Sales commission expense of $255.

29: Paid cash for utilities of $400.

30: Recorded the following adjusting entries:

Physical count of Inventory on June 30 showed 50 units of goods on hand, $385 Depreciation, $100

Accrued salary expense of $500

Accrued interest expense, $ 187.

Unearned service revenue was earned by the amount of $3,794.29

Prepared all additional adjustments necessary

Hint: Prepaid Rent, Prepaid Insurance,

Special Considerations,

-

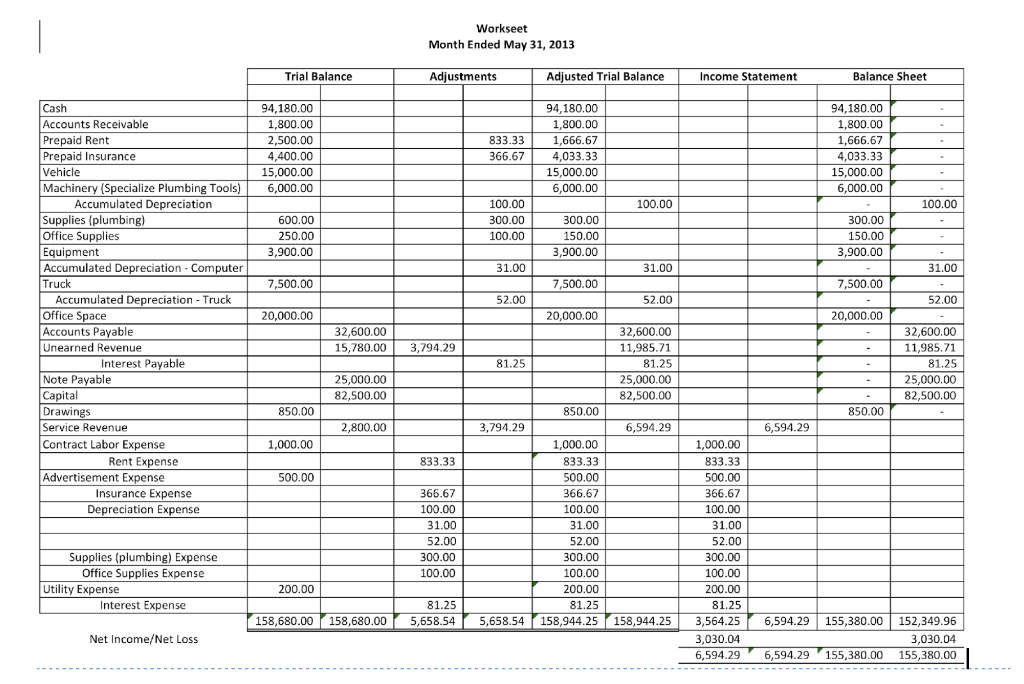

Worksheet from previous months

-

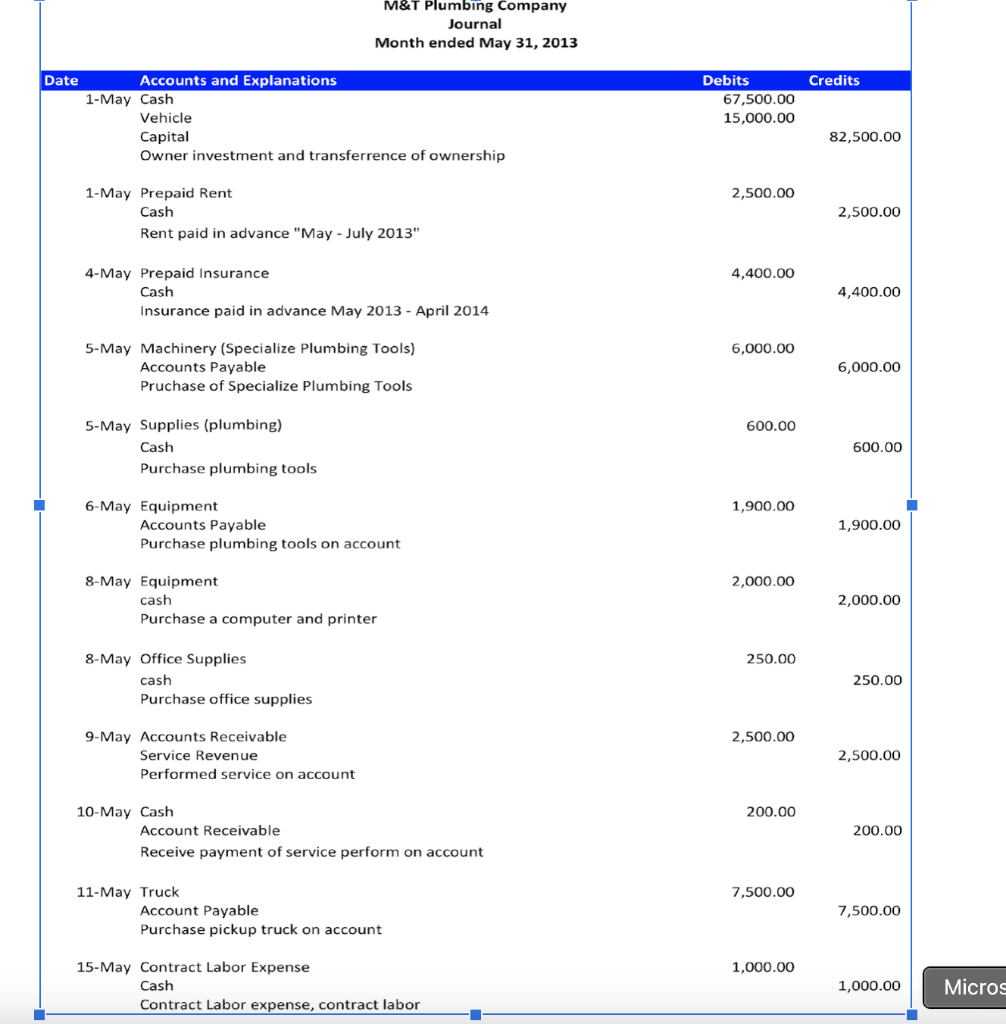

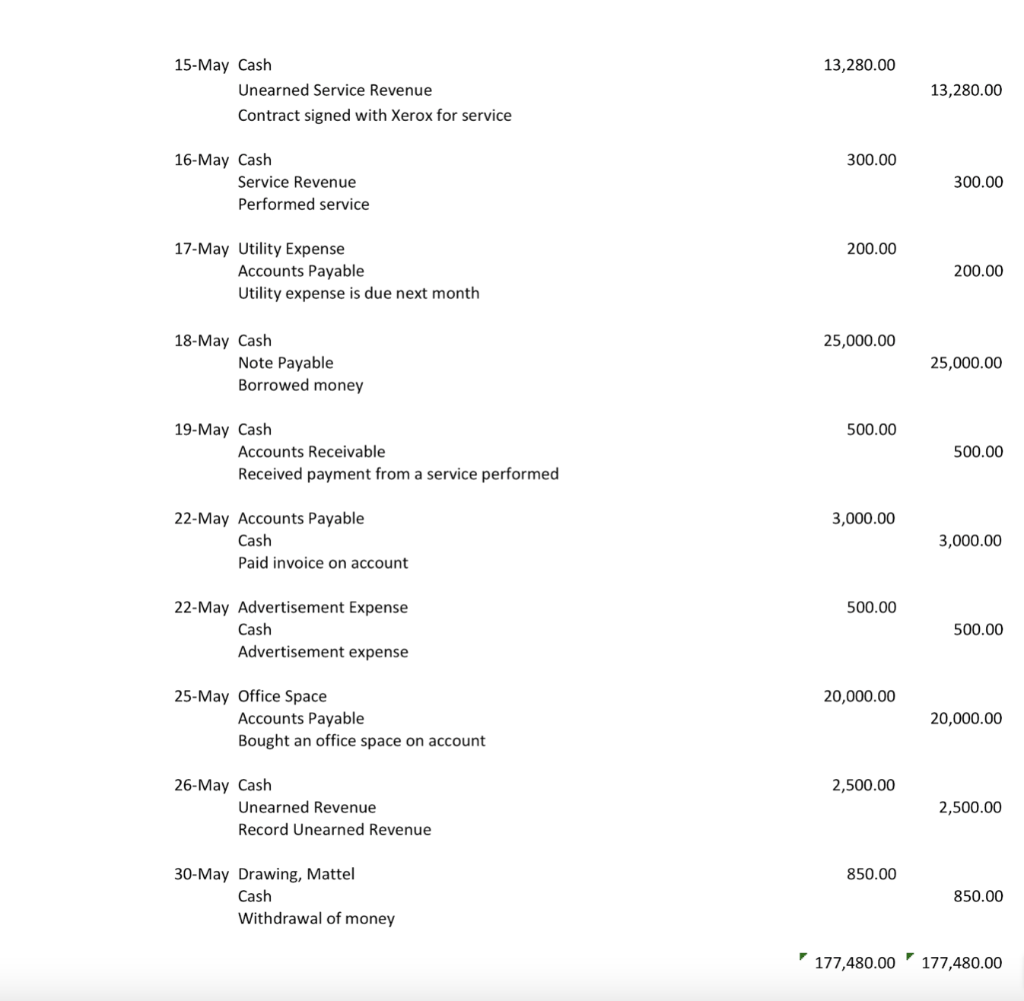

Journal Entries

Requirements (2 points each)

-

Prepare a Chart of Accounts

-

Prepare perpetual inventory records for July using FIFO method. (You must figure cost on the 10th, 28th, and 31st).

-

Journalize and post transactions. Key all by dates and denote account balances as Bal.

-

Journalize and post the adjusting entries. Denote each adjustment amount as adj.

-

Prepare Financial Statements. Denote income statement as a multiple step.

Workseet Month Ended May 31, 2013 Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet 94,180.00 1,800.00 2,500.00 4,400.00 15,000.00 6,000.00 94,180.00 1.800.00 1,666.67 4.033.33 15,000.00 6,000.00 100.00 600.00 250.00 3,900.00 300.00 150.00 3,900.00 31.00 7,500.00 7,500.00 52.00 Cash Accounts Receivable Prepaid Rent Prepaid Insurance Vehicle Machinery (Specialize Plumbing Tools) Accumulated Depreciation Guni Supplies (plumbing) Office Supplies Equipment Accumulated Depreciation - Computer Truck Accumulated Depreciation - Truck Office Space Orie Accounts Payable Unearned Revenue Interest Payable M Note Payable Capital Drawings Service Revenue Contract Labor Expense Rent Expense Advertisement Expense Insurance Expense Depreciation Expense 20,000.00 20,000.00 32,600.00 15,780.00 3,794.29 94,180.00 1,800.00 833.33 1,666.67 366.67 4,033.33 15,000.00 6,000.00 100.00 100.00 300.00 300.00 100.00 150.00 3,900.00 31.00 31.00 7,500.00 52.00 52.00 20,000.00 32,600.00 11,985.71 81.25 81.25 25,000.00 82,500.00 850.00 3,794.29 6,594.29 1,000.00 833.33 500.00 366.67 10000 100.00 21.00 31.00 52.00 300.00 100.00 200.00 81.25 5,658.54 158,944.25 158,944.25 32,600.00 11,985.71 81.25 25,000.00 82.500.00 25,000.00 82,500.00 850.00 850.00 2,800.00 6,594.29 1,000.00 833.33 500.00 366.67 100.00 31.00 52.00 300.00 100.00 1,000.00 833.33 500.00 366.67 100.00 2100 31.00 5200 52.00 2000 300.00 100.00 200.00 Supplies (plumbing) Expense Office Supplies Expense Utility Expense Interest Expense 200.00 81.25 158,680.00 158,680.00 81.25 5,658.54 6,594.29 Net Income/Net Loss 3,564.25 3,030.04 6,594.29 155,380.00 152,349.96 3,030.04 155,380.00 155,380.00 6,594.29 M&T Plumbing Company Journal Month ended May 31, 2013 Credits Date Accounts and Explanations 1-May Cash Vehicle Capital Owner investment and transferrence of ownership Debits 67,500.00 15,000.00 82,500.00 2,500.00 1-May Prepaid Rent Cash Rent paid in advance "May - July 2013" 2,500.00 4,400.00 4-May Prepaid Insurance Cash Insurance paid in advance May 2013 - April 2014 4,400.00 6,000.00 5-May Machinery (Specialize Plumbing Tools) Accounts Payable Pruchase of Specialize Plumbing Tools 6,000.00 600.00 5-May Supplies (plumbing) Cash Purchase plumbing tools 600.00 1,900.00 6-May Equipment Accounts Payable Purchase plumbing tools on account 1,900.00 2,000.00 8-May Equipment cash Purchase a computer and printer 2,000.00 250.00 8-May Office Supplies cash Purchase office supplies 250.00 2,500.00 9-May Accounts Receivable Service Revenue Performed service on account 2,500.00 200.00 10-May Cash Account Receivable Receive payment of service perform on account 200.00 7,500.00 11-May Truck Account Payable Purchase pickup truck on account 7,500.00 1,000.00 15-May Contract Labor Expense Cash Contract Labor expense, contract labor 1,000.00 Micros 13,280.00 15-May Cash Unearned Service Revenue Contract signed with Xerox for service 13,280.00 300.00 16-May Cash Service Revenue Performed service 300.00 200.00 17-May Utility Expense Accounts Payable Utility expense is due next month 200.00 25,000.00 18-May Cash Note Payable Borrowed money 25,000.00 500.00 19-May Cash Accounts Receivable Received payment from a service performed 500.00 3,000.00 22-May Accounts Payable Cash Paid invoice on account 3,000.00 500.00 22-May Advertisement Expense Cash Advertisement expense 500.00 20,000.00 25-May Office Space Accounts Payable Bought an office space on account 20,000.00 2,500.00 26-May Cash Unearned Revenue Record Unearned Revenue 2,500.00 850.00 30-May Drawing, Mattel Cash Withdrawal of money 850.00 177,480.00 177,480.00 Workseet Month Ended May 31, 2013 Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet 94,180.00 1,800.00 2,500.00 4,400.00 15,000.00 6,000.00 94,180.00 1.800.00 1,666.67 4.033.33 15,000.00 6,000.00 100.00 600.00 250.00 3,900.00 300.00 150.00 3,900.00 31.00 7,500.00 7,500.00 52.00 Cash Accounts Receivable Prepaid Rent Prepaid Insurance Vehicle Machinery (Specialize Plumbing Tools) Accumulated Depreciation Guni Supplies (plumbing) Office Supplies Equipment Accumulated Depreciation - Computer Truck Accumulated Depreciation - Truck Office Space Orie Accounts Payable Unearned Revenue Interest Payable M Note Payable Capital Drawings Service Revenue Contract Labor Expense Rent Expense Advertisement Expense Insurance Expense Depreciation Expense 20,000.00 20,000.00 32,600.00 15,780.00 3,794.29 94,180.00 1,800.00 833.33 1,666.67 366.67 4,033.33 15,000.00 6,000.00 100.00 100.00 300.00 300.00 100.00 150.00 3,900.00 31.00 31.00 7,500.00 52.00 52.00 20,000.00 32,600.00 11,985.71 81.25 81.25 25,000.00 82,500.00 850.00 3,794.29 6,594.29 1,000.00 833.33 500.00 366.67 10000 100.00 21.00 31.00 52.00 300.00 100.00 200.00 81.25 5,658.54 158,944.25 158,944.25 32,600.00 11,985.71 81.25 25,000.00 82.500.00 25,000.00 82,500.00 850.00 850.00 2,800.00 6,594.29 1,000.00 833.33 500.00 366.67 100.00 31.00 52.00 300.00 100.00 1,000.00 833.33 500.00 366.67 100.00 2100 31.00 5200 52.00 2000 300.00 100.00 200.00 Supplies (plumbing) Expense Office Supplies Expense Utility Expense Interest Expense 200.00 81.25 158,680.00 158,680.00 81.25 5,658.54 6,594.29 Net Income/Net Loss 3,564.25 3,030.04 6,594.29 155,380.00 152,349.96 3,030.04 155,380.00 155,380.00 6,594.29 M&T Plumbing Company Journal Month ended May 31, 2013 Credits Date Accounts and Explanations 1-May Cash Vehicle Capital Owner investment and transferrence of ownership Debits 67,500.00 15,000.00 82,500.00 2,500.00 1-May Prepaid Rent Cash Rent paid in advance "May - July 2013" 2,500.00 4,400.00 4-May Prepaid Insurance Cash Insurance paid in advance May 2013 - April 2014 4,400.00 6,000.00 5-May Machinery (Specialize Plumbing Tools) Accounts Payable Pruchase of Specialize Plumbing Tools 6,000.00 600.00 5-May Supplies (plumbing) Cash Purchase plumbing tools 600.00 1,900.00 6-May Equipment Accounts Payable Purchase plumbing tools on account 1,900.00 2,000.00 8-May Equipment cash Purchase a computer and printer 2,000.00 250.00 8-May Office Supplies cash Purchase office supplies 250.00 2,500.00 9-May Accounts Receivable Service Revenue Performed service on account 2,500.00 200.00 10-May Cash Account Receivable Receive payment of service perform on account 200.00 7,500.00 11-May Truck Account Payable Purchase pickup truck on account 7,500.00 1,000.00 15-May Contract Labor Expense Cash Contract Labor expense, contract labor 1,000.00 Micros 13,280.00 15-May Cash Unearned Service Revenue Contract signed with Xerox for service 13,280.00 300.00 16-May Cash Service Revenue Performed service 300.00 200.00 17-May Utility Expense Accounts Payable Utility expense is due next month 200.00 25,000.00 18-May Cash Note Payable Borrowed money 25,000.00 500.00 19-May Cash Accounts Receivable Received payment from a service performed 500.00 3,000.00 22-May Accounts Payable Cash Paid invoice on account 3,000.00 500.00 22-May Advertisement Expense Cash Advertisement expense 500.00 20,000.00 25-May Office Space Accounts Payable Bought an office space on account 20,000.00 2,500.00 26-May Cash Unearned Revenue Record Unearned Revenue 2,500.00 850.00 30-May Drawing, Mattel Cash Withdrawal of money 850.00 177,480.00 177,480.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started