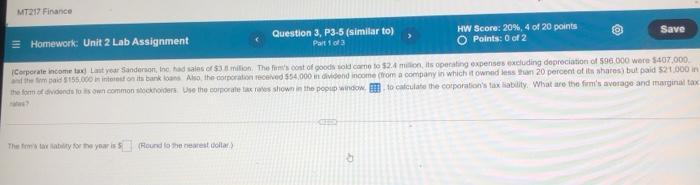

Question: MT217 Finance Homework: Unit 2 Lab Assignment Question 3, P3-5 (similar to) Part 1 of 3 HW Score: 20%, 4 of 20 points O

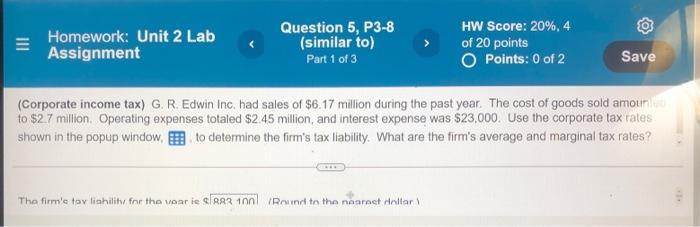

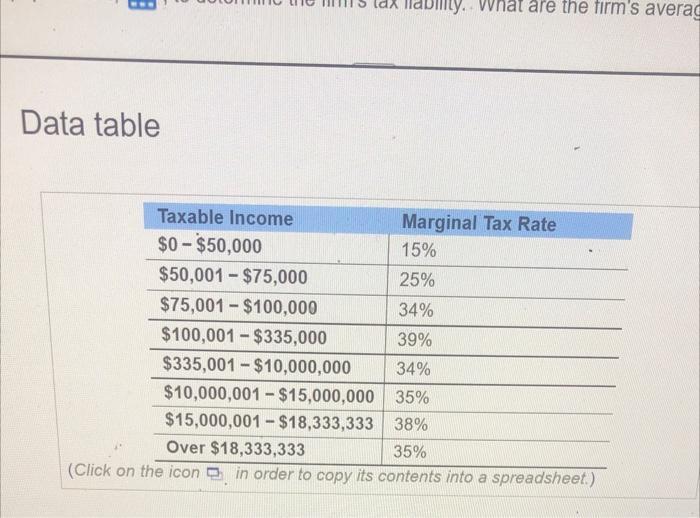

MT217 Finance Homework: Unit 2 Lab Assignment Question 3, P3-5 (similar to) Part 1 of 3 HW Score: 20%, 4 of 20 points O Points: 0 of 2 Save (Corporate income tax) Last year Sanderson, Inc. had sales of $3.8 milion. The firm's cost of goods sold came to $2.4 million, its operating expenses excluding depreciation of 596.000 were $407,000. and the Sem paid $155,000 in interest on its bank loans. Also, the corporation received $54,000 in dividend income (from a company in which it owned less than 20 percent of its shares) but paid $21,000 in the form of dividends to its own common stockholders Use the corporate tax rates shown in the popup window. to calculate the corporation's tax liability. What are the firm's average and marginal tax The firm's tax liability for the year is 5 (Round to the nearest dollar) III Homework: Unit 2 Lab Assignment Question 5, P3-8 (similar to) Part 1 of 3 HW Score: 20%, 4 of 20 points O Points: 0 of 2 Save (Corporate income tax) G. R. Edwin Inc. had sales of $6.17 million during the past year. The cost of goods sold amounted to $2.7 million. Operating expenses totaled $2.45 million, and interest expense was $23,000. Use the corporate tax rates shown in the popup window, to determine the firm's tax liability. What are the firm's average and marginal tax rates? The firm's tax liahility for the year is $883 100 Round to the nearest dollar) Data table What are the firm's averag Taxable Income Marginal Tax Rate $0-$50,000 $50,001-$75,000 $75,001-$100,000 15% 25% 34% $100,001-$335,000 39% $335,001-$10,000,000 34% $10,000,001-$15,000,000 35% $15,000,001-$18,333,333 38% Over $18,333,333 35% (Click on the icon in order to copy its contents into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Problem 1 Sanderson Inc Given Sales 31 million Cost of Goods Sold 24 million Operating Expenses 407000 Depreciation 96000 Interest Expense 21000 Dividend Income from 20 ownership 54000 Dividends Paid ... View full answer

Get step-by-step solutions from verified subject matter experts