MT482-2: Asses the principle characteristics of liabilities (debt), equity and assets.

This assignment will require you to dig deep into the structure and composition of Campbell Soups liabilities (debt) and equity. This will help you better understand the sources of funding in any business.

Locate the Campbell Soup Cases 3-2 and 3-3 on pages 219 and 220 of your text. Be sure to submit thoughtful and substantial answers to the questions following each case.

Thank you for your help.

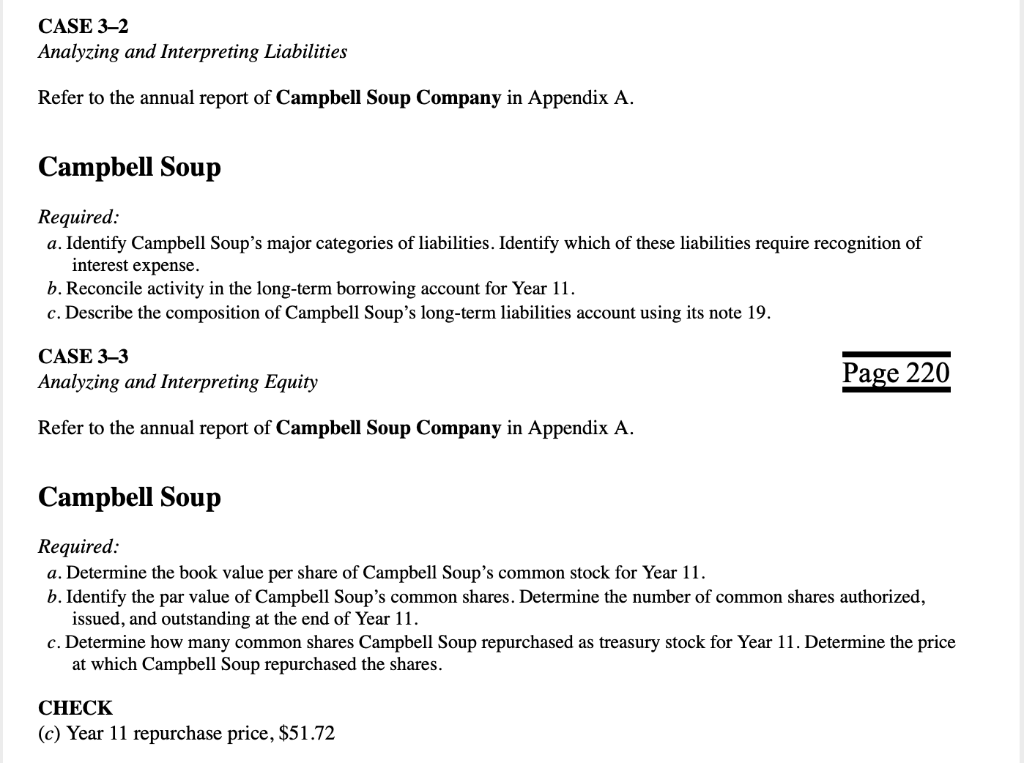

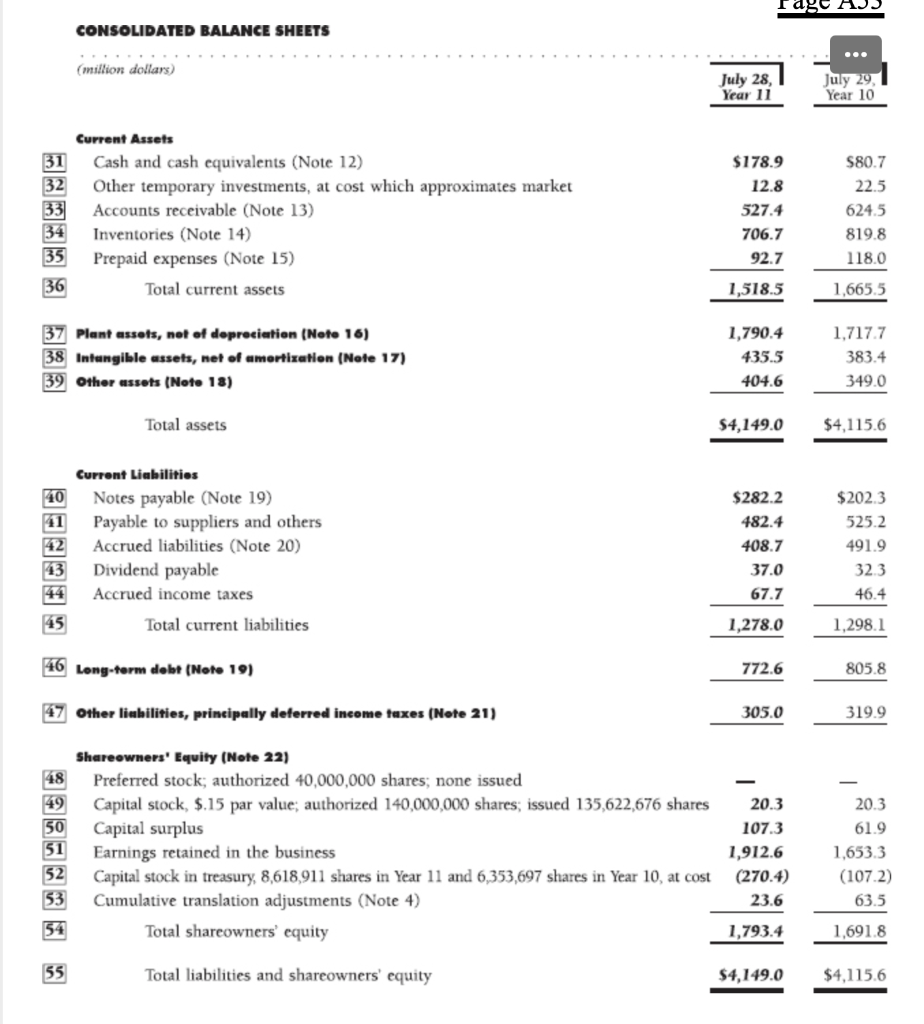

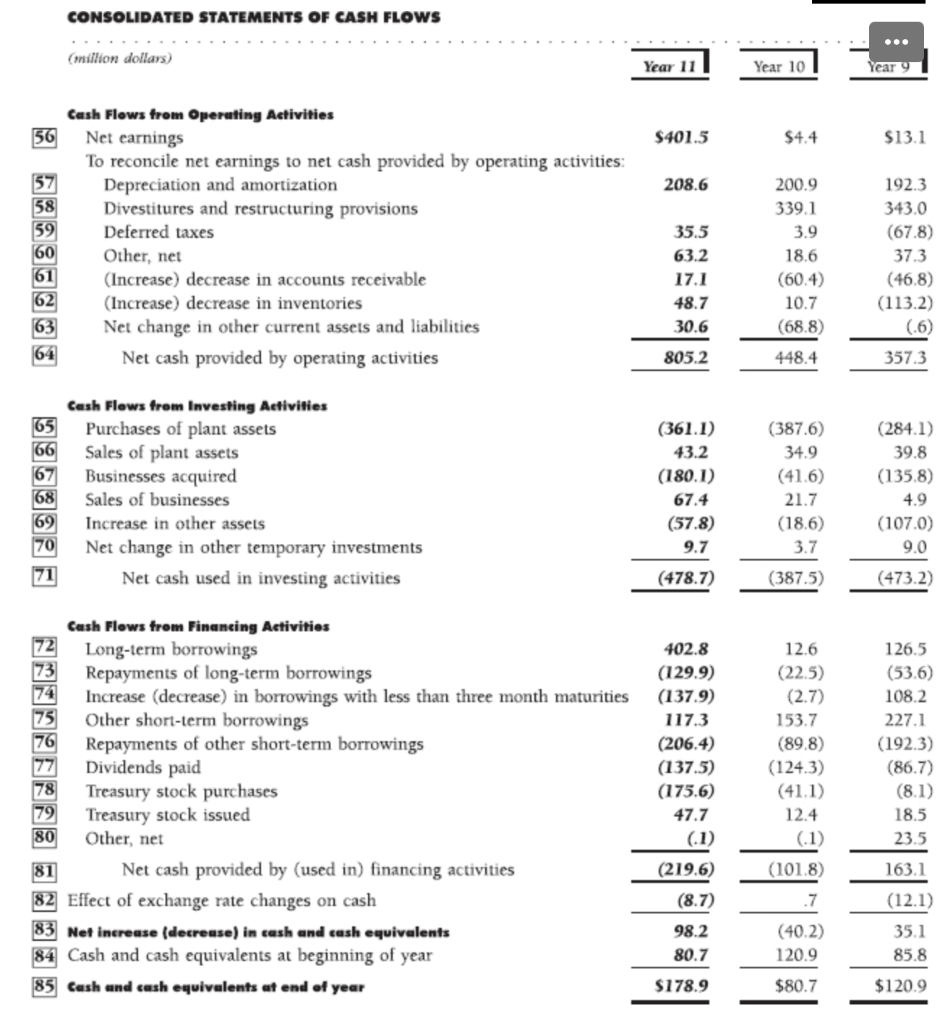

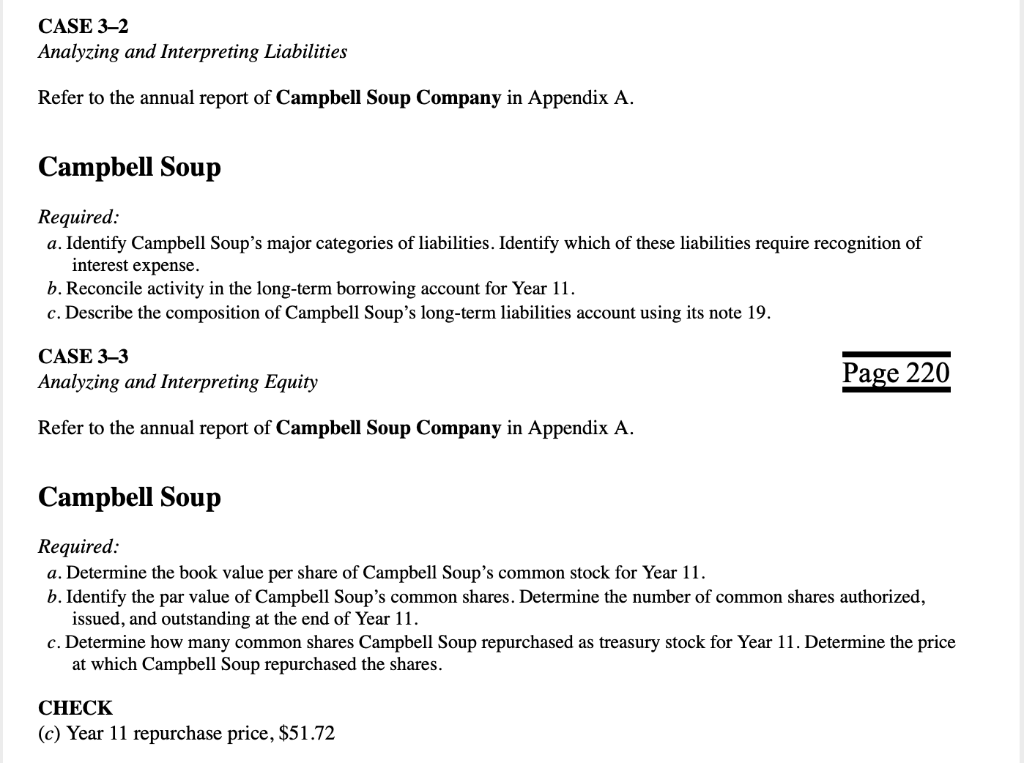

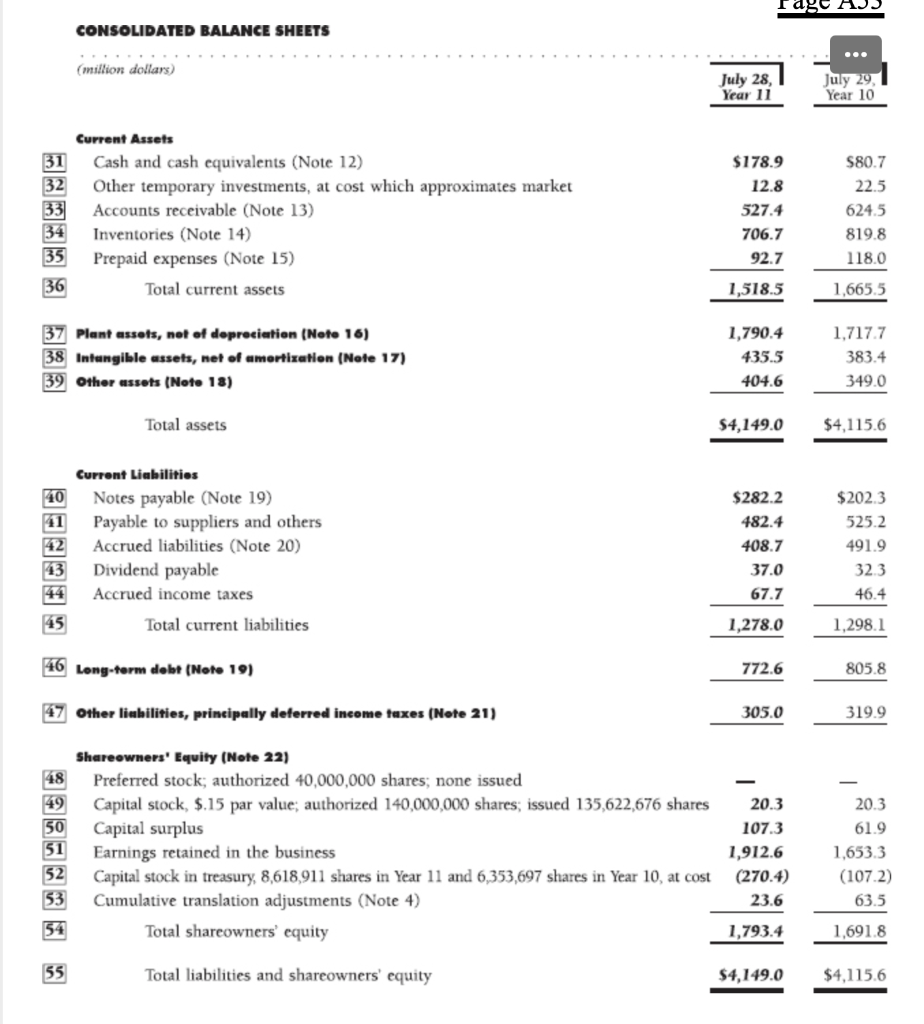

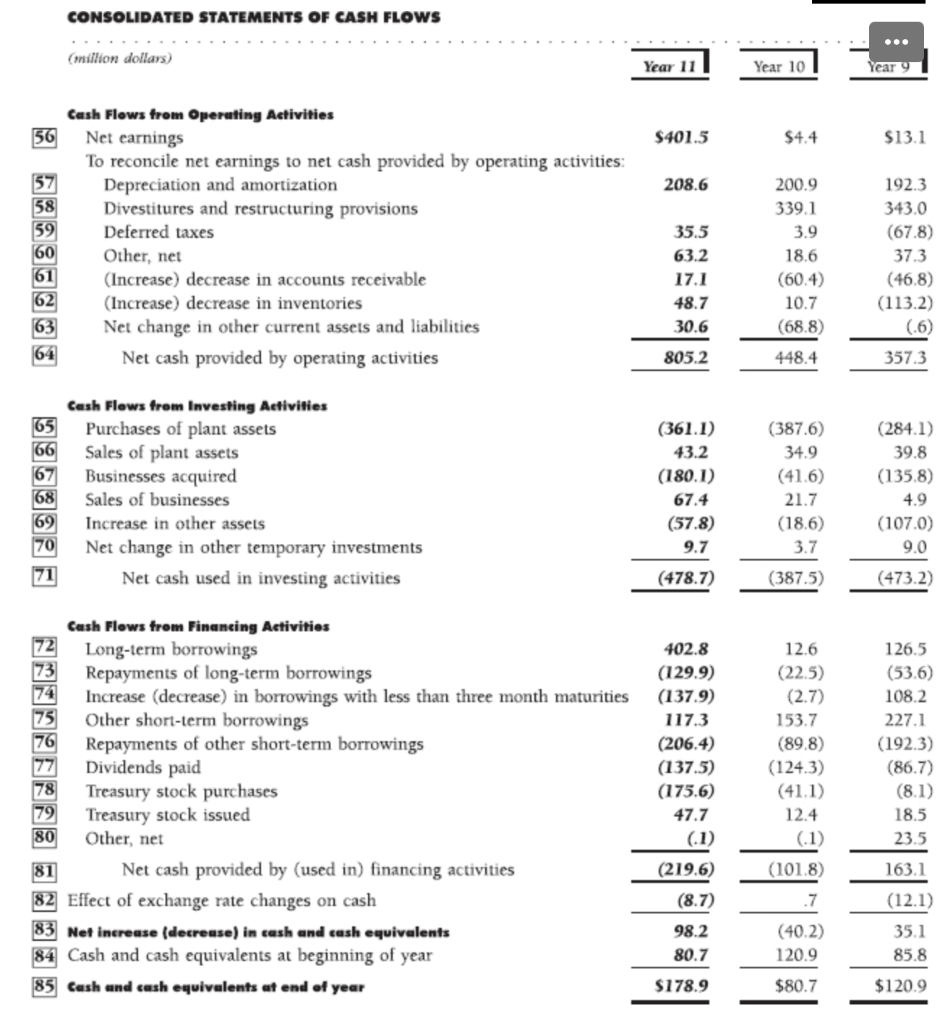

CASE 32 Analyzing and Interpreting Liabilities Refer to the annual report of Campbell Soup Company in Appendix A. Campbell Soup Required: a. Identify Campbell Soup's major categories of liabilities. Identify which of these liabilities require recognition of interest expense. b. Reconcile activity in the long-term borrowing account for Year 11. c. Describe the composition of Campbell Soup's long-term liabilities account using its note 19. CASE 3-3 Analyzing and Interpreting Equity Page 220 Refer to the annual report of Campbell Soup Company in Appendix A. Campbell Soup Required: a. Determine the book value per share of Campbell Soup's common stock for Year 11. b. Identify the par value of Campbell Soup's common shares. Determine the number of common shares authorized, issued, and outstanding at the end of Year 11. c. Determine how many common shares Campbell Soup repurchased as treasury stock for Year 11. Determine the price at which Campbell Soup repurchased the shares. CHECK (c) Year 11 repurchase price, $51.72 Iago HJS CONSOLIDATED BALANCE SHEETS (million dollars) July 28, Year 11 July 29, Year 10 Current Assets 31 Cash and cash equivalents (Note 12) 32 Other temporary investments, at cost which approximates market 33 Accounts receivable (Note 13) 34 Inventories (Note 14) 35 Prepaid expenses (Note 15) 36 Total current assets $178.9 12.8 527.4 706.7 92.7 $80.7 22.5 624.5 819.8 118.0 1,518.5 1,665.5 37 Plant assets, not of depreciation (Note 16) 38 Intangible assets, net of amortization (Note 17) 39 Other assets (Note 18) 1,790.4 435.5 404.6 1,717.7 383.4 349.0 Total assets $4,149.0 $4,115.6 40 42 13 44 Current Liabilities Notes payable (Note 19) Payable to suppliers and others Accrued liabilities (Note 20) Dividend payable Accrued income taxes Total current liabilities $282.2 482.4 408.7 37.0 67.7 $2023 525.2 491.9 323 46.4 45 1,278.0 1,298.1 46 Long-term dobt (Nore 19) 772.6 805.8 47 Other liabilities, principally deferred income taxes (Note 21) 305.0 319.9 48 49 50 51 52 33 54 Shareowners' Equity (Note 22) Preferred stock; authorized 40,000,000 shares, none issued Capital stock, $.15 par value; authorized 140,000,000 shares, issued 135,622,676 shares Capital surplus Earnings retained in the business Capital stock in treasury, 8,618,911 shares in Year 11 and 6,353,697 shares in Year 10, at cost Cumulative translation adjustments (Note 4) Total shareowners' equity 20.3 107.3 1,912.6 (270.4) 23.6 20.3 61.9 1,653.3 (1072) 63.5 1,793.4 1,691.8 55 Total liabilities and shareowners' equity $4,149.0 $4.115.6 CONSOLIDATED STATEMENTS OF CASH FLOWS (million dollars) Year 11 Year 10 Year 9 56 $401.5 $4.4 $13.1 208.6 Cash Flows from Operating Activities Net earnings To reconcile net earnings to net cash provided by operating activities: 57 Depreciation and amortization 58 Divestitures and restructuring provisions 59 Deferred taxes 60 Other, net 61 (Increase) decrease in accounts receivable 62 (Increase) decrease in inventories 63 Net change in other current assets and liabilities 64 Net cash provided by operating activities 35.5 63.2 200.9 339.1 3.9 18.6 (60.4) 10.7 (68.8) 192.3 343.0 (67.8) 37.3 (46.8) (113.2) 0.6) 17.1 48.7 30.6 805.2 448.4 357.3 65 66 67 68 69 170 (361.1) 43.2 (180.1) Cash Flows from Investing Activities Purchases of plant assets Sales of plant assets Businesses acquired Sales of businesses Increase in other assets Net change in other temporary investments Net cash used in investing activities (387.6) 34.9 (41.6) 21.7 (18.6) 3.7 (284.1) 39.8 (135.8) 4.9 (107.0) 9.0 67.4 (57.8) 9.7 171 (478.7) (387.5) (473.2) Cash Flows from Financing Activities 72 Long-term borrowings 173 Repayments of long-term borrowings 74 Increase (decrease) in borrowings with less than three month maturities 75 Other short-term borrowings 76 Repayments of other short-term borrowings 77 Dividends paid 78 Treasury stock purchases 79 Treasury stock issued 80 Other, net 81 Net cash provided by (used in) financing activities 82 Effect of exchange rate changes on cash 83 Net increase (decrease) in cash and cash equivalents 84 Cash and cash equivalents at beginning of year 85 Cash and cash equivalents at end of year 402.8 (129.9) (137.9) 117.3 (206.4) (137.5) (175.6) 47.7 (.1) 12.6 (22.5) (2.7) 153.7 (89.8) (124.3) (41.1) 12.4 (.1) 126.5 (53.6) 108.2 227.1 (192.3) (86.7) (8.1) 18.5 23.5 (219.6) (101.8) 163.1 (8.7) .7 (12.1) 98.2 80.7 (40.2) 120.9 35.1 85.8 $178.9 $80.7 $120.9 (million dollars) Preferred Stock Capital Stock $20.3 Capital Surplus $42.3 Earnings Retained in the Business $1,879.1 13.1 Capital Stock Cumulative in Translation Treasuryl Adjustments S(75.2) $28.5 Total Shareowners Equity $1,895.0 13.1 (116.4) (8.1) (116.4) (8.1) 8.5 12.6 (26.4) 2.1 21.1 (26.4) 1.778.3 4.4 20.3 50.8 (70.7) 1.775.8 4.4 (126.9) (126.9) (41.1) (41.1) 86 Balance at July 31, Year 8 Net earnings Cash dividends ($.90 per share) Treasury stock purchased Treasury stock issued under Management incentive and Stock option plans Translation adjustments 87 Balance at July 30, Year 9 Net earnings Cash dividends ($.98 per share) Treasury stock purchased Treasury stock issued under Management incentive and Stock option plans Translation adjustments Balance at July 29, Year 10 88 Net earnings 89 Cash dividonds ($1.12 per share) 90 Treasury stock purchased 91 Treasury stock issued under Management incentive and Stock option plans 92 Translation adjustments 93 Sale of foreign operations 94 Balance at July 28, Year 11 11.1 4.6 61.4 15.7 61.4 1,691.8 401.5 20.3 61.9 1,653.3 401.5 (1072) 63.5 (142.2) (175.6) (142.2) (175.6) 45.4 12.4 (29.9) (10.0) $23.6 57.8 (29.9) (10.0) $1,793.4 $20.3 $107.3 $1,912.6 S(270.4) 95 Changes in Number of Shares (thousands of shares) Issued 135.622.7 Out- standing 129,038.6 (250.6) 790.6 In Treasury 6,584.1 250.6 (790.6) 135,622.7 Balance at July 31, Year 8 Treasury stock purchased Treasury stock issued under Management incentive and Stock option plans Balance at July 30, Year 9 Treasury stock purchased Treasury stock issued under Management incentive and Stock option plans Balance at July 29, Year 10 Treasury stock purchased Treasury stock issued under Management incentivo and Stock option plans Balence of July 28, Year 11 135,622.7 129,578.6 (833.0) 523.4 129.269.0 (3,395.4) 1,130.2 127,003.8 6,044.1 833.0 (523.4) 6,353.7 3,395.4 (1,130.2) 8,618.9 135,622.7 CASE 32 Analyzing and Interpreting Liabilities Refer to the annual report of Campbell Soup Company in Appendix A. Campbell Soup Required: a. Identify Campbell Soup's major categories of liabilities. Identify which of these liabilities require recognition of interest expense. b. Reconcile activity in the long-term borrowing account for Year 11. c. Describe the composition of Campbell Soup's long-term liabilities account using its note 19. CASE 3-3 Analyzing and Interpreting Equity Page 220 Refer to the annual report of Campbell Soup Company in Appendix A. Campbell Soup Required: a. Determine the book value per share of Campbell Soup's common stock for Year 11. b. Identify the par value of Campbell Soup's common shares. Determine the number of common shares authorized, issued, and outstanding at the end of Year 11. c. Determine how many common shares Campbell Soup repurchased as treasury stock for Year 11. Determine the price at which Campbell Soup repurchased the shares. CHECK (c) Year 11 repurchase price, $51.72 Iago HJS CONSOLIDATED BALANCE SHEETS (million dollars) July 28, Year 11 July 29, Year 10 Current Assets 31 Cash and cash equivalents (Note 12) 32 Other temporary investments, at cost which approximates market 33 Accounts receivable (Note 13) 34 Inventories (Note 14) 35 Prepaid expenses (Note 15) 36 Total current assets $178.9 12.8 527.4 706.7 92.7 $80.7 22.5 624.5 819.8 118.0 1,518.5 1,665.5 37 Plant assets, not of depreciation (Note 16) 38 Intangible assets, net of amortization (Note 17) 39 Other assets (Note 18) 1,790.4 435.5 404.6 1,717.7 383.4 349.0 Total assets $4,149.0 $4,115.6 40 42 13 44 Current Liabilities Notes payable (Note 19) Payable to suppliers and others Accrued liabilities (Note 20) Dividend payable Accrued income taxes Total current liabilities $282.2 482.4 408.7 37.0 67.7 $2023 525.2 491.9 323 46.4 45 1,278.0 1,298.1 46 Long-term dobt (Nore 19) 772.6 805.8 47 Other liabilities, principally deferred income taxes (Note 21) 305.0 319.9 48 49 50 51 52 33 54 Shareowners' Equity (Note 22) Preferred stock; authorized 40,000,000 shares, none issued Capital stock, $.15 par value; authorized 140,000,000 shares, issued 135,622,676 shares Capital surplus Earnings retained in the business Capital stock in treasury, 8,618,911 shares in Year 11 and 6,353,697 shares in Year 10, at cost Cumulative translation adjustments (Note 4) Total shareowners' equity 20.3 107.3 1,912.6 (270.4) 23.6 20.3 61.9 1,653.3 (1072) 63.5 1,793.4 1,691.8 55 Total liabilities and shareowners' equity $4,149.0 $4.115.6 CONSOLIDATED STATEMENTS OF CASH FLOWS (million dollars) Year 11 Year 10 Year 9 56 $401.5 $4.4 $13.1 208.6 Cash Flows from Operating Activities Net earnings To reconcile net earnings to net cash provided by operating activities: 57 Depreciation and amortization 58 Divestitures and restructuring provisions 59 Deferred taxes 60 Other, net 61 (Increase) decrease in accounts receivable 62 (Increase) decrease in inventories 63 Net change in other current assets and liabilities 64 Net cash provided by operating activities 35.5 63.2 200.9 339.1 3.9 18.6 (60.4) 10.7 (68.8) 192.3 343.0 (67.8) 37.3 (46.8) (113.2) 0.6) 17.1 48.7 30.6 805.2 448.4 357.3 65 66 67 68 69 170 (361.1) 43.2 (180.1) Cash Flows from Investing Activities Purchases of plant assets Sales of plant assets Businesses acquired Sales of businesses Increase in other assets Net change in other temporary investments Net cash used in investing activities (387.6) 34.9 (41.6) 21.7 (18.6) 3.7 (284.1) 39.8 (135.8) 4.9 (107.0) 9.0 67.4 (57.8) 9.7 171 (478.7) (387.5) (473.2) Cash Flows from Financing Activities 72 Long-term borrowings 173 Repayments of long-term borrowings 74 Increase (decrease) in borrowings with less than three month maturities 75 Other short-term borrowings 76 Repayments of other short-term borrowings 77 Dividends paid 78 Treasury stock purchases 79 Treasury stock issued 80 Other, net 81 Net cash provided by (used in) financing activities 82 Effect of exchange rate changes on cash 83 Net increase (decrease) in cash and cash equivalents 84 Cash and cash equivalents at beginning of year 85 Cash and cash equivalents at end of year 402.8 (129.9) (137.9) 117.3 (206.4) (137.5) (175.6) 47.7 (.1) 12.6 (22.5) (2.7) 153.7 (89.8) (124.3) (41.1) 12.4 (.1) 126.5 (53.6) 108.2 227.1 (192.3) (86.7) (8.1) 18.5 23.5 (219.6) (101.8) 163.1 (8.7) .7 (12.1) 98.2 80.7 (40.2) 120.9 35.1 85.8 $178.9 $80.7 $120.9 (million dollars) Preferred Stock Capital Stock $20.3 Capital Surplus $42.3 Earnings Retained in the Business $1,879.1 13.1 Capital Stock Cumulative in Translation Treasuryl Adjustments S(75.2) $28.5 Total Shareowners Equity $1,895.0 13.1 (116.4) (8.1) (116.4) (8.1) 8.5 12.6 (26.4) 2.1 21.1 (26.4) 1.778.3 4.4 20.3 50.8 (70.7) 1.775.8 4.4 (126.9) (126.9) (41.1) (41.1) 86 Balance at July 31, Year 8 Net earnings Cash dividends ($.90 per share) Treasury stock purchased Treasury stock issued under Management incentive and Stock option plans Translation adjustments 87 Balance at July 30, Year 9 Net earnings Cash dividends ($.98 per share) Treasury stock purchased Treasury stock issued under Management incentive and Stock option plans Translation adjustments Balance at July 29, Year 10 88 Net earnings 89 Cash dividonds ($1.12 per share) 90 Treasury stock purchased 91 Treasury stock issued under Management incentive and Stock option plans 92 Translation adjustments 93 Sale of foreign operations 94 Balance at July 28, Year 11 11.1 4.6 61.4 15.7 61.4 1,691.8 401.5 20.3 61.9 1,653.3 401.5 (1072) 63.5 (142.2) (175.6) (142.2) (175.6) 45.4 12.4 (29.9) (10.0) $23.6 57.8 (29.9) (10.0) $1,793.4 $20.3 $107.3 $1,912.6 S(270.4) 95 Changes in Number of Shares (thousands of shares) Issued 135.622.7 Out- standing 129,038.6 (250.6) 790.6 In Treasury 6,584.1 250.6 (790.6) 135,622.7 Balance at July 31, Year 8 Treasury stock purchased Treasury stock issued under Management incentive and Stock option plans Balance at July 30, Year 9 Treasury stock purchased Treasury stock issued under Management incentive and Stock option plans Balance at July 29, Year 10 Treasury stock purchased Treasury stock issued under Management incentivo and Stock option plans Balence of July 28, Year 11 135,622.7 129,578.6 (833.0) 523.4 129.269.0 (3,395.4) 1,130.2 127,003.8 6,044.1 833.0 (523.4) 6,353.7 3,395.4 (1,130.2) 8,618.9 135,622.7