Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MTPF CASE STUDY SCENARIO Scott and Amy Miller are seeking financial advice from you to help them improve their finances. Scott is your nephew, and

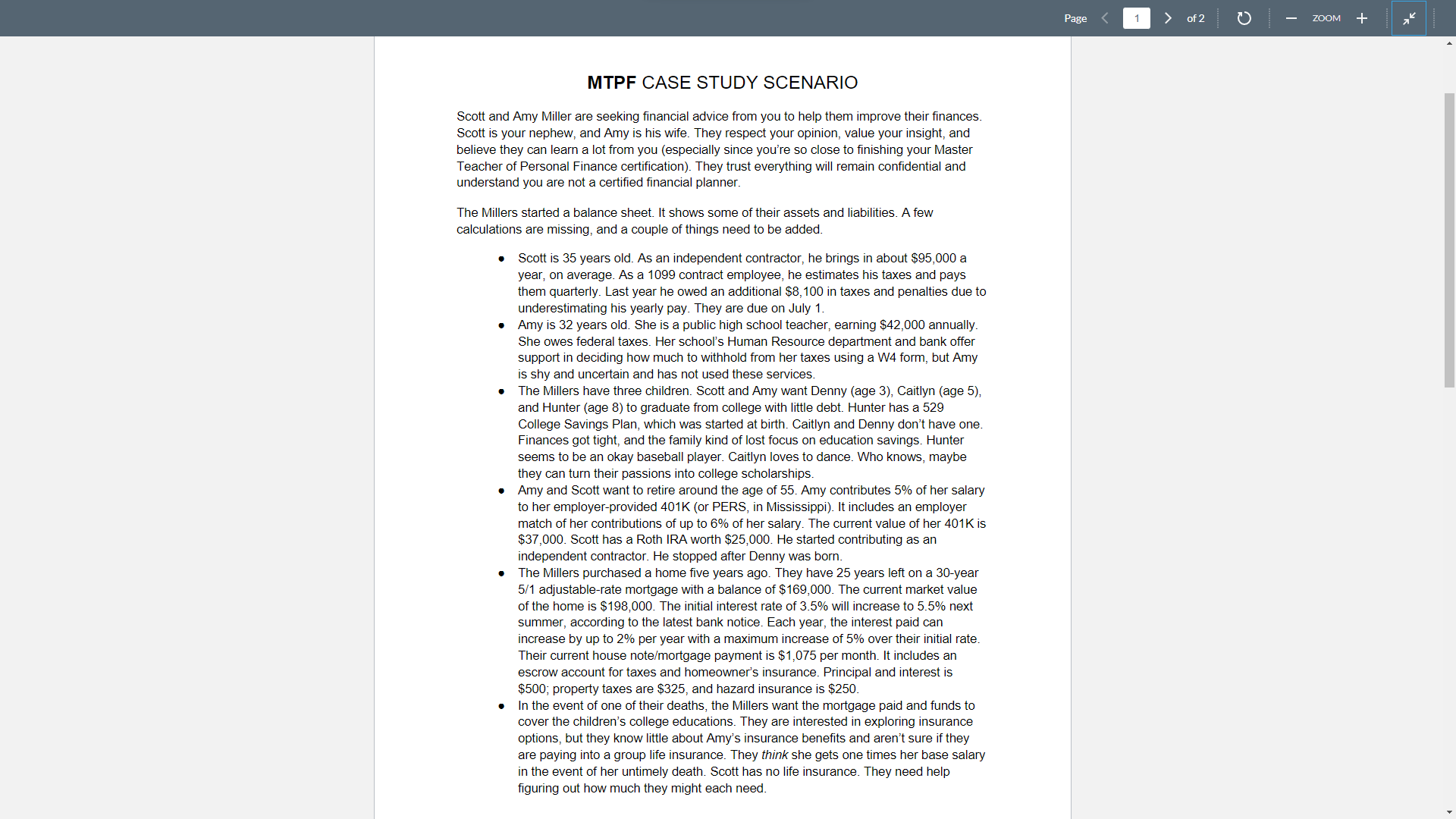

MTPF CASE STUDY SCENARIO Scott and Amy Miller are seeking financial advice from you to help them improve their finances. Scott is your nephew, and Amy is his wife. They respect your opinion, value your insight, and believe they can learn a lot from you (especially since you're so close to finishing your Master Teacher of Personal Finance certification). They trust everything will remain confidential and understand you are not a certified financial planner. The Millers started a balance sheet. It shows some of their assets and liabilities. A few calculations are missing, and a couple of things need to be added. - Scott is 35 years old. As an independent contractor, he brings in about $95,000a year, on average. As a 1099 contract employee, he estimates his taxes and pays them quarterly. Last year he owed an additional $8,100 in taxes and penalties due to underestimating his yearly pay. They are due on July 1. - Amy is 32 years old. She is a public high school teacher, earning $42,000 annually. She owes federal taxes. Her school's Human Resource department and bank offer support in deciding how much to withhold from her taxes using a W4 form, but Amy is shy and uncertain and has not used these services. - The Millers have three children. Scott and Amy want Denny (age 3), Caitlyn (age 5), and Hunter (age 8) to graduate from college with little debt. Hunter has a 529 College Savings Plan, which was started at birth. Caitlyn and Denny don't have one. Finances got tight, and the family kind of lost focus on education savings. Hunter seems to be an okay baseball player. Caitlyn loves to dance. Who knows, maybe they can turn their passions into college scholarships. - Amy and Scott want to retire around the age of 55 . Amy contributes 5% of her salary to her employer-provided 401K (or PERS, in Mississippi). It includes an employer match of her contributions of up to 6% of her salary. The current value of her 401K is $37,000. Scott has a Roth IRA worth $25,000. He started contributing as an independent contractor. He stopped after Denny was born. - The Millers purchased a home five years ago. They have 25 years left on a 30-year 5/1 adjustable-rate mortgage with a balance of $169,000. The current market value of the home is $198,000. The initial interest rate of 3.5% will increase to 5.5% next summer, according to the latest bank notice. Each year, the interest paid can increase by up to 2% per year with a maximum increase of 5% over their initial rate. Their current house note/mortgage payment is $1,075 per month. It includes an escrow account for taxes and homeowner's insurance. Principal and interest is $500; property taxes are $325, and hazard insurance is $250. - In the event of one of their deaths, the Millers want the mortgage paid and funds to cover the children's college educations. They are interested in exploring insurance options, but they know little about Amy's insurance benefits and aren't sure if they are paying into a group life insurance. They think she gets one times her base salary in the event of her untimely death. Scott has no life insurance. They need help figuring out how much they might each need

MTPF CASE STUDY SCENARIO Scott and Amy Miller are seeking financial advice from you to help them improve their finances. Scott is your nephew, and Amy is his wife. They respect your opinion, value your insight, and believe they can learn a lot from you (especially since you're so close to finishing your Master Teacher of Personal Finance certification). They trust everything will remain confidential and understand you are not a certified financial planner. The Millers started a balance sheet. It shows some of their assets and liabilities. A few calculations are missing, and a couple of things need to be added. - Scott is 35 years old. As an independent contractor, he brings in about $95,000a year, on average. As a 1099 contract employee, he estimates his taxes and pays them quarterly. Last year he owed an additional $8,100 in taxes and penalties due to underestimating his yearly pay. They are due on July 1. - Amy is 32 years old. She is a public high school teacher, earning $42,000 annually. She owes federal taxes. Her school's Human Resource department and bank offer support in deciding how much to withhold from her taxes using a W4 form, but Amy is shy and uncertain and has not used these services. - The Millers have three children. Scott and Amy want Denny (age 3), Caitlyn (age 5), and Hunter (age 8) to graduate from college with little debt. Hunter has a 529 College Savings Plan, which was started at birth. Caitlyn and Denny don't have one. Finances got tight, and the family kind of lost focus on education savings. Hunter seems to be an okay baseball player. Caitlyn loves to dance. Who knows, maybe they can turn their passions into college scholarships. - Amy and Scott want to retire around the age of 55 . Amy contributes 5% of her salary to her employer-provided 401K (or PERS, in Mississippi). It includes an employer match of her contributions of up to 6% of her salary. The current value of her 401K is $37,000. Scott has a Roth IRA worth $25,000. He started contributing as an independent contractor. He stopped after Denny was born. - The Millers purchased a home five years ago. They have 25 years left on a 30-year 5/1 adjustable-rate mortgage with a balance of $169,000. The current market value of the home is $198,000. The initial interest rate of 3.5% will increase to 5.5% next summer, according to the latest bank notice. Each year, the interest paid can increase by up to 2% per year with a maximum increase of 5% over their initial rate. Their current house note/mortgage payment is $1,075 per month. It includes an escrow account for taxes and homeowner's insurance. Principal and interest is $500; property taxes are $325, and hazard insurance is $250. - In the event of one of their deaths, the Millers want the mortgage paid and funds to cover the children's college educations. They are interested in exploring insurance options, but they know little about Amy's insurance benefits and aren't sure if they are paying into a group life insurance. They think she gets one times her base salary in the event of her untimely death. Scott has no life insurance. They need help figuring out how much they might each need Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started