Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MTY Food Group Inc. is a Canadian franchisor and operator of numerous quick service restaurants operating under 75 brand names such as Thai Express,

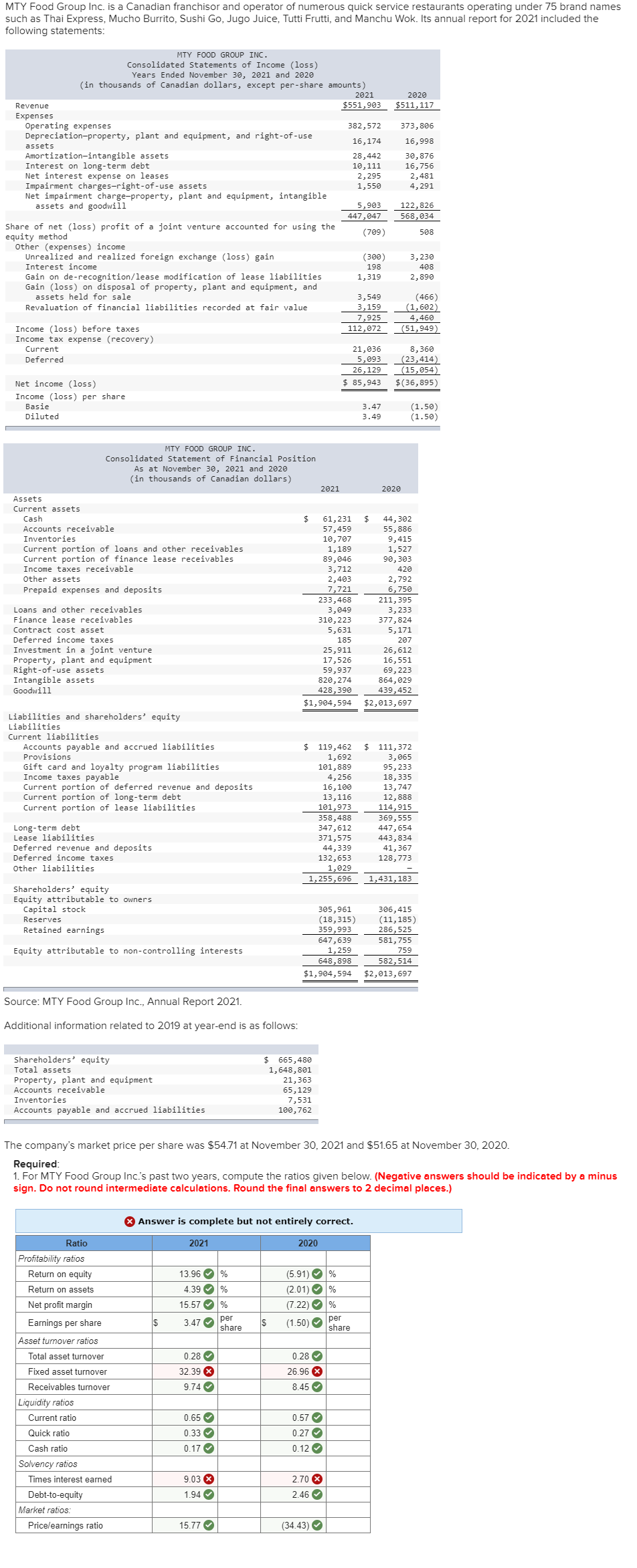

MTY Food Group Inc. is a Canadian franchisor and operator of numerous quick service restaurants operating under 75 brand names such as Thai Express, Mucho Burrito, Sushi Go, Jugo Juice, Tutti Frutti, and Manchu Wok. Its annual report for 2021 included the following statements: Revenue Expenses MTY FOOD GROUP INC. Consolidated Statements of Income (loss) Years Ended November 30, 2021 and 2020 (in thousands of Canadian dollars, except per-share amounts) 2021 $551,903 2020 $511,117 Operating expenses 382,572 373,806 Depreciation-property, plant and equipment, and right-of-use 16,174 assets 16,998 Amortization-intangible assets 28,442 30,876 Interest long-term debt 10,111 16,756 Net interest expense on leases 2,295 2,481 Impairment charges-right-of-use assets 1,550 4,291 Net impairment charge-property, plant and equipment, intangible assets and goodwill 5,903 122,826 447,047 568,034 Share of net (loss) profit of a joint venture accounted for using the equity method (709) 508 Other (expenses) income Unrealized and realized foreign exchange (loss) gain (300) 3,230 Interest income 198 408 Gain on de-recognition/lease modification of lease liabilities. 1,319 2,890 Gain (loss) on disposal of property, plant and equipment, and assets held for sale 3,549 (466) Revaluation of financial liabilities recorded at fair value 3,159 (1,602) 7,925 4,460 Income (loss) before taxes 112,072 (51,949) Income tax expense (recovery) Current Deferred Net income (loss) 21,036 8,360 5,093 (23,414) 26,129 (15,054) $ 85,943 $(36,895) Income (loss) per share Basie Diluted 3.47 3.49 (1.50) (1.50) Assets Current assets Cash MTY FOOD GROUP INC. Consolidated Statement of Financial Position As at November 30, 2021 and 2020 (in thousands of Canadian dollars) Accounts receivable Inventories Current portion of loans and other receivables Current portion of finance lease receivables Income taxes receivable Other assets Prepaid expenses and deposits Loans and other receivables Finance lease receivables Contract cost asset Deferred income taxes Investment in a joint venture Property, plant and equipment Right-of-use assets Intangible assets Goodwill Liabilities and shareholders' equity Liabilities 2021 2020 $ 61,231 $ 44,302 57,459 55,886 10,707 9,415 1,189 1,527 89,046 90,303 3,712 420 2,403 2,792 7,721 233,468 6,750 211,395 3,049 3,233 310,223 377,824 5,631 185 5,171 207 25,911 26,612 17,526 16,551 59,937 69,223 820,274 864,029 428,390 439,452 $1,904,594 $2,013,697 Current liabilities Accounts payable and accrued liabilities Provisions $ 119,462 $111,372 Gift card and loyalty program liabilities Income taxes payable 1,692 101,889 3,065 95,233 4,256 18,335 Current portion of deferred revenue and deposits 16,100 13,747 Current portion of long-term debt Current portion of lease liabilities Long-term debt Lease liabilities Deferred revenue and deposits Deferred income taxes Other liabilities Shareholders' equity Equity attributable to owners Capital stock Reserves 13,116 12,888 101,973 114,915 358,488 369,555 347,612 447,654 371,575 443,834 44,339 132,653 1,029 1,255,696 41,367 128,773 1,431,183 Retained earnings Equity attributable to non-controlling interests Source: MTY Food Group Inc., Annual Report 2021. Additional information related to 2019 at year-end is as follows: Shareholders' equity Total assets Property, plant and equipment Accounts receivable Inventories Accounts payable and accrued liabilities 305,961 306,415 (18,315) (11,185) 359,993 286,525 647,639 581,755 1,259 648,898 $1,904,594 759 582,514 $2,013,697 $ 665,480 1,648,801 21,363 65,129 7,531 100,762 The company's market price per share was $54.71 at November 30, 2021 and $51.65 at November 30, 2020. Required: 1. For MTY Food Group Inc.'s past two years, compute the ratios given below. (Negative answers should be indicated by a minus sign. Do not round intermediate calculations. Round the final answers to 2 decimal places.) * Answer is complete but not entirely correct. Ratio Profitability ratios Return on equity 2021 2020 13.96 % (5.91) % Return on assets 4.39 % (2.01) % Net profit margin Earnings per share Asset turnover ratios Total asset turnover 15.57 % (7.22) % $ 3.47 per share $ (1.50) per share 0.28 0.28 Fixed asset turnover 32.39 26.96 x Receivables turnover 9.74 8.45 Liquidity ratios Current ratio 0.65 0.57 Quick ratio 0.33 0.27 0.17 0.12 Cash ratio Solvency ratios Times interest earned 9.03 2.70 x Debt-to-equity 1.94 2.46 Market ratios: Price/earnings ratio 15.77 (34.43)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started