Answered step by step

Verified Expert Solution

Question

1 Approved Answer

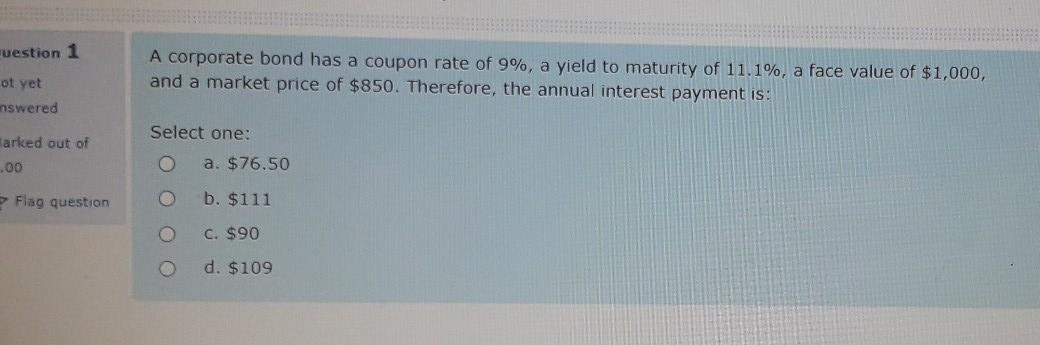

muestion 1 A corporate bond has a coupon rate of 9%, a yield to maturity of 11.1%, a face value of $1,000, and a market

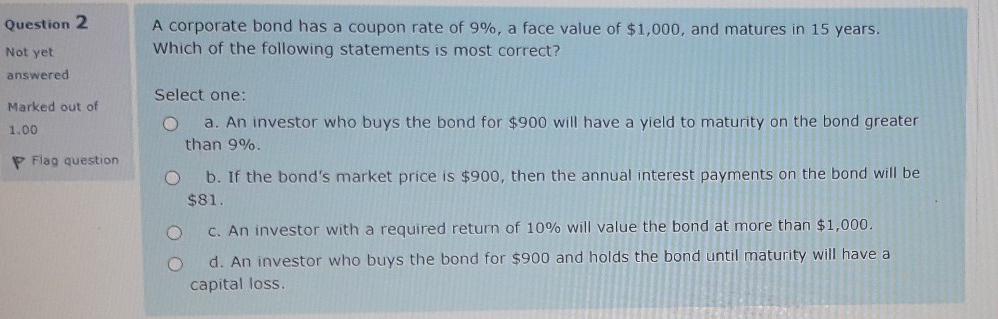

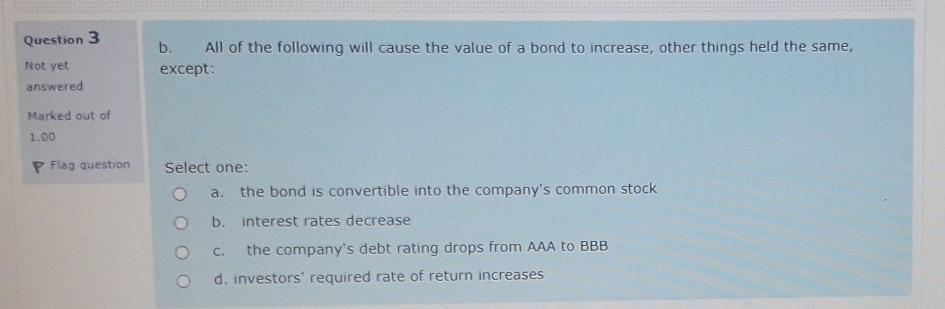

muestion 1 A corporate bond has a coupon rate of 9%, a yield to maturity of 11.1%, a face value of $1,000, and a market price of $850. Therefore, the annual interest payment is: ot yet nswered Select one: arked out of .00 a. $76.50 Flag question b. $111 C. $90 d. $109 Question 2 A corporate bond has a coupon rate of 9%, a face value of $1,000, and matures in 15 years. Which of the following statements is most correct? Not yet answered Marked out of 1.00 Select one: O a. An investor who buys the bond for $900 will have a yield to maturity on the bond greater than 9%. P Flag question b. If the bond's market price is $900, then the annual interest payments on the bond will be $81. C. An investor with a required return of 10% will value the bond at more than $1,000. d. An investor who buys the bond for $900 and holds the bond until maturity will have a capital loss Question 3 b. All of the following will cause the value of a bond to increase, other things held the same, except: Not yet answered Marked out of 1.00 P Flag question Select one: a. the bond is convertible into the company's common stock O b. interest rates decrease the company's debt rating drops from AAA to BBB d. investors' required rate of return increases

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started