Answered step by step

Verified Expert Solution

Question

1 Approved Answer

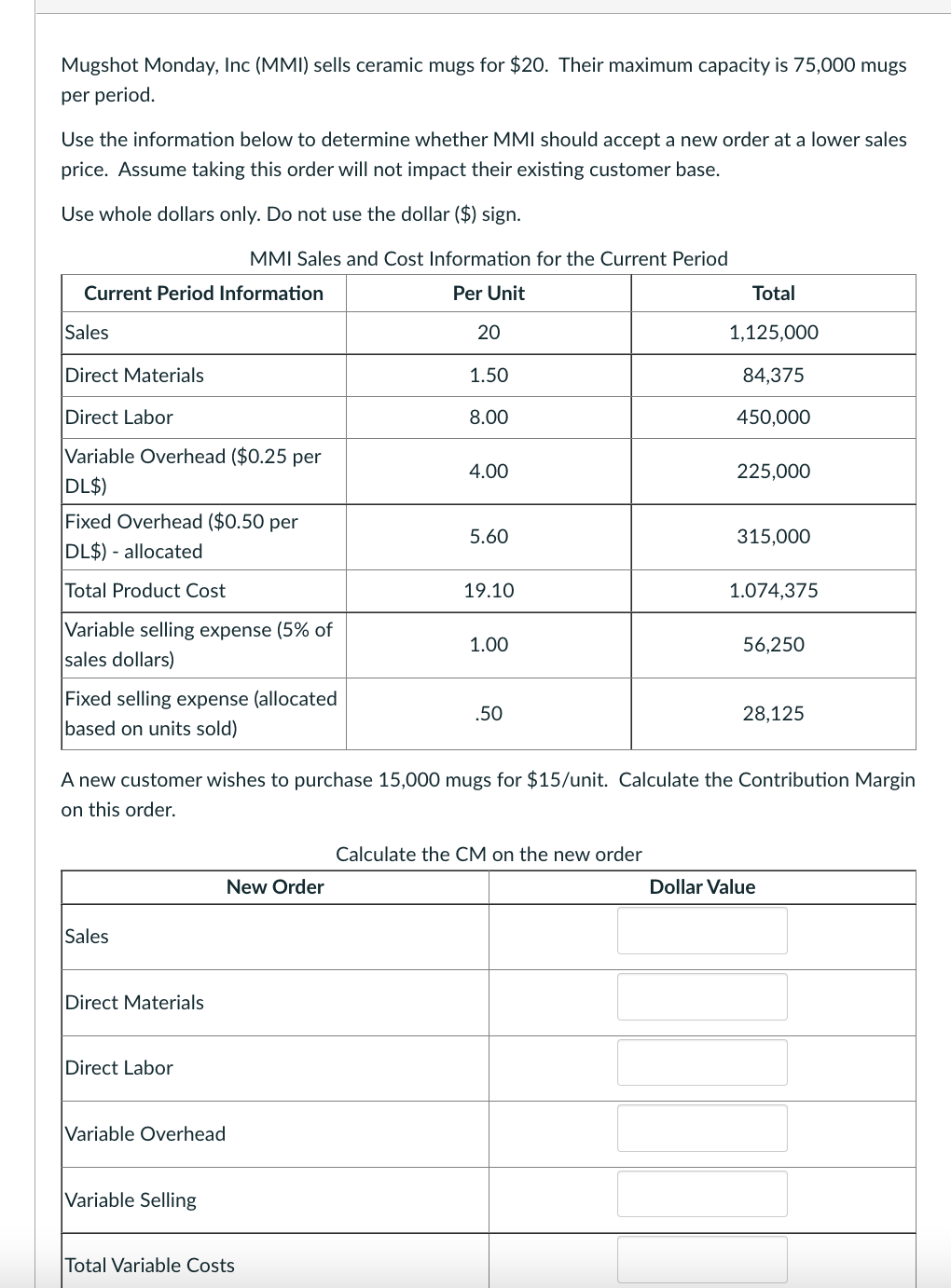

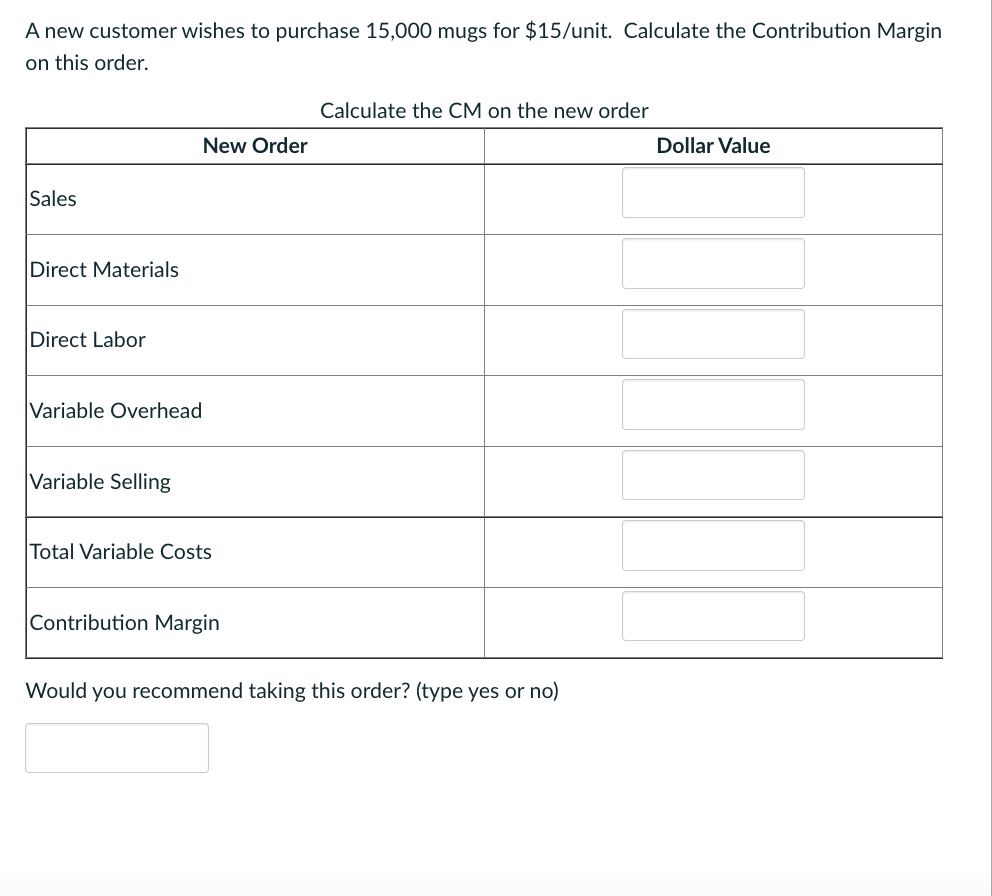

Mugshot Monday, Inc (MMI) sells ceramic mugs for $20. Their maximum capacity is 75,000 mugs per period. Use the information below to determine whether

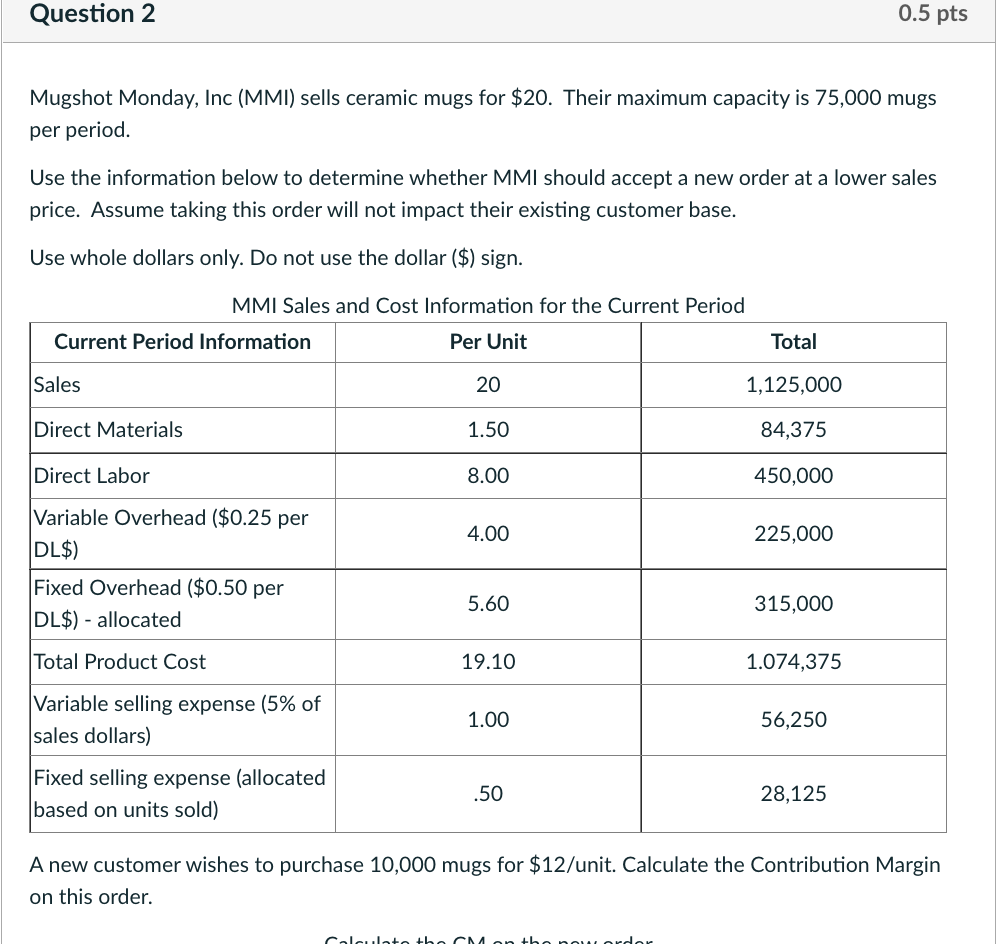

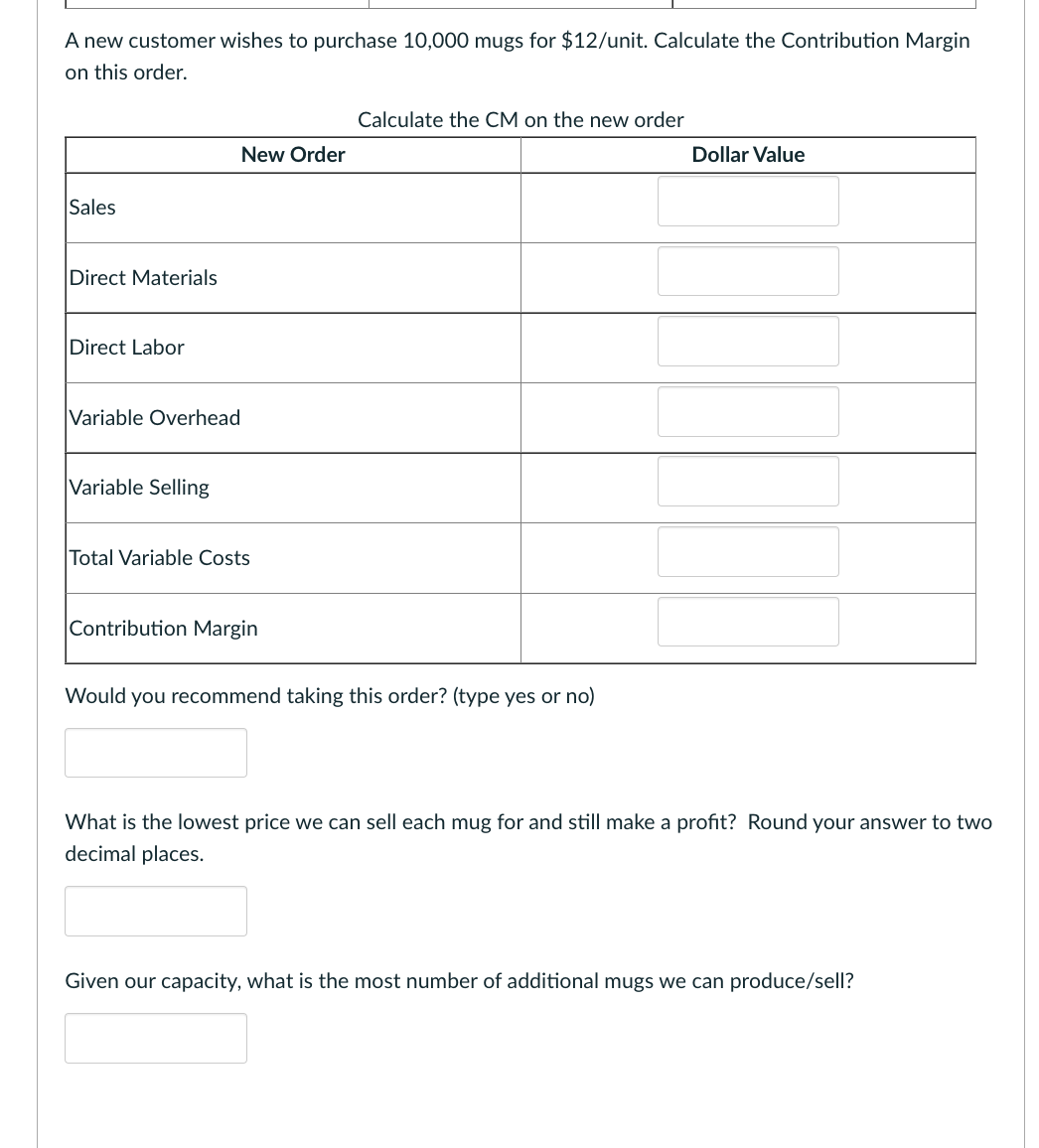

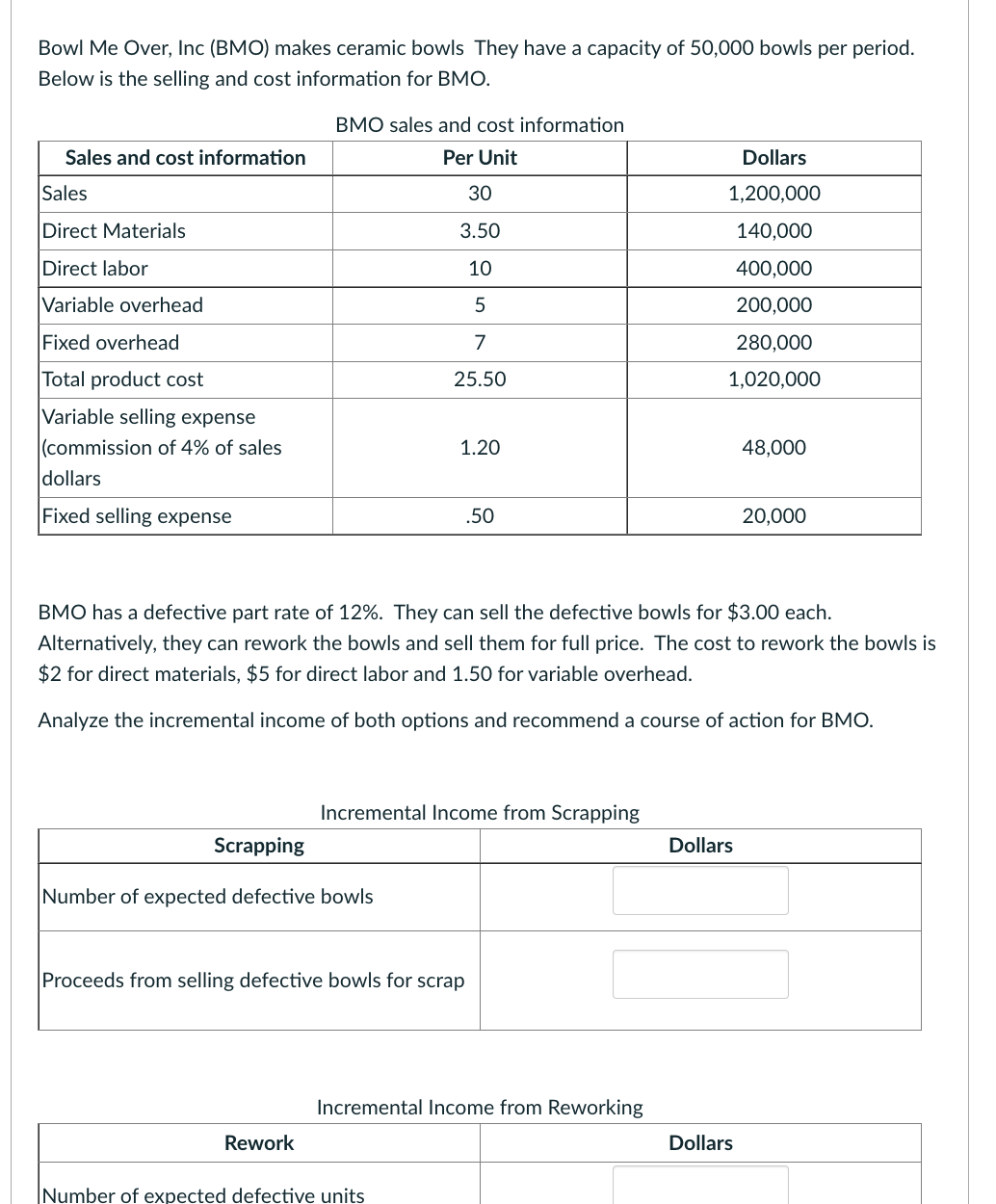

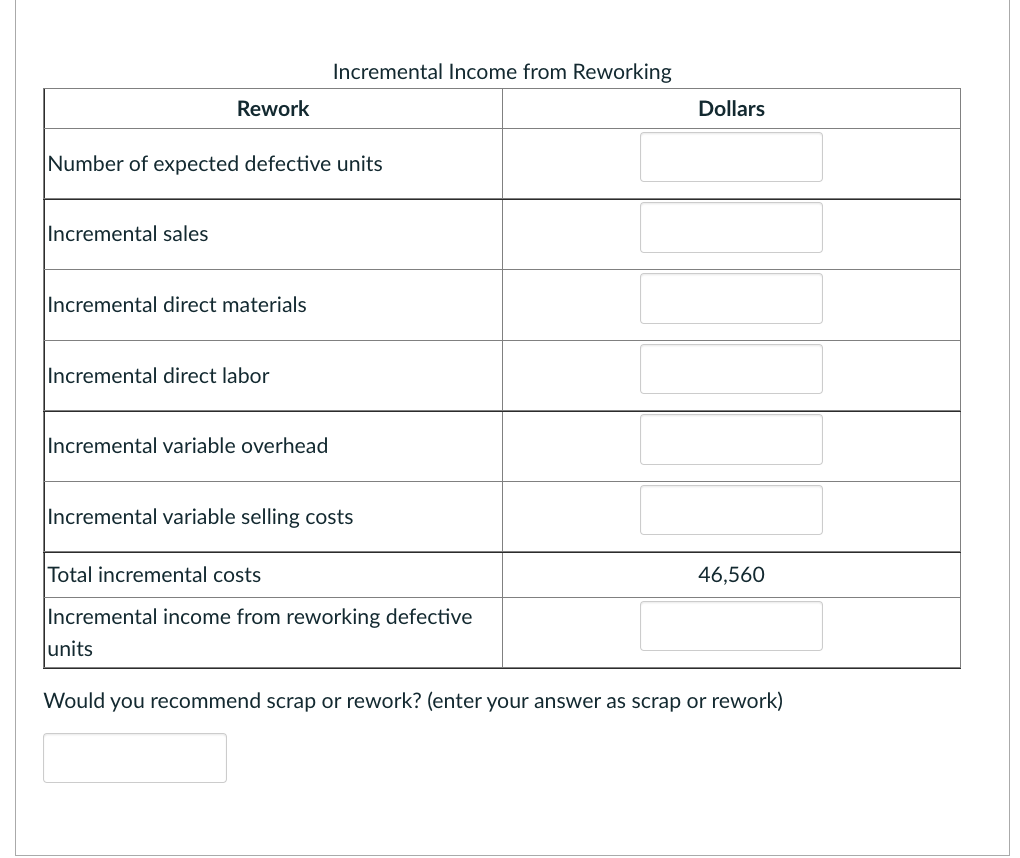

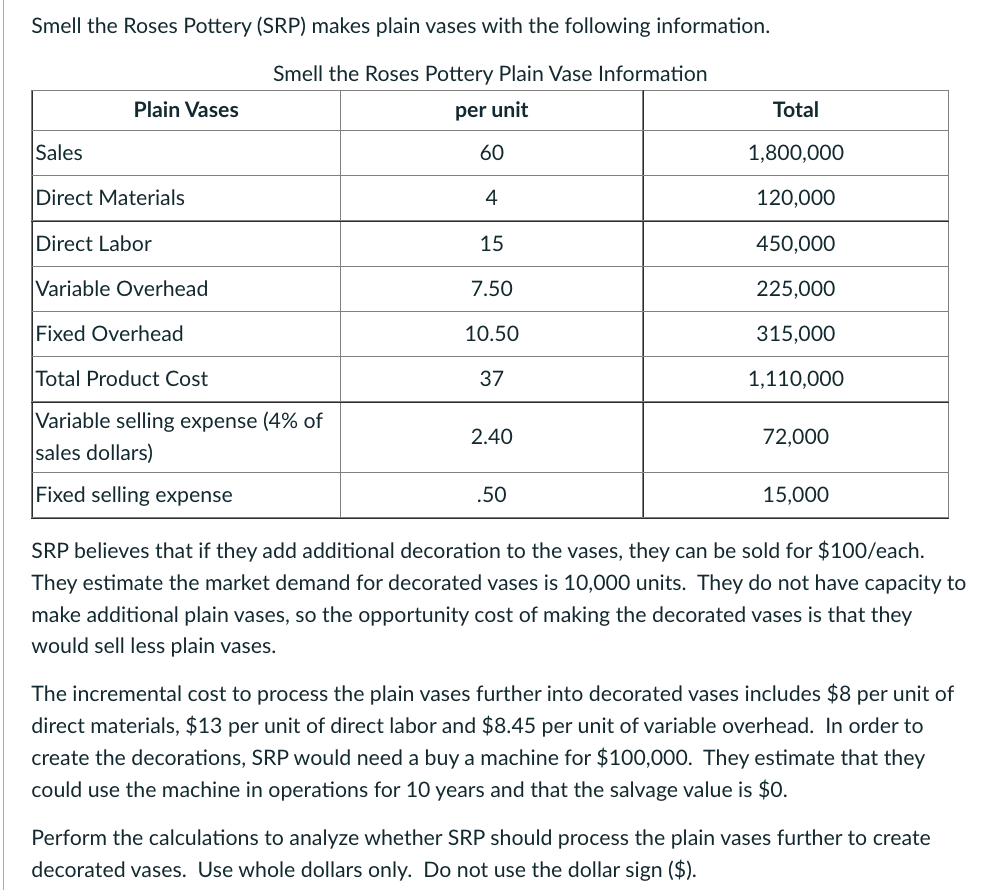

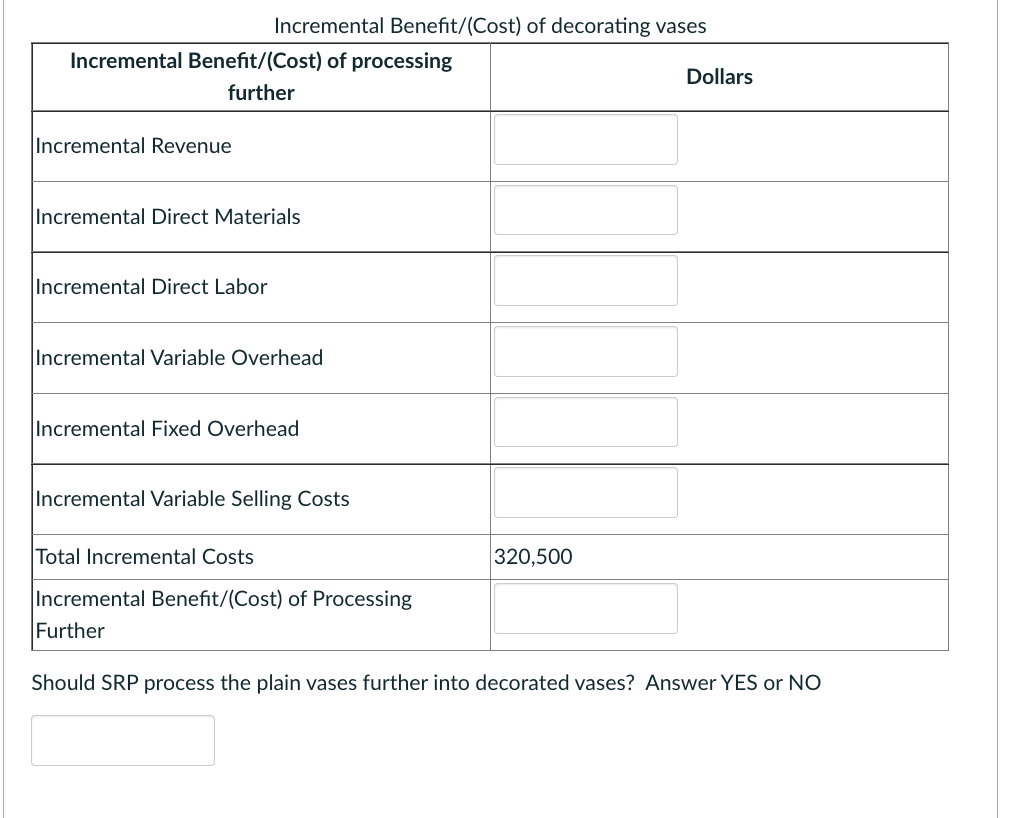

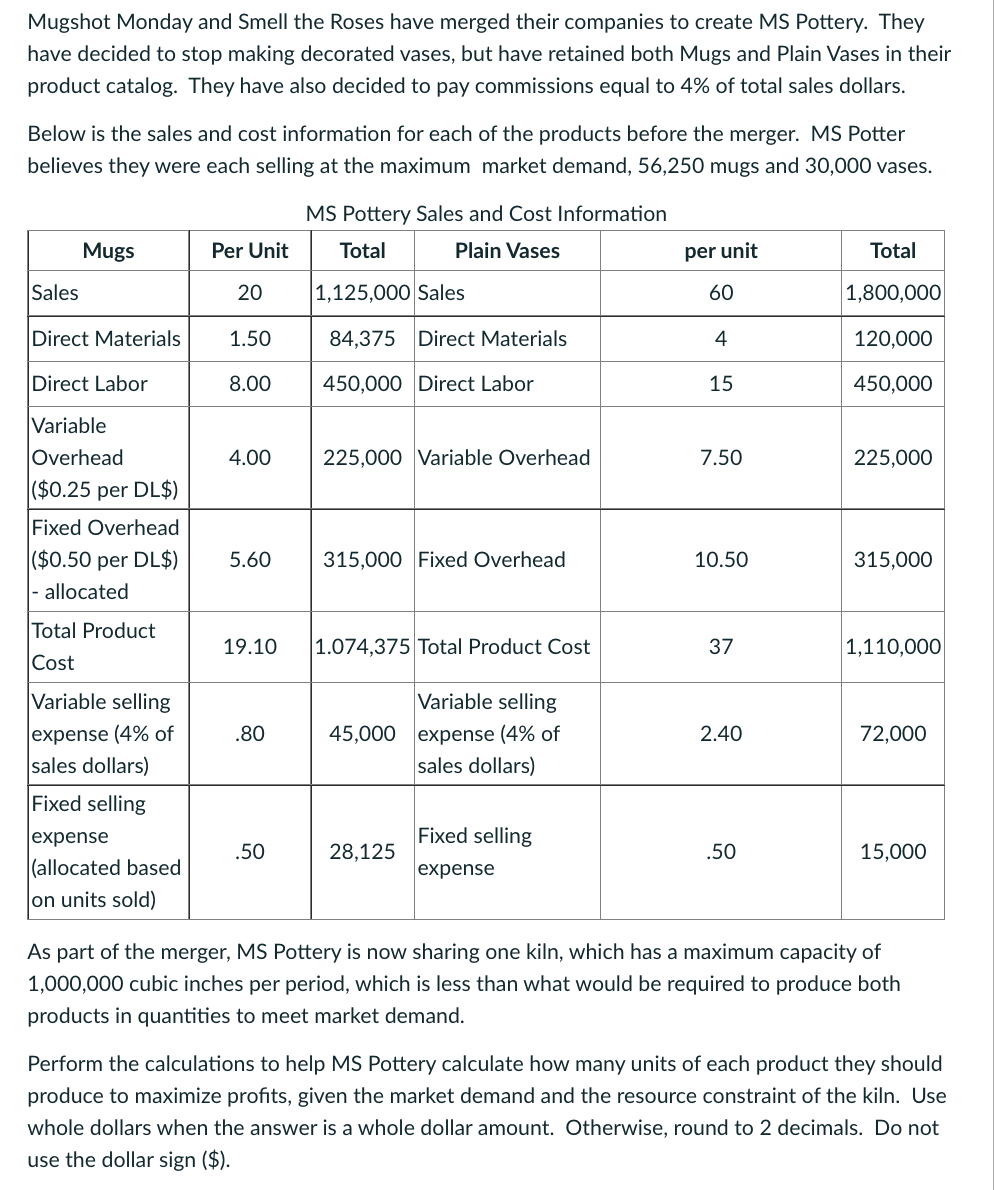

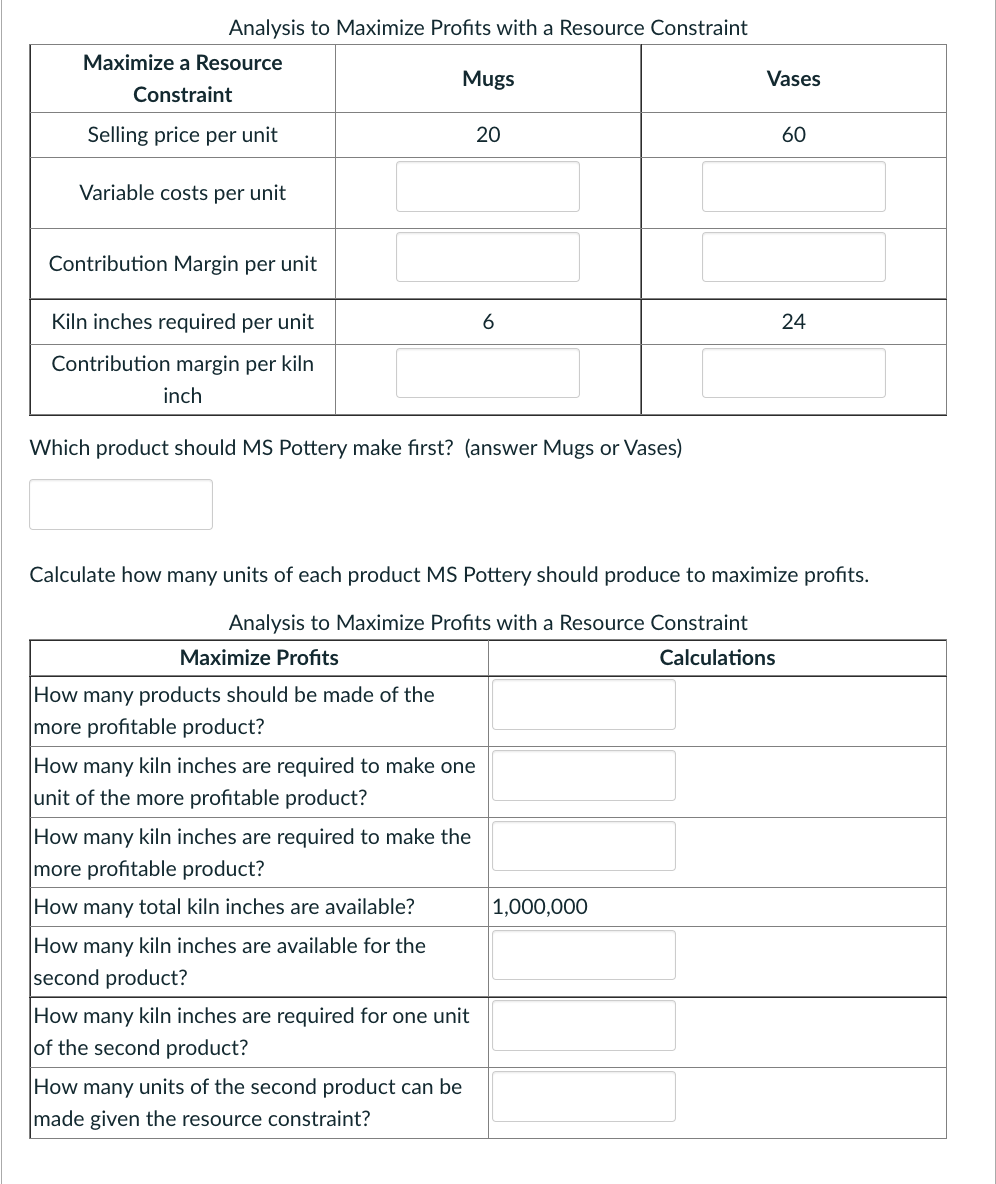

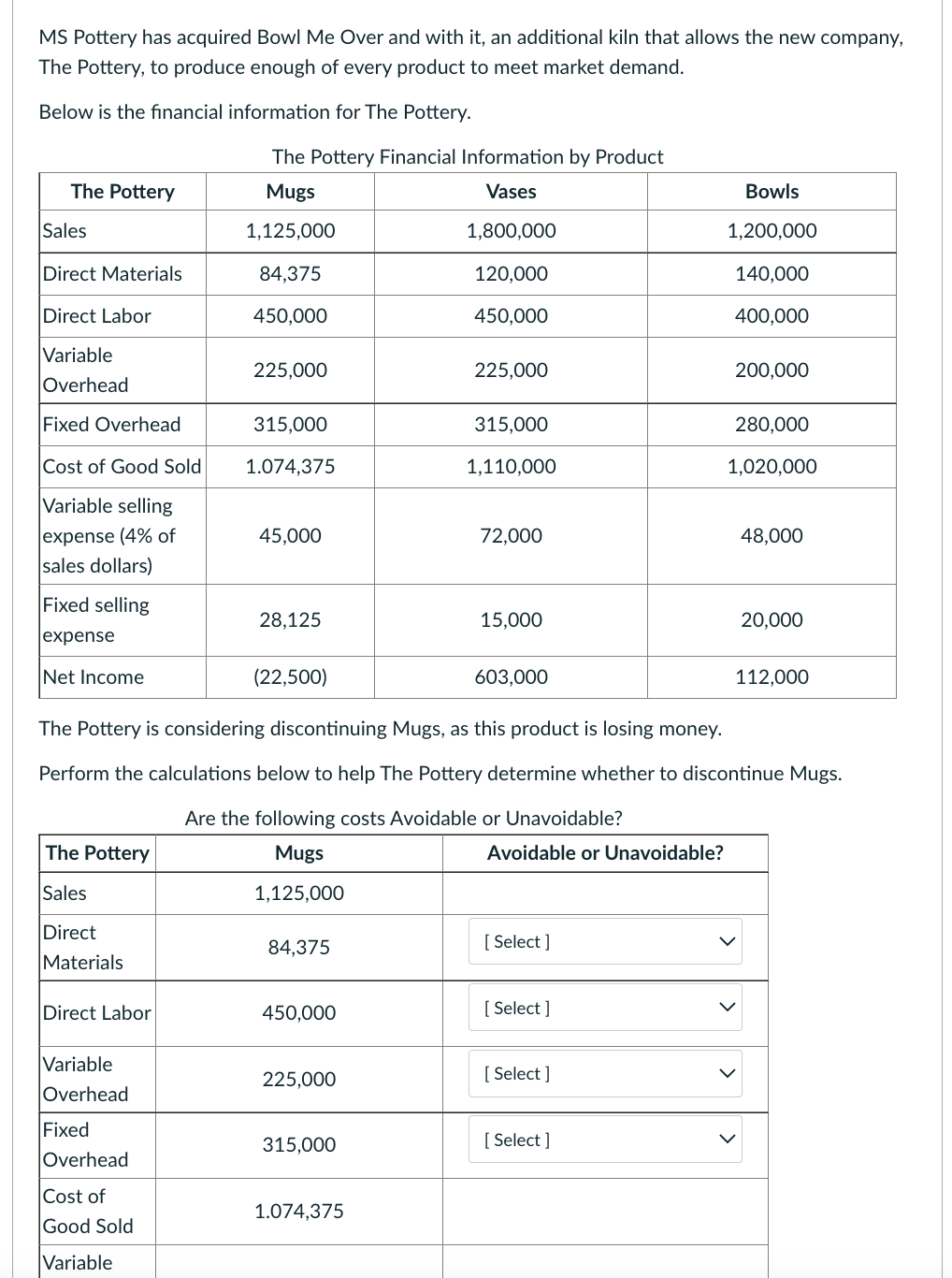

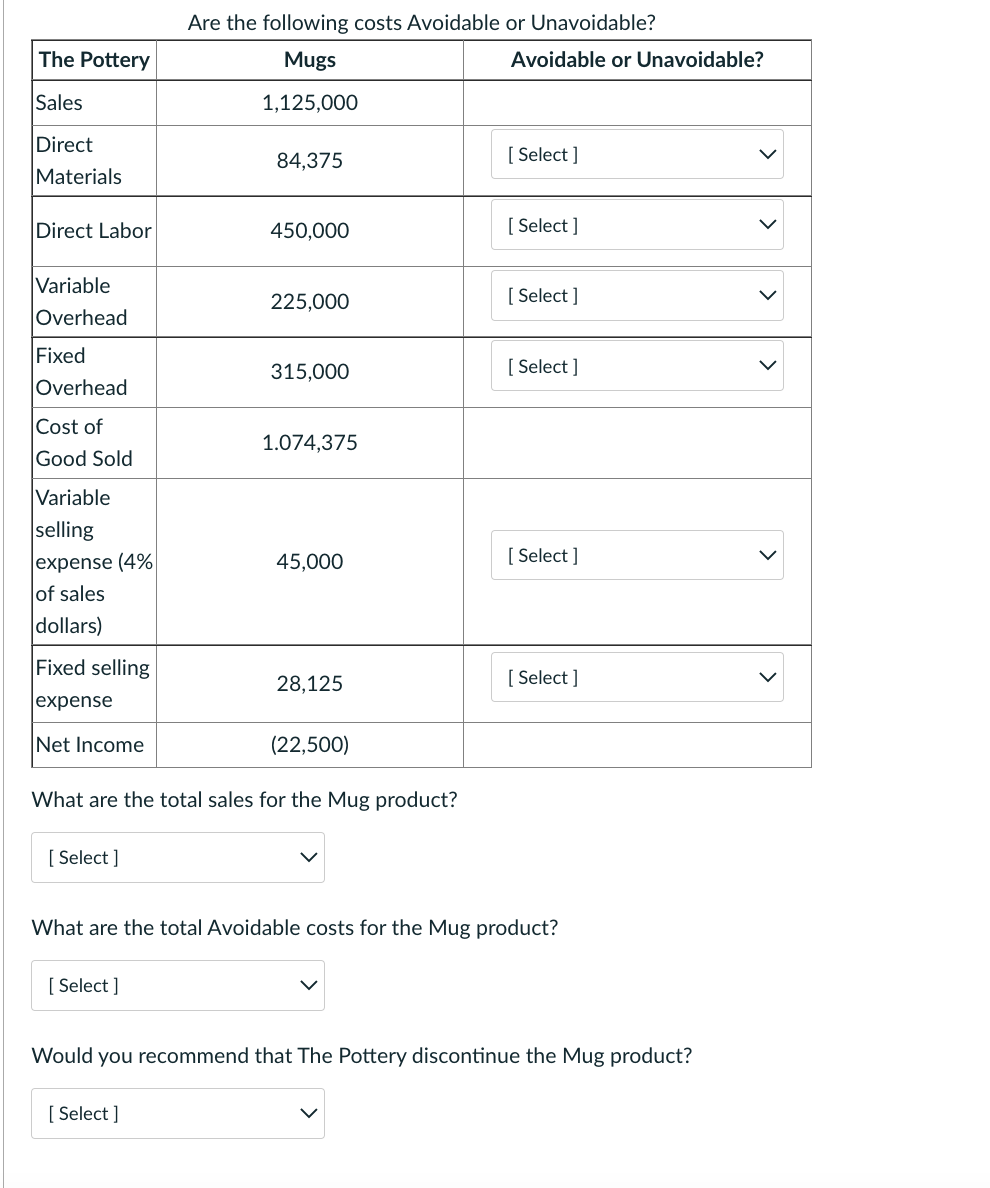

Mugshot Monday, Inc (MMI) sells ceramic mugs for $20. Their maximum capacity is 75,000 mugs per period. Use the information below to determine whether MMI should accept a new order at a lower sales price. Assume taking this order will not impact their existing customer base. Use whole dollars only. Do not use the dollar ($) sign. MMI Sales and Cost Information for the Current Period Current Period Information Per Unit Total Sales 20 1,125,000 Direct Materials 1.50 84,375 Direct Labor 8.00 450,000 Variable Overhead ($0.25 per 4.00 225,000 DL$) Fixed Overhead ($0.50 per 5.60 315,000 DL$) allocated Total Product Cost 19.10 1.074,375 Variable selling expense (5% of 1.00 56,250 sales dollars) Fixed selling expense (allocated .50 28,125 based on units sold) A new customer wishes to purchase 15,000 mugs for $15/unit. Calculate the Contribution Margin on this order. Calculate the CM on the new order New Order Dollar Value Sales Direct Materials Direct Labor Variable Overhead Variable Selling Total Variable Costs A new customer wishes to purchase 15,000 mugs for $15/unit. Calculate the Contribution Margin on this order. Calculate the CM on the new order New Order Dollar Value Sales Direct Materials Direct Labor Variable Overhead Variable Selling Total Variable Costs Contribution Margin Would you recommend taking this order? (type yes or no) Question 2 0.5 pts Mugshot Monday, Inc (MMI) sells ceramic mugs for $20. Their maximum capacity is 75,000 mugs per period. Use the information below to determine whether MMI should accept a new order at a lower sales price. Assume taking this order will not impact their existing customer base. Use whole dollars only. Do not use the dollar ($) sign. MMI Sales and Cost Information for the Current Period Current Period Information Per Unit Total Sales Direct Materials 20 1,125,000 1.50 84,375 Direct Labor 8.00 450,000 Variable Overhead ($0.25 per 4.00 225,000 DL$) Fixed Overhead ($0.50 per 5.60 315,000 DL$) allocated Total Product Cost 19.10 1.074,375 Variable selling expense (5% of 1.00 56,250 sales dollars) Fixed selling expense (allocated .50 28,125 based on units sold) A new customer wishes to purchase 10,000 mugs for $12/unit. Calculate the Contribution Margin on this order. A new customer wishes to purchase 10,000 mugs for $12/unit. Calculate the Contribution Margin on this order. Calculate the CM on the new order New Order Dollar Value Sales Direct Materials Direct Labor Variable Overhead Variable Selling Total Variable Costs Contribution Margin Would you recommend taking this order? (type yes or no) What is the lowest price we can sell each mug for and still make a profit? Round your answer to two decimal places. Given our capacity, what is the most number of additional mugs we can produce/sell? Bowl Me Over, Inc (BMO) makes ceramic bowls They have a capacity of 50,000 bowls per period. Below is the selling and cost information for BMO. Sales and cost information Sales Direct Materials Direct labor Variable overhead Fixed overhead BMO sales and cost information Per Unit Dollars 30 1,200,000 3.50 140,000 10 400,000 5 200,000 7 280,000 25.50 1,020,000 Total product cost Variable selling expense (commission of 4% of sales 1.20 48,000 dollars Fixed selling expense .50 20,000 BMO has a defective part rate of 12%. They can sell the defective bowls for $3.00 each. Alternatively, they can rework the bowls and sell them for full price. The cost to rework the bowls is $2 for direct materials, $5 for direct labor and 1.50 for variable overhead. Analyze the incremental income of both options and recommend a course of action for BMO. Incremental Income from Scrapping Scrapping Dollars Number of expected defective bowls Proceeds from selling defective bowls for scrap Incremental Income from Reworking Rework Number of expected defective units Dollars Incremental Income from Reworking Rework Dollars Number of expected defective units Incremental sales Incremental direct materials Incremental direct labor Incremental variable overhead Incremental variable selling costs Total incremental costs Incremental income from reworking defective units 46,560 Would you recommend scrap or rework? (enter your answer as scrap or rework) Smell the Roses Pottery (SRP) makes plain vases with the following information. Smell the Roses Pottery Plain Vase Information Plain Vases per unit Sales 60 Total 1,800,000 Direct Materials 4 120,000 Direct Labor 15 450,000 Variable Overhead 7.50 225,000 Fixed Overhead 10.50 315,000 Total Product Cost 37 1,110,000 Variable selling expense (4% of 2.40 72,000 sales dollars) Fixed selling expense .50 15,000 SRP believes that if they add additional decoration to the vases, they can be sold for $100/each. They estimate the market demand for decorated vases is 10,000 units. They do not have capacity to make additional plain vases, so the opportunity cost of making the decorated vases is that they would sell less plain vases. The incremental cost to process the plain vases further into decorated vases includes $8 per unit of direct materials, $13 per unit of direct labor and $8.45 per unit of variable overhead. In order to create the decorations, SRP would need a buy a machine for $100,000. They estimate that they could use the machine in operations for 10 years and that the salvage value is $0. Perform the calculations to analyze whether SRP should process the plain vases further to create decorated vases. Use whole dollars only. Do not use the dollar sign ($). Incremental Benefit/(Cost) of decorating vases Incremental Benefit/(Cost) of processing Dollars further Incremental Revenue Incremental Direct Materials Incremental Direct Labor Incremental Variable Overhead Incremental Fixed Overhead Incremental Variable Selling Costs Total Incremental Costs 320,500 Incremental Benefit/(Cost) of Processing Further Should SRP process the plain vases further into decorated vases? Answer YES or NO Mugshot Monday and Smell the Roses have merged their companies to create MS Pottery. They have decided to stop making decorated vases, but have retained both Mugs and Plain Vases in their product catalog. They have also decided to pay commissions equal to 4% of total sales dollars. Below is the sales and cost information for each of the products before the merger. MS Potter believes they were each selling at the maximum market demand, 56,250 mugs and 30,000 vases. MS Pottery Sales and Cost Information Mugs Per Unit Sales 20 Total 1,125,000 Sales Plain Vases per unit Total 60 1,800,000 Direct Materials 1.50 84,375 Direct Materials 4 120,000 Direct Labor 8.00 450,000 Direct Labor 15 450,000 Variable Overhead 4.00 225,000 Variable Overhead 7.50 225,000 ($0.25 per DL$) Fixed Overhead ($0.50 per DL$) 5.60 315,000 Fixed Overhead 10.50 315,000 allocated Total Product 19.10 1.074,375 Total Product Cost 37 1,110,000 Cost Variable selling Variable selling expense (4% of .80 45,000 expense (4% of 2.40 72,000 sales dollars) sales dollars) Fixed selling expense Fixed selling .50 28,125 .50 15,000 (allocated based expense on units sold) As part of the merger, MS Pottery is now sharing one kiln, which has a maximum capacity of 1,000,000 cubic inches per period, which is less than what would be required to produce both products in quantities to meet market demand. Perform the calculations to help MS Pottery calculate how many units of each product they should produce to maximize profits, given the market demand and the resource constraint of the kiln. Use whole dollars when the answer is a whole dollar amount. Otherwise, round to 2 decimals. Do not use the dollar sign ($). Analysis to Maximize Profits with a Resource Constraint Maximize a Resource Constraint Selling price per unit Variable costs per unit Contribution Margin per unit Kiln inches required per unit Contribution margin per kiln Mugs 20 6 inch Which product should MS Pottery make first? (answer Mugs or Vases) Vases 60 24 Calculate how many units of each product MS Pottery should produce to maximize profits. Analysis to Maximize Profits with a Resource Constraint Maximize Profits How many products should be made of the more profitable product? Calculations How many kiln inches are required to make one unit of the more profitable product? How many kiln inches are required to make the more profitable product? How many total kiln inches are available? How many kiln inches are available for the second product? How many kiln inches are required for one unit of the second product? How many units of the second product can be made given the resource constraint? 1,000,000 MS Pottery has acquired Bowl Me Over and with it, an additional kiln that allows the new company, The Pottery, to produce enough of every product to meet market demand. Below is the financial information for The Pottery. The Pottery Financial Information by Product The Pottery Mugs Vases Bowls Sales 1,125,000 1,800,000 1,200,000 Direct Materials 84,375 120,000 140,000 Direct Labor 450,000 450,000 400,000 Variable 225,000 225,000 200,000 Overhead Fixed Overhead 315,000 315,000 280,000 Cost of Good Sold 1.074,375 1,110,000 1,020,000 Variable selling expense (4% of 45,000 72,000 48,000 sales dollars) Fixed selling 28,125 15,000 20,000 expense Net Income (22,500) 603,000 112,000 The Pottery is considering discontinuing Mugs, as this product is losing money. Perform the calculations below to help The Pottery determine whether to discontinue Mugs. Are the following costs Avoidable or Unavoidable? Mugs 1,125,000 Avoidable or Unavoidable? The Pottery Sales Direct 84,375 [Select] Materials Direct Labor 450,000 [Select] Variable 225,000 [Select] Overhead Fixed 315,000 [Select] Overhead Cost of 1.074,375 Good Sold Variable > > > > > > > The Pottery Are the following costs Avoidable or Unavoidable? Avoidable or Unavoidable? Sales Direct Mugs 1,125,000 84,375 [Select] Materials Direct Labor 450,000 [Select] Variable 225,000 [Select] Overhead Fixed 315,000 [Select] Overhead Cost of 1.074,375 Good Sold Variable selling expense (4% 45,000 [Select] of sales dollars) Fixed selling 28,125 [Select] expense Net Income (22,500) What are the total sales for the Mug product? [Select] What are the total Avoidable costs for the Mug product? [Select] Would you recommend that The Pottery discontinue the Mug product? [Select]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started