Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Muhajir Berhad purchased an equipment on 1 July 2018 at a cost of RM900,000. The estimated economic life of the equipment is 8 years

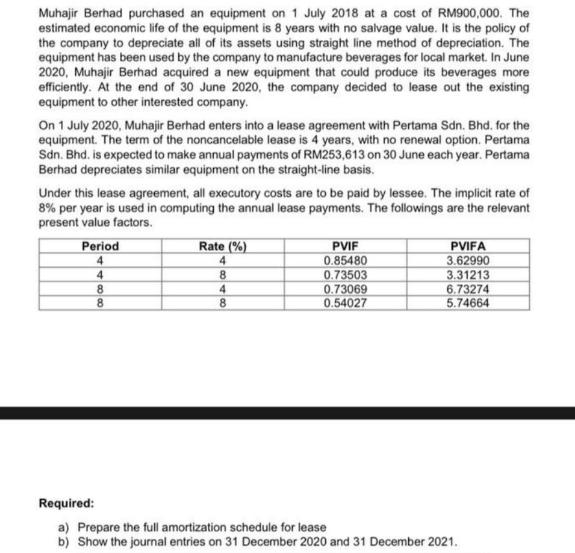

Muhajir Berhad purchased an equipment on 1 July 2018 at a cost of RM900,000. The estimated economic life of the equipment is 8 years with no salvage value. It is the policy of the company to depreciate all of its assets using straight line method of depreciation. The equipment has been used by the company to manufacture beverages for local market. In June 2020, Muhajir Berhad acquired a new equipment that could produce its beverages more efficiently. At the end of 30 June 2020, the company decided to lease out the existing equipment to other interested company. On 1 July 2020, Muhajir Berhad enters into a lease agreement with Pertama Sdn. Bhd. for the equipment. The term of the noncancelable lease is 4 years, with no renewal option. Pertama Sdn. Bhd. is expected to make annual payments of RM253,613 on 30 June each year. Pertama Berhad depreciates similar equipment on the straight-line basis. Under this lease agreement, all executory costs are to be paid by lessee. The implicit rate of 8% per year is used in computing the annual lease payments. The followings are the relevant present value factors. Period 4 4 8 8 Rate (%) 4 8 4 8 PVIF 0.85480 0.73503 0.73069 0.54027 PVIFA 3.62990 3.31213 6.73274 5.74664 Required: a) Prepare the full amortization schedule for lease b) Show the journal entries on 31 December 2020 and 31 December 2021.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Solution a Amortization Schedule for Lease Period Lease Payment Interest Expense Principal Reduction ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started