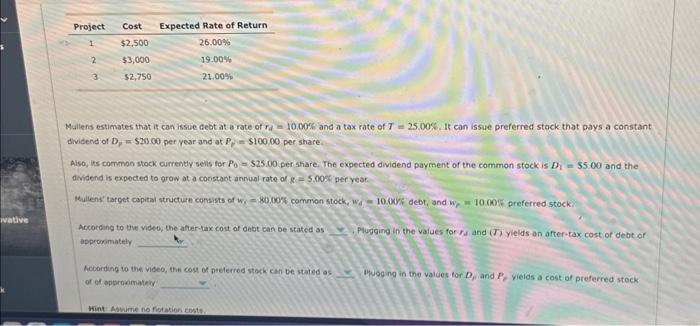

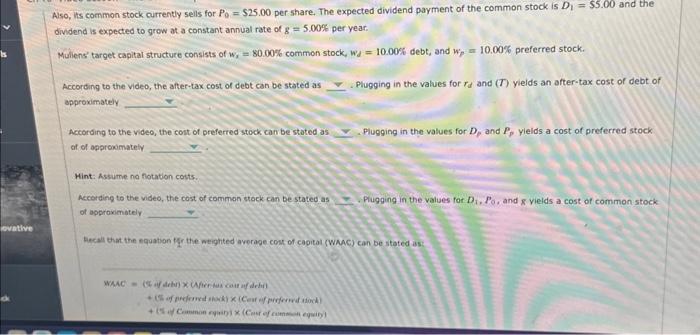

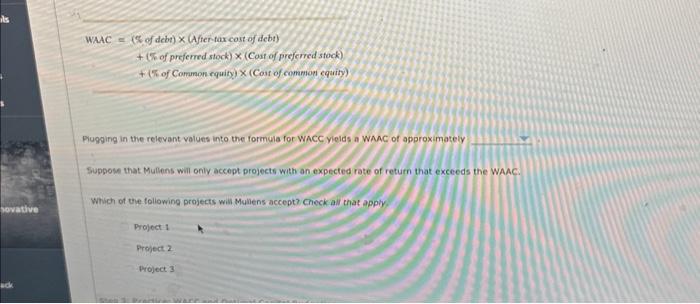

Mullens estimates that it can issue debt at a rate of rA=10.00% and a tax rate of T=25.00%. It can issue preferred stock that pays a constant dividend of Dp=$20.00 per year and at Pp=$100.00 per share. Aiso, its common stock currently selis for P0=$25.00 per share. The expected dividend payment of the common stock is D1=$5.00 and the dividend is expecteo to grow at a constant annual rote of g=5.00% per year. Milens target capital structure consists of wy=80.00% common stock, wd=10.00% debt, and wp=10.00% preferred stock: According to the vided, the after tax cont of oebt can be stated as approsimately Plugging in the values for rd and (T ) yields an after-tax cost of debt of hocording to the video, the coss of preterred stokk can be stated of of el approsinativer Thogging in the values tor Df and Ff vieids a cost of preferred stock Hint Aathime no flotation exsts. Uso, its common stock currently sells for P0=$25.00 per share. The expected dividend payment of the common stock is D1=$5.00 and the dividend is expected to grow at a constant annual rate of g=5.00% per year. Muliens' target capital structure consists of wx=80.00% common stock, wd=10.00% debt, and wp=10.00% preferred stock. According to the video, the after-tax cost of debt can be stated as Plugging in the values for rd and (T) yields an after-tax cost of debt of approximately According to the video, the cont of preferred stock can be stated as Plugging in the values for Dp and Pp yields a cost of preferred stock of of approximately Mint: Assume na fotation costs. According to the video, the cost of common stock can be stated as Plugging in the values for D1,P0, and g vields a cost of common stock of approvimately Whall that the equation for the neighted average cosk of capital (WMC) can be stated as: WAAC=(%ofdebt)(Aftertaxcostofdebt)+(%ofpreferredstock)(Costofpreferredstock)+(%ofCommonrquity)(Costofcommonequity) Piugging in the relevant values into the formula for WACC yieids a WAMC of approximately Suppose that Multens will only accept projects with an expected rate of return that exceeds the WAAC. Which of the toliowing projects wis Muliens acceptr Cneck all that apply. Project 1 Propect 2 Project 3