Mullet, Shark and Starfish operate a business which conducts deep sea fishing trips. Their partnership agreement states that all profits and losses are to

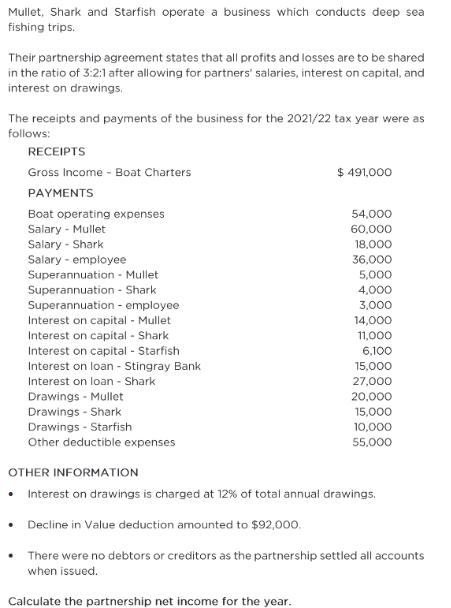

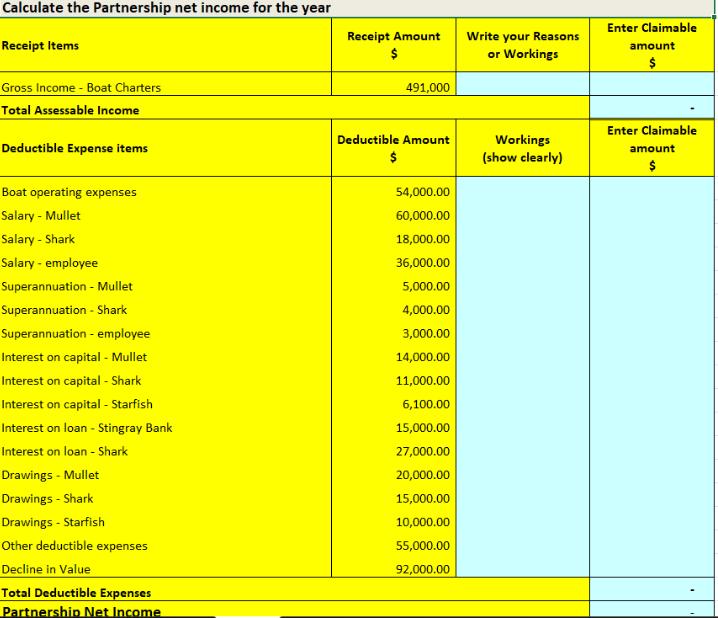

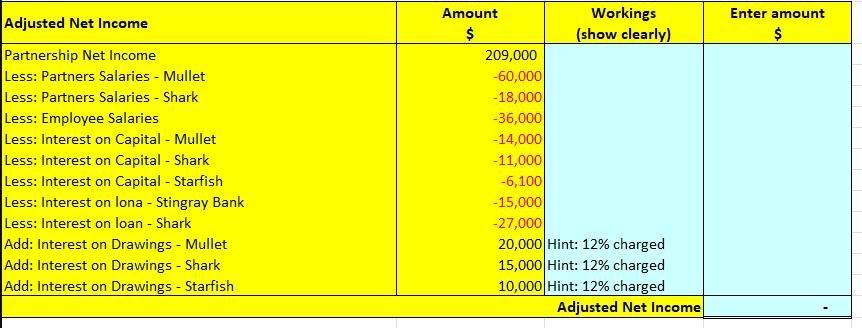

Mullet, Shark and Starfish operate a business which conducts deep sea fishing trips. Their partnership agreement states that all profits and losses are to be shared in the ratio of 3:2:1 after allowing for partners' salaries, interest on capital, and interest on drawings. The receipts and payments of the business for the 2021/22 tax year were as follows: RECEIPTS Gross Income - Boat Charters PAYMENTS Boat operating expenses Salary - Mullet Salary - Shark Salary - employee Superannuation- Mullet Superannuation - Shark Superannuation - employee Interest on capital - Mullet Interest on capital - Shark Interest on capital - Starfish Interest on loan - Stingray Bank Interest on loan - Shark Drawings Mullet Drawings - Shark Drawings - Starfish Other deductible expenses $ 491,000 54,000 60,000 18,000 36,000 5,000 4,000 3,000 14,000 11,000 6,100 15,000 27,000 20,000 15,000 10,000 55,000 OTHER INFORMATION Interest on drawings is charged at 12% of total annual drawings. Decline in Value deduction amounted to $92,000. There were no debtors or creditors as the partnership settled all accounts when issued. Calculate the partnership net income for the year. Calculate the Partnership net income for the year Receipt Items Gross Income - Boat Charters Total Assessable Income Deductible Expense items Boat operating expenses Salary - Mullet Salary - Shark Salary - employee Superannuation - Mullet Superannuation - Shark Superannuation - employee Interest on capital - Mullet Interest on capital - Shark Interest on capital - Starfish Interest on loan - Stingray Bank Interest on loan - Shark Drawings - Mullet Drawings - Shark Drawings - Starfish Other deductible expenses Decline in Value Total Deductible Expenses Partnership Net Income Receipt Amount $ 491,000 Deductible Amount $ 54,000.00 60,000.00 18,000.00 36,000.00 5,000.00 4,000.00 3,000.00 14,000.00 11,000.00 6,100.00 15,000.00 27,000.00 20,000.00 15,000.00 10,000.00 55,000.00 92,000.00 Write your Reasons or Workings Workings (show clearly) Enter Claimable amount $ Enter Claimable amount $ Adjusted Net Income Partnership Net Income Less: Partners Salaries - Mullet Less: Partners Salaries - Shark Less: Employee Salaries Less: Interest on Capital - Mullet Less: Interest on Capital - Shark Less: Interest on Capital - Starfish Less: Interest on lona - Stingray Bank Less: Interest on loan - Shark Add: Interest on Drawings - Mullet Add: Interest on Drawings - Shark Add: Interest on Drawings - Starfish Amount $ Workings (show clearly) 209,000 -60,000 -18,000 -36,000 -14,000 -11,000 -6,100 -15,000 -27,000 20,000 Hint: 12% charged 15,000 Hint: 12% charged 10,000 Hint: 12% charged Adjusted Net Income Enter amount $

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the partnership net income for the year well follow these steps 1 Calculate the total d...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started