Multi Media Art (MMA) is a major multimedia art gallery in Montreal. MMA has the largest collection of multimedia art in Canada and has five major exhibits a year. MMA is a private not-for- profit organization with funding received primarily from private contributors and government grants. The board of directors turns over its members every three years. A new board was just announced for 2021 to 2024. The new board has a number of younger members who have rejuvenated a previous idea to expand a new section of the gallery for the work of children. This would require major fundraising over the next few years. It is anticipated that this addition would attract a wider audience to the gallery and encourage young children to become interested in multimedia art at an early age. The new board, although energetic and ambitious, lacks knowledge of accounting. Board members were recruited for their marketing skills and love of multimedia art. They have asked you to assist them over the next few months to select accounting policies and provide recommendations for changes to their existing policies. They want to comply with any CPA handbook recommendations, but are not familiar with the content. The board is concerned with the costs involved with preparing financial statements and wants to minimize costs. After the meeting with the board of directors you sat down and reviewed their financial statements for 2021. The year end is June 30th. Notes from your review are included in Exhibit I. A set of financial statements has been provided to any donors who requested them in the past. In addition, government agencies require a set of audited financial statements as a requirement for government grants. Required: Prepare the report requested by the board of directors.

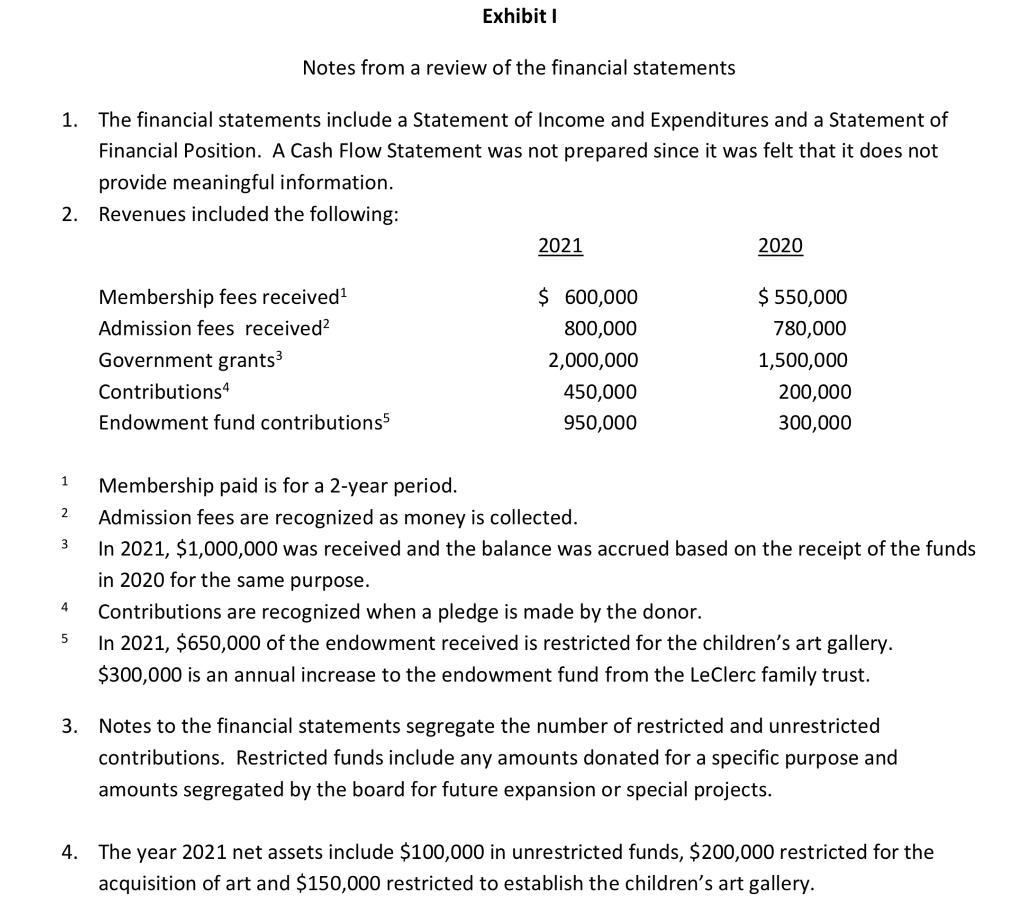

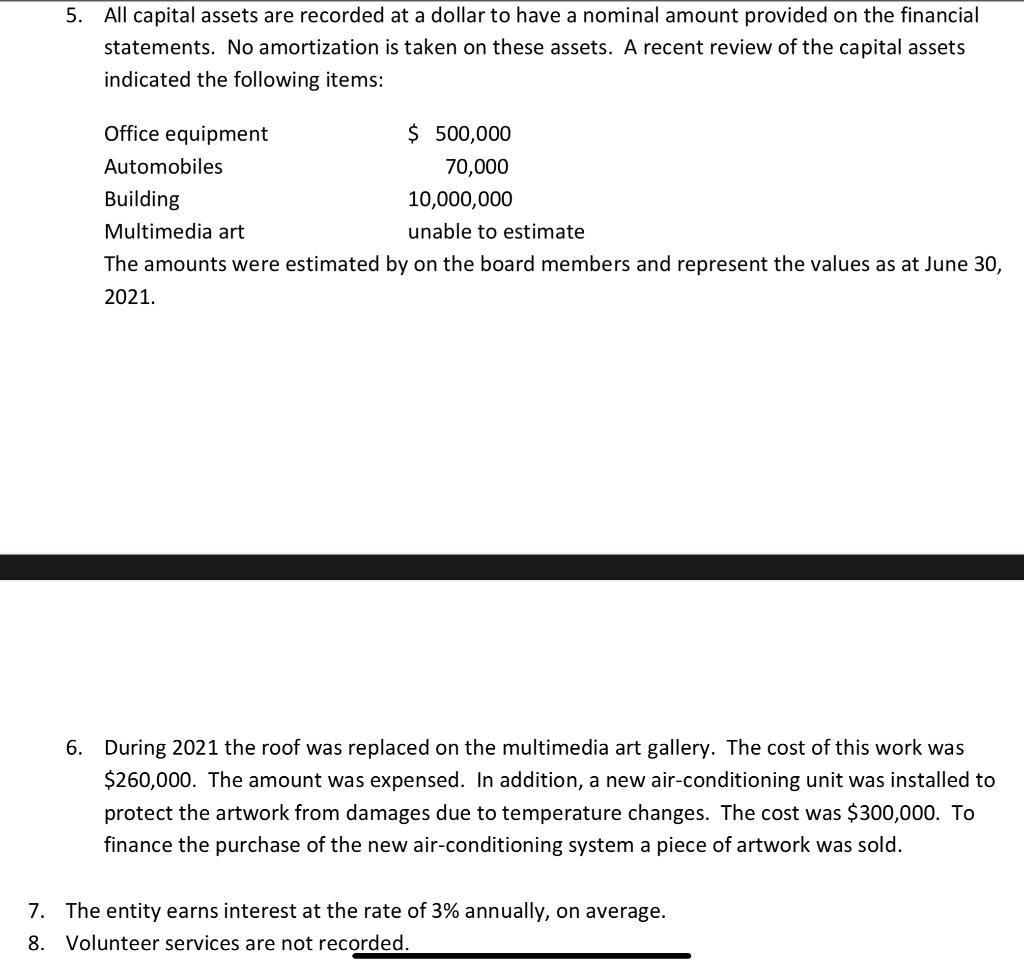

Exhibiti Notes from a review of the financial statements 1. The financial statements include a Statement of Income and Expenditures and a Statement of Financial Position. A Cash Flow Statement was not prepared since it was felt that it does not provide meaningful information. 2. Revenues included the following: 2021 2020 Membership fees received1 Admission fees received Government grants3 Contributions Endowment fund contributions $ 600,000 800,000 2,000,000 450,000 950,000 $ 550,000 780,000 1,500,000 200,000 300,000 1 2 3 Membership paid is for a 2-year period. Admission fees are recognized as money is collected. In 2021, $1,000,000 was received and the balance was accrued based on the receipt of the funds in 2020 for the same purpose. Contributions are recognized when a pledge is made by the donor. In 2021, $650,000 of the endowment received is restricted for the children's art gallery. $300,000 is an annual increase to the endowment fund from the Leclerc family trust. 4 5 3. Notes to the financial statements segregate the number of restricted and unrestricted contributions. Restricted funds include any amounts donated for a specific purpose and amounts segregated by the board for future expansion or special projects. 4. The year 2021 net assets include $100,000 in unrestricted funds, $200,000 restricted for the acquisition of art and $150,000 restricted to establish the children's art gallery. 5. All capital assets are recorded at a dollar to have a nominal amount provided on the financial statements. No amortization is taken on these assets. A recent review of the capital assets indicated the following items: Office equipment $ 500,000 Automobiles 70,000 Building 10,000,000 Multimedia art unable to estimate The amounts were estimated by on the board members and represent the values as at June 30, 2021. 6. During 2021 the roof was replaced on the multimedia art gallery. The cost of this work was $260,000. The amount was expensed. In addition, a new air-conditioning unit was installed to protect the artwork from damages due to temperature changes. The cost was $300,000. To finance the purchase of the new air-conditioning system a piece of artwork was sold. 7. The entity earns interest at the rate of 3% annually, on average. 8. Volunteer services are not recorded. Exhibiti Notes from a review of the financial statements 1. The financial statements include a Statement of Income and Expenditures and a Statement of Financial Position. A Cash Flow Statement was not prepared since it was felt that it does not provide meaningful information. 2. Revenues included the following: 2021 2020 Membership fees received1 Admission fees received Government grants3 Contributions Endowment fund contributions $ 600,000 800,000 2,000,000 450,000 950,000 $ 550,000 780,000 1,500,000 200,000 300,000 1 2 3 Membership paid is for a 2-year period. Admission fees are recognized as money is collected. In 2021, $1,000,000 was received and the balance was accrued based on the receipt of the funds in 2020 for the same purpose. Contributions are recognized when a pledge is made by the donor. In 2021, $650,000 of the endowment received is restricted for the children's art gallery. $300,000 is an annual increase to the endowment fund from the Leclerc family trust. 4 5 3. Notes to the financial statements segregate the number of restricted and unrestricted contributions. Restricted funds include any amounts donated for a specific purpose and amounts segregated by the board for future expansion or special projects. 4. The year 2021 net assets include $100,000 in unrestricted funds, $200,000 restricted for the acquisition of art and $150,000 restricted to establish the children's art gallery. 5. All capital assets are recorded at a dollar to have a nominal amount provided on the financial statements. No amortization is taken on these assets. A recent review of the capital assets indicated the following items: Office equipment $ 500,000 Automobiles 70,000 Building 10,000,000 Multimedia art unable to estimate The amounts were estimated by on the board members and represent the values as at June 30, 2021. 6. During 2021 the roof was replaced on the multimedia art gallery. The cost of this work was $260,000. The amount was expensed. In addition, a new air-conditioning unit was installed to protect the artwork from damages due to temperature changes. The cost was $300,000. To finance the purchase of the new air-conditioning system a piece of artwork was sold. 7. The entity earns interest at the rate of 3% annually, on average. 8. Volunteer services are not recorded