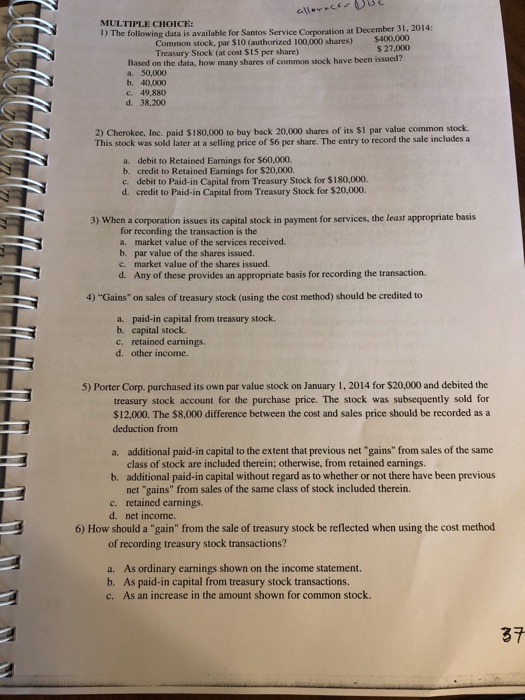

MULTIPLE CHOICE 1) The following data is available for Santos Service Corporation at December 31, 2014: Common stock, par $10 (authorized 100,000 shares) $400.000 Treasury Stock (at cost $15 per share) $ 27,000 Based on the data, how many shares of common stock have been issued? a. 50,000 b. 40,000 c. 49,880 d. 38,200 2) Cherokee, Inc. paid $180.000 to buy back 20,000 shares of its $1 par value common stock. This stock was sold later at a selling price of $6 per share. The entry to record the sale includes a a. debit to Retained Earnings for $60,000. b. credit to Retained Earnings for $20,000. c. debit to Paid-in Capital from Treasury Stock for $180,000. d. credit to Paid-in Capital from Treasury Stock for $20,000. 3) When a corporation issues its capital stock in payment for services, the least appropriate basis for recording the transaction is the a. market value of the services received. b. par value of the shares issued. c. market value of the shares issued d. Any of these provides an appropriate basis for recording the transaction. 4) "Gains" on sales of treasury stock (using the cost method) should be credited to a. paid-in capital from treasury stock. b. capital stock. c. retained earnings. d. other income. 5) Porter Corp, purchased its own par value stock on January 1, 2014 for $20,000 and debited the treasury stock account for the purchase price. The stock was subsequently sold for $12,000The S8.000 difference between the cost and sales price should be recorded as a deduction from additional paid-in capital to the extent that previous net "gains" from sales of the same a. class of stock are included therein; otherwise, from retained earnings b. additional paid-in capital without regard as to whether or not there have been previous net "gains" from sales of the same class of stock included therein. retained earnings. c. d. net income. 6) How should a "gain" from the sale of treasury stock be reflected when using the cost method of recording treasury stock transactions? a. As ordinary earnings shown on the income statement. b. As paid-in capital from treasury stock transactions. c. As an increase in the amount shown for common stock. 37