Multiple choice

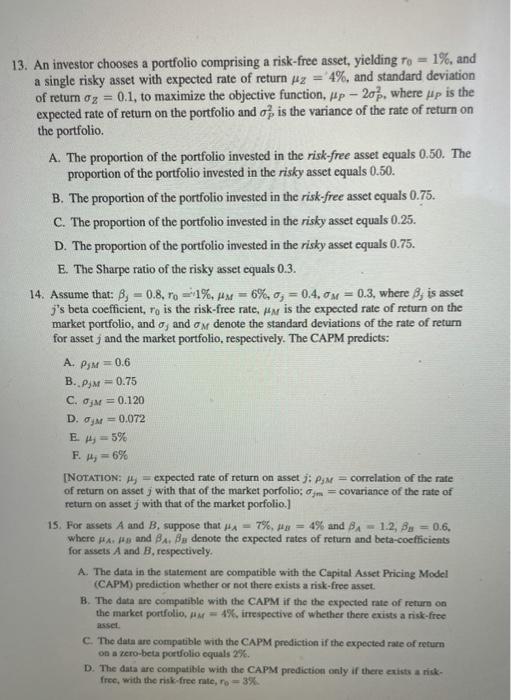

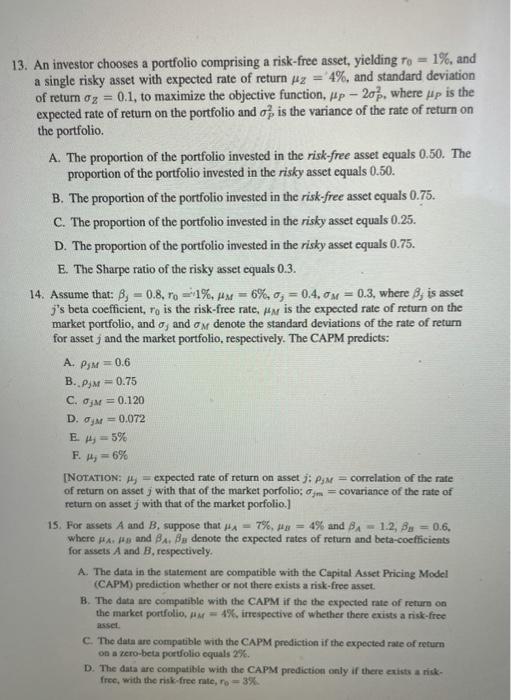

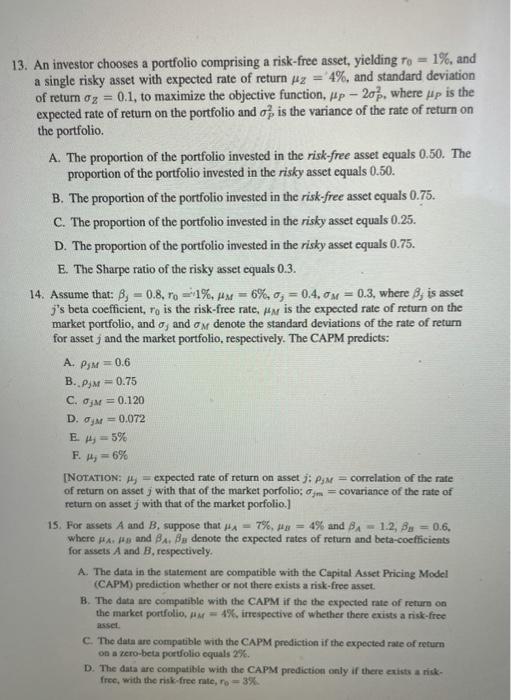

13. An investor chooses a portfolio comprising a risk-free asset, yielding To = 1%, and a single risky asset with expected rate of return pz = 4%, and standard deviation of return oz = 0.1, to maximize the objective function, pp-205. where jp is the expected rate of return on the portfolio and of is the variance of the rate of return on the portfolio A. The proportion of the portfolio invested in the risk-free asset equals 0.50. The proportion of the portfolio invested in the risky asset equals 0.50. B. The proportion of the portfolio invested in the risk-free asset equals 0.75. C. The proportion of the portfolio invested in the risky asset equals 0.25. D. The proportion of the portfolio invested in the risky asset equals 0.75. E. The Sharpe ratio of the risky asset equals 0.3. 14. Assume that: B; -0.8.ro -11%, =6%, 0,= 0.4.0m = 0.3, where 8, is asset j's beta coefficient, ro is the risk-free rate, an is the expected rate of return on the market portfolio, and o; and om denote the standard deviations of the rate of return for asset ; and the market portfolio, respectively. The CAPM predicts: A. PM = 0.6 -0.75 C. M = 0.120 D. OM = 0.072 E M -5% F. H, -6% [NOTATION: H = expected rate of return on assetj: PjM = correlation of the rate of return on asset with that of the market porfolio; Ojn = covariance of the rate of return on asset with that of the market porfolio.] 15. For assets A and B. suppose that A -7%. = 4% and B.- 1.2, Bu = 0.6. where A and Bar Ba denote the expected rates of return and beta-coefficients for assets A and B, respectively. A. The data in the statement are compatible with the Capital Asset Pricing Model (CAPM) prediction whether or not there exists a risk-free asset. B. The data are compatible with the CAPM if the the expected rate of return on the market portfolio, AM = 4%. irrespective of whether there exists a risk-free asset C. The data are compatible with the CAPM pn iction if the expected rate of return on a zero-beta portfolio oquals 2%. D. The data are compatible with the CAPM prediction only if there exists a risk- free, with the risk-free mate.ro - 3% . M = 16. Asset j's standard deviation of return is on = 0.3, while for the market portfolio 0.2. The expected rate of return on the market portfolio is um = 9% and risk- free interest rate is ro = 1%. Let PjM the correlation between the rate of return on asset j and that of the market portfolio. A. The information is incompatible with the Capital Asset Pricing Model, CAPM, if m=0.5 and the expected rate of return on asset ; equals 7%. B. If PM = -1, asset j's beta-coefficient, B; = -1. C. If PyM = 1, asset j's beta-coefficient, B; = 1.5. D. If PM = 0, the CAPM predicts that asset j's expected rate equals 1%. 17. In a capital market for which there are many risky assets but no risk-free asset, it is found that the expected rate of return on the market portfolio, un, equals 8%. A. In CAPM equilibrium the expected rate of return on a zero-beta portfolio equals zero (equal to what the risk-free rate would be if a risk free asset existed). B. In CAPM equilibrium, suppose the beta-coefficient on an asset is found to be 0.75, then the expected rate of return on the asset is predicted to be 6%. C. If the expected rate of retum on a zero-beta portfolio equals 2%, then risk-averse investors could achieve a risk-free rate of return of 2%. D. In CAPM equilibrium if the expected rate of return on a zero-beta portfolio equals 2%, then the expected rate of retum on an asset with beta-coefficient equal to 1.5 is predicted to be 11%. E. In the absence of a risk-free asset, the market cannot be in CAPM equilibrium. 18. In a frictionless asset market a positive state price has been found for every possible state that could occur, i.e. x > 0, for all k = 1, 2, ..., where is the number of possible states A. If the Arbitrage Principle holds, then the price of each asset equals the weighted average of the state prices multiplied by the probabilities of the various states corresponding to that asset. B. According to the Risk Neutral Valuation Relationship (RNVR), the Arbitrage Principle implies that the state price for each state equals the probabilty that the state will be observed. C. An arbitrage portfolio can be found with a positive payoff in some states (those with a higher than average state price), and a zero payoff in other states. D. Arbitrage opportunities are absent in this market. 19. In frictionless markets with exactly two states of nature, 1, and 2, the Risk Neutral Valuation Relationship (RNVR) is found to hold with implied discount factor, 8 = 5/8, with the probability of state 1, 1 = 2/5. It follows that: A. Arbitrage opportunities are absent. B. Arbitrage opportunities can be absent only if there exists no asset with a payoffs (1, 1) in states 1 and 2, respectively. C. The price of an asset with payoffs equal to 12, 8) in states 1 and 2, respectively is equal to 6. D. State prices equal 3/8 for state 1, and 5/8 for state 2. 20. Suppose that the Arbitrage Pricing Theory (APT) holds in an asset market in which rates of return are determined according to a two factor model, with factor risk premia Xi = 0.20 and X2 = 0.05, corresponding to factors 1 and 2, respectively. It follows that: A. The expected rate of return for asset j with factor loadings 6,1 = 0.1 and b;2 1.0 for each factor respectively, must equal 7%, whether or not a risk-free asset exists. B. With a risk-free rate of return equal to 2%, the expected rate of return for asset i with factor loadings ba = 0.3 and bi2 = 2.0 for factors 1 and 2, respectively, equals 16%. C. The risk premium for asset z with factor loadings b1 = 0.2 and b 2 = 1.2 for each factor respectively, equals 10%. D. If there exists an asset w with factor loadings bul> 0 and bw2 0, there must exist an arbitrage opportunity. E. An asset ke with factor loadings bu = 0.5 and bia = 0.4 and an observed average risk premium of 12% implies that the asset is overvalued, or that the APT cannot in fact hold in this asset market. 13. An investor chooses a portfolio comprising a risk-free asset, yielding To = 1%, and a single risky asset with expected rate of return pz = 4%, and standard deviation of return oz = 0.1, to maximize the objective function, pp-205. where jp is the expected rate of return on the portfolio and of is the variance of the rate of return on the portfolio A. The proportion of the portfolio invested in the risk-free asset equals 0.50. The proportion of the portfolio invested in the risky asset equals 0.50. B. The proportion of the portfolio invested in the risk-free asset equals 0.75. C. The proportion of the portfolio invested in the risky asset equals 0.25. D. The proportion of the portfolio invested in the risky asset equals 0.75. E. The Sharpe ratio of the risky asset equals 0.3. 14. Assume that: B; -0.8.ro -11%, =6%, 0,= 0.4.0m = 0.3, where 8, is asset j's beta coefficient, ro is the risk-free rate, an is the expected rate of return on the market portfolio, and o; and om denote the standard deviations of the rate of return for asset ; and the market portfolio, respectively. The CAPM predicts: A. PM = 0.6 -0.75 C. M = 0.120 D. OM = 0.072 E M -5% F. H, -6% [NOTATION: H = expected rate of return on assetj: PjM = correlation of the rate of return on asset with that of the market porfolio; Ojn = covariance of the rate of return on asset with that of the market porfolio.] 15. For assets A and B. suppose that A -7%. = 4% and B.- 1.2, Bu = 0.6. where A and Bar Ba denote the expected rates of return and beta-coefficients for assets A and B, respectively. A. The data in the statement are compatible with the Capital Asset Pricing Model (CAPM) prediction whether or not there exists a risk-free asset. B. The data are compatible with the CAPM if the the expected rate of return on the market portfolio, AM = 4%. irrespective of whether there exists a risk-free asset C. The data are compatible with the CAPM pn iction if the expected rate of return on a zero-beta portfolio oquals 2%. D. The data are compatible with the CAPM prediction only if there exists a risk- free, with the risk-free mate.ro - 3% . M = 16. Asset j's standard deviation of return is on = 0.3, while for the market portfolio 0.2. The expected rate of return on the market portfolio is um = 9% and risk- free interest rate is ro = 1%. Let PjM the correlation between the rate of return on asset j and that of the market portfolio. A. The information is incompatible with the Capital Asset Pricing Model, CAPM, if m=0.5 and the expected rate of return on asset ; equals 7%. B. If PM = -1, asset j's beta-coefficient, B; = -1. C. If PyM = 1, asset j's beta-coefficient, B; = 1.5. D. If PM = 0, the CAPM predicts that asset j's expected rate equals 1%. 17. In a capital market for which there are many risky assets but no risk-free asset, it is found that the expected rate of return on the market portfolio, un, equals 8%. A. In CAPM equilibrium the expected rate of return on a zero-beta portfolio equals zero (equal to what the risk-free rate would be if a risk free asset existed). B. In CAPM equilibrium, suppose the beta-coefficient on an asset is found to be 0.75, then the expected rate of return on the asset is predicted to be 6%. C. If the expected rate of retum on a zero-beta portfolio equals 2%, then risk-averse investors could achieve a risk-free rate of return of 2%. D. In CAPM equilibrium if the expected rate of return on a zero-beta portfolio equals 2%, then the expected rate of retum on an asset with beta-coefficient equal to 1.5 is predicted to be 11%. E. In the absence of a risk-free asset, the market cannot be in CAPM equilibrium. 18. In a frictionless asset market a positive state price has been found for every possible state that could occur, i.e. x > 0, for all k = 1, 2, ..., where is the number of possible states A. If the Arbitrage Principle holds, then the price of each asset equals the weighted average of the state prices multiplied by the probabilities of the various states corresponding to that asset. B. According to the Risk Neutral Valuation Relationship (RNVR), the Arbitrage Principle implies that the state price for each state equals the probabilty that the state will be observed. C. An arbitrage portfolio can be found with a positive payoff in some states (those with a higher than average state price), and a zero payoff in other states. D. Arbitrage opportunities are absent in this market. 19. In frictionless markets with exactly two states of nature, 1, and 2, the Risk Neutral Valuation Relationship (RNVR) is found to hold with implied discount factor, 8 = 5/8, with the probability of state 1, 1 = 2/5. It follows that: A. Arbitrage opportunities are absent. B. Arbitrage opportunities can be absent only if there exists no asset with a payoffs (1, 1) in states 1 and 2, respectively. C. The price of an asset with payoffs equal to 12, 8) in states 1 and 2, respectively is equal to 6. D. State prices equal 3/8 for state 1, and 5/8 for state 2. 20. Suppose that the Arbitrage Pricing Theory (APT) holds in an asset market in which rates of return are determined according to a two factor model, with factor risk premia Xi = 0.20 and X2 = 0.05, corresponding to factors 1 and 2, respectively. It follows that: A. The expected rate of return for asset j with factor loadings 6,1 = 0.1 and b;2 1.0 for each factor respectively, must equal 7%, whether or not a risk-free asset exists. B. With a risk-free rate of return equal to 2%, the expected rate of return for asset i with factor loadings ba = 0.3 and bi2 = 2.0 for factors 1 and 2, respectively, equals 16%. C. The risk premium for asset z with factor loadings b1 = 0.2 and b 2 = 1.2 for each factor respectively, equals 10%. D. If there exists an asset w with factor loadings bul> 0 and bw2 0, there must exist an arbitrage opportunity. E. An asset ke with factor loadings bu = 0.5 and bia = 0.4 and an observed average risk premium of 12% implies that the asset is overvalued, or that the APT cannot in fact hold in this asset market