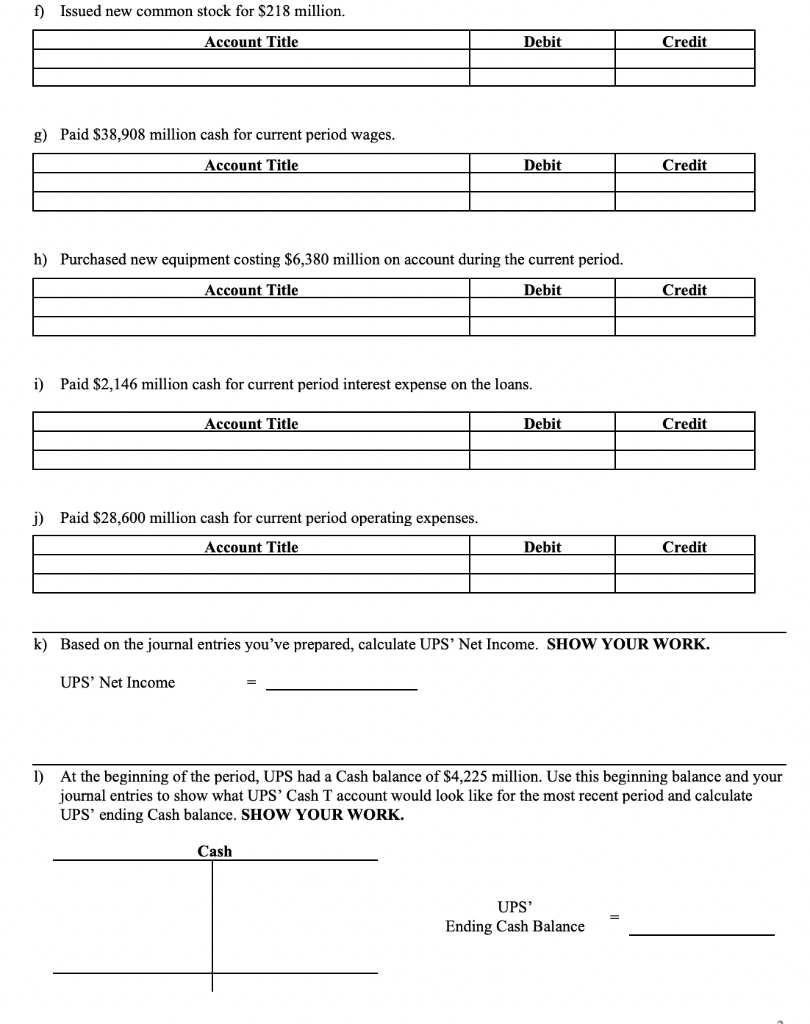

Multiple Choice (2 points each) Circle the best answer to each of the following questions. 1. When a company has performed services for a client but has not yet received payment, it: a. makes no entry until the cash is received. b. debits Accounts Receivable and credits Revenue. debits Accounts Payable and credits Revenue. d. debits Cash and credits Accounts Receivable. C. 2. Brewer Company's controller accidentally erased the 8/1/20 balance for the Cash account. However, she can see that the 8/31/20 Cash balance is $350,000, the company collected $900,000 cash during August 2020 and paid $1,000,000 cash during August 2020. What was the 8/1/20 Cash balance? $550,000 b. $350,000 $250,000 d. $450,000 a. a. 3. Which of the following statements is TRUE? If a company provides service and bills its client $20,000, the journal entry to record this transaction will cause Total Assets to increase. b. If a company collects a cash deposit of $20,000 for services not yet performed, the journal entry to record this transaction will cause Net Income to increase. If a company pays $20,000 for inventory previously purchased on account, the journal entry to record this payment will cause Total Liabilities to increase. d. None of the above. c. On September 1, Marina, Inc. purchased $500,000 worth of merchandise inventory on credit. On September 14, Marina paid $500,000 cash related to this purchase. 4. The journal entry to record the September 1 transaction will have the following effect on Marina's financial statements: a. Total Expenses will increase by $500,000. b. Total Liabilities will increase by $500,000. c. Total Assets will decrease by $500,000. d. Total Stockholders' Equity will decrease by $500,000. None of the above. e. a. 5. The journal entry to record the September 14 transaction will have the following effect on Marina's financial statements: Total Expenses will increase by $500,000. b. Total Liabilities will increase by $500,000. Total Assets will decrease by $500,000. d. Total Stockholders' Equity will decrease by $500,000. None of the above. c. e. 1 On September 1, Marina, Inc. purchased $500,000 worth of merchandise inventory on credit. On September 14, Marina paid $500,000 cash related to this purchase. a. 4. The journal entry to record the September 1 transaction will have the following effect on Marina's financial statements: Total Expenses will increase by $500,000. b. Total Liabilities will increase by $500,000. c. Total Assets will decrease by $500,000. d. Total Stockholders' Equity will decrease by $500,000. None of the above. e. a. 5. The journal entry to record the September 14 transaction will have the following effect on Marina's financial statements: Total Expenses will increase by $500,000. b. Total Liabilities will increase by $500,000. c. Total Assets will decrease by $500,000. d. Total Stockholders' Equity will decrease by $500,000. e. None of the above. 1 a. 6. Which of the following accounts is decreased with a CREDIT? Unearned Revenue b. Sales Revenue c. Accounts Receivable d. Accounts Payable Problem (38 points) United Parcel Service, Inc. (UPS) says in its first footnote that: "it was founded in 1907 as a private messenger and delivery service in Seattle, Washington. Today, we are the world's largest package delivery company, a leader in the U.S. less-than-truckload industry and the premier provider of global supply chain management solutions. The global market for these services includes transportation, distribution, contract logistics, ground freight, ocean freight, air freight, customs brokerage, insurance and financing. We operate one of the largest airlines in the world, as well as the world's largest fleet of alternative-powered vehicles. We deliver packages each business day for 1.6 million shipping customers to 9.9 million delivery customers in over 220 countries and territories. In 2019, we delivered an average of 21.9 million pieces per day, or a total of 5.5 billion packages." UPS Below you will see SOME (not all!) of UPS' transactions in their most recent fiscal year. Provide the journal entry or entries (accounts and amounts) needed to record each transaction. a) Borrowed $5,205 million cash from a bank by signing a note payable. Account Title Debit Credit b) Had $74,094 million in credit sales to customers. Account Title Debit Credit c) Purchased $698 million worth of supplies (fuel) on account. Account Title Debit Credit d) Collected $68,438 million cash from customers related to prior credit sales. Account Title Debit Credit e) Declared and paid cash dividends of $3,194 million. Account Title Debit Credit 2 f) Issued new common stock for $218 million. Account Title Debit Credit g) Paid $38,908 million cash for current period wages. Account Title Debit Credit h) Purchased new equipment costing $6,380 million on account during the current period. Account Title Debit Credit i) Paid $2,146 million cash for current period interest expense on the loans. Account Title Debit Credit j) Paid $28,600 million cash for current period operating expenses. Account Title Debit Credit k) Based on the journal entries you've prepared, calculate UPS' Net Income. SHOW YOUR WORK. UPS' Net Income 1) At the beginning of the period, UPS had a Cash balance of $4,225 million. Use this beginning balance and your journal entries to show what UPS' Cash T account would look like for the most recent period and calculate UPS'ending Cash balance. SHOW YOUR WORK. Cash UPS' Ending Cash Balance