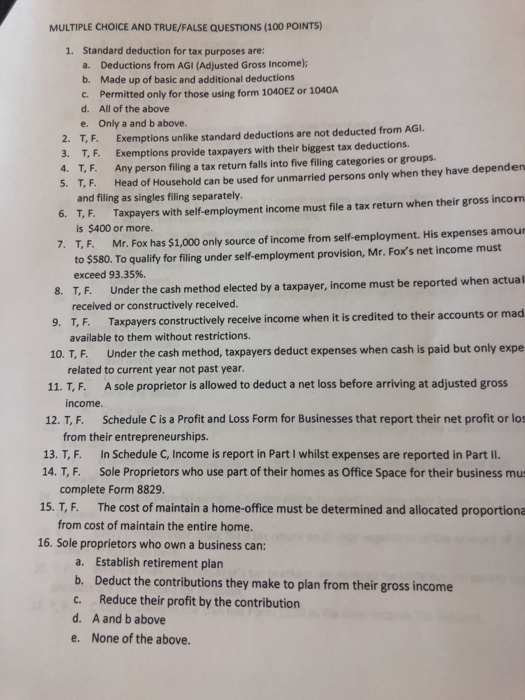

MULTIPLE CHOICE AND TRUE/FALSE QUESTIONS (100 POINTS) 1. Standard deduction for tax purposes are: a. Deductions from AGI (Adjusted Gross Income) b. Made up of basic and additional deductions Permitted only for those using form 1040EZ or 1040A c. d. All of the above e. Only a and b above. 2. T, F. Exemptions unlike standard deductions are not deducted from AGI 3. T, F. Exemptions provide taxpayers with their biggest tax deductions 4. T, F. Any person filing a tax return falls into five filing categories or groups. S. T, F. Head of Household can be used for unmarried persons only when they have dependen T, F. Taxpayers with self-employment income must file a tax return when their gross incom is $400 or more. and filing as singles filing separately. 6. 7. T, F. Mr. Fox has $1,000 only source of income from self-employment. His expenses amour to $580. To qualify for filing under self-employment provision, Mr. Fox's net income must exceed 93.35%. T, F. received or constructively received. T, F. Taxpayers constructively receive income when it is credited to their accounts or mad available to them without restrictions. Under the cash method elected by a taxpayer, income must be reported when actual 8. 9. 10. T, F. 11. T, F. A sole proprietor is allowed to deduct a net loss before arriving at adjusted gros 12. T, F. Under the cash method, taxpayers deduct expenses when cash is paid but only expe related to current year not past year. income. Schedule C is a Profit and Loss Form for Businesses that report their net profit or los from their entrepreneurships. 13. T, F. In Schedule C, Income is report in Part I whilst expenses are reported in Part Il. 14. T, F. Sole Proprietors who use part of their homes as Office Space for their business mu 15. T, F. 16. Sole proprietors who own a business can: complete Form 8829. The cost of maintain a home-office must be determined and allocated proportiona from cost of maintain the entire home. a. Establish retirement plan b. Deduct the contributions they make to plan from their gross income c. Reduce their profit by the contribution d. A and b above e. None of the above. MULTIPLE CHOICE AND TRUE/FALSE QUESTIONS (100 POINTS) 1. Standard deduction for tax purposes are: a. Deductions from AGI (Adjusted Gross Income) b. Made up of basic and additional deductions Permitted only for those using form 1040EZ or 1040A c. d. All of the above e. Only a and b above. 2. T, F. Exemptions unlike standard deductions are not deducted from AGI 3. T, F. Exemptions provide taxpayers with their biggest tax deductions 4. T, F. Any person filing a tax return falls into five filing categories or groups. S. T, F. Head of Household can be used for unmarried persons only when they have dependen T, F. Taxpayers with self-employment income must file a tax return when their gross incom is $400 or more. and filing as singles filing separately. 6. 7. T, F. Mr. Fox has $1,000 only source of income from self-employment. His expenses amour to $580. To qualify for filing under self-employment provision, Mr. Fox's net income must exceed 93.35%. T, F. received or constructively received. T, F. Taxpayers constructively receive income when it is credited to their accounts or mad available to them without restrictions. Under the cash method elected by a taxpayer, income must be reported when actual 8. 9. 10. T, F. 11. T, F. A sole proprietor is allowed to deduct a net loss before arriving at adjusted gros 12. T, F. Under the cash method, taxpayers deduct expenses when cash is paid but only expe related to current year not past year. income. Schedule C is a Profit and Loss Form for Businesses that report their net profit or los from their entrepreneurships. 13. T, F. In Schedule C, Income is report in Part I whilst expenses are reported in Part Il. 14. T, F. Sole Proprietors who use part of their homes as Office Space for their business mu 15. T, F. 16. Sole proprietors who own a business can: complete Form 8829. The cost of maintain a home-office must be determined and allocated proportiona from cost of maintain the entire home. a. Establish retirement plan b. Deduct the contributions they make to plan from their gross income c. Reduce their profit by the contribution d. A and b above e. None of the above