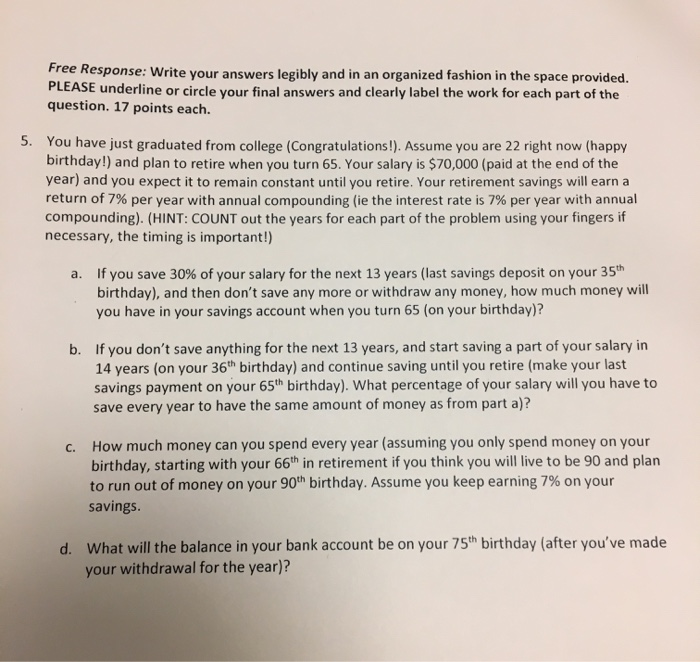

Multiple Choice: Carefully read the questions below and WRITE THE LETTER of the correct answer in the space to the right of each question. 8 points each. The formula for the present value of an annuity is PVCN... = x(1 - 1). Conceptually, what is this formula doing? a. Summing N cashflows of C dollars together and THEN discounting this sum back to today b. Discounting a single cash flow of C dollars back to today. C. Discounting all cash flows back today and THEN adding these discounted values up d. None of the above 2._ 2. Based on our discussion in class, when evaluating the value of any opportunity we should base our analysis on... a. Our subjective preferences for the opportunity b. Competitive market prices C. The advice of a friend d. I don't know I'm in a food coma because this class is right after lunch 3. Which of the following is an arbitrage opportunity? a. You believe the price of Apple stock is too high, so you want to short the stock b. You believe the price of Google stock is too low, so you want to buy the stock c. The price of Royal Dutch Shell stock on the London stock exchange is $100 and the price on the New York Stock Exchange is $110 d. The price of corn on the Chicago mercantile exchange is $6 per bushel and the price of corn on the Philadelphia Mercantile exchange is $6 per bushel 4. You are scheduled to receive $10,000 in one year. An increase in the interest rate will have what effect on the present value of this cash flow? a. It will cause the present value to rise. b. It will have no effect on the present value. c. The effect cannot be determined with the information provided. d. It will cause the present value to fall. Free Response: Write your answers legibly and in an organized fashion in the space provided. PLEASE underline or circle your final answers and clearly label the work for each part of the question. 17 points each. 5. You have just graduated from college (Congratulations!). Assume you are 22 right now (happy birthday!) and plan to retire when you turn 65. Your salary is $70,000 (paid at the end of the year) and you expect it to remain constant until you retire. Your retirement savings will earn a return of 7% per year with annual compounding (ie the interest rate is 7% per year with annual compounding). (HINT: COUNT out the years for each part of the problem using your fingers if necessary, the timing is important!) a. If you save 30% of your salary for the next 13 years (last savings deposit on your 35th birthday), and then don't save any more or withdraw any money, how much money will you have in your savings account when you turn 65 (on your birthday)? b. If you don't save anything for the next 13 years, and start saving a part of your salary in 14 years (on your 36th birthday) and continue saving until you retire (make your last savings payment on your 65th birthday). What percentage of your salary will you have to save every year to have the same amount of money as from part a)? c. How much money can you spend every year (assuming you only spend money on your birthday, starting with your 66th in retirement if you think you will live to be 90 and plan to run out of money on your 90th birthday. Assume you keep earning 7% on your savings. d. What will the balance in your bank account be on your 75th birthday (after you've made your withdrawal for the year)