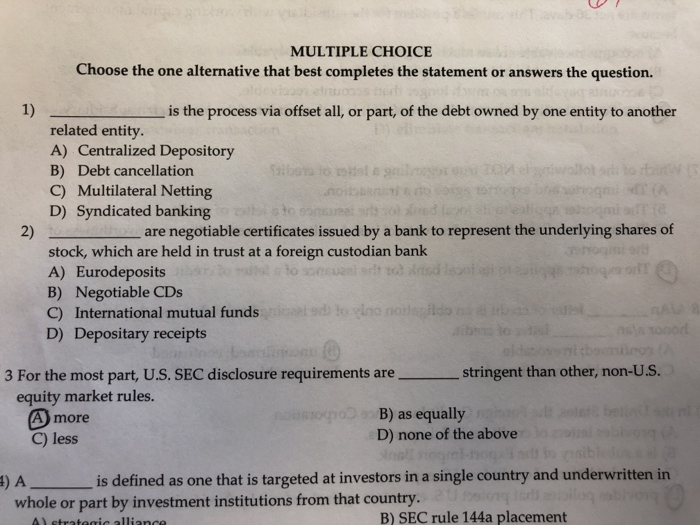

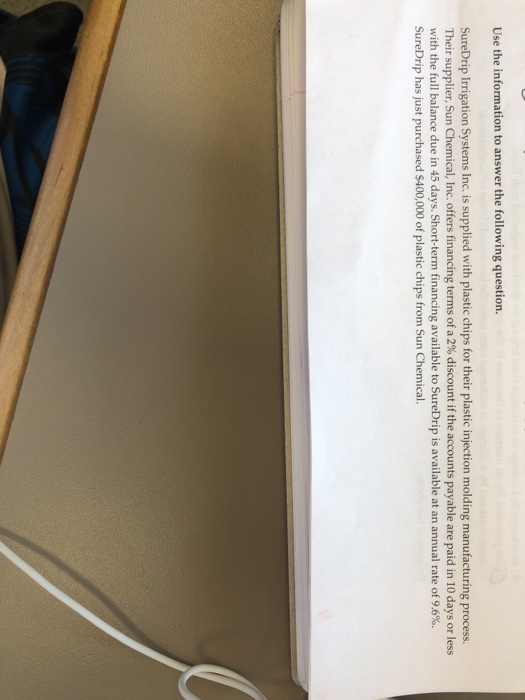

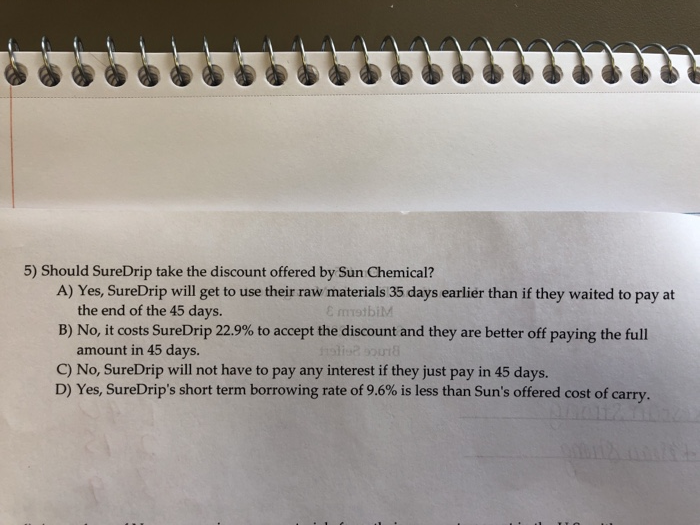

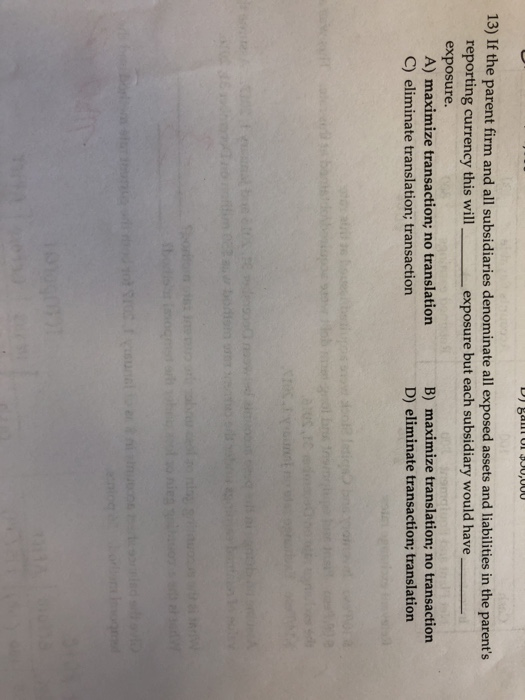

MULTIPLE CHOICE Choose the one alternative that best completes the statement or answers the question. 1) is the process via offset all, or part, of the debt owned by one entity to another related entity A) Centralized Depository B) Debt cancellation C) Multilateral Netting D) Syndicated banking 2) are negotiable certificates issued by a bank to represent the underlying shares of stock, which are held in trust at a foreign custodian bank A) Eurodeposits B) Negotiable CDs C) International mutual funds D) Depositary receipts stringent than other, non-U.S. 3 For the most part, U.S. SEC disclosure requirements are equity market rules. more C) less B) as equally D) none of the above is defined as one that is targeted at investors in a single country and underwritten in whole or part by investment institutions from that country. B) SEC rule 144a placement Use the information to answer the following question. SureDrip Irrigation Systems Inc. is supplied with plastic chips for their plastic injection molding manufacturing process. Their supplier Sun Chemical, Inc. offers financing terms of a 2% discount if the accounts payable are paid in 10 days or less with the full balance due in 45 days. Short-term financing available to SureDrip is available at an annual rate of 9.6%. SureDrip has just purchased $400,000 of plastic chips from Sun Chemical 5) Should SureDrip take the discount offered by Sun Chemical? A) Yes, SureDrip will get to use their raw materials 35 days earlier than if they waited to pay at the end of the 45 days B) No, it costs SureDrip 22.9% to accept the discount and they are better off paying the full netbiM amount in 45 days. C) No, SureDrip will not have to pay any interest if they just pay in 45 days. D) Yes, SureDrip's short term borrowing rate of 9.6% is less than Sun's offered cost of carry. 13) If the parent firm and all subsidiaries denominate all exposed assets and liabilities in the parent's reporting currency this willexposure but each subsidiary would have exposure. B) maximize translation; no transaction D) eliminate transaction; translation A) maximize transaction; no translation C) eliminate translation; transaction