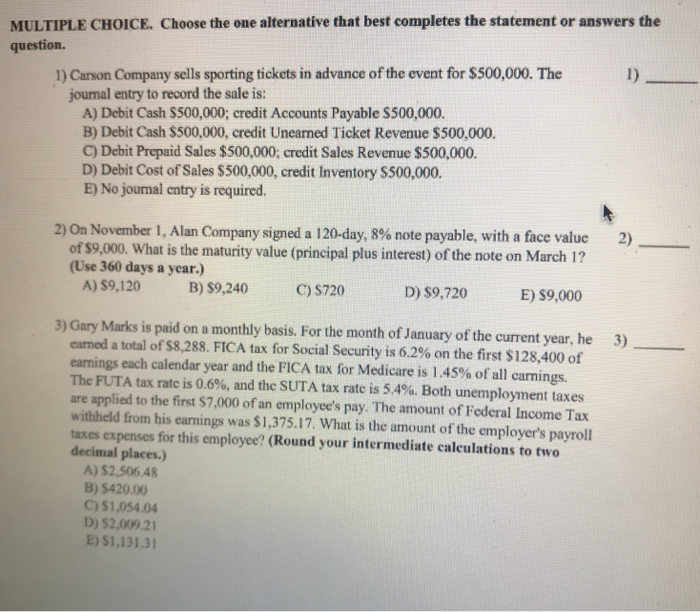

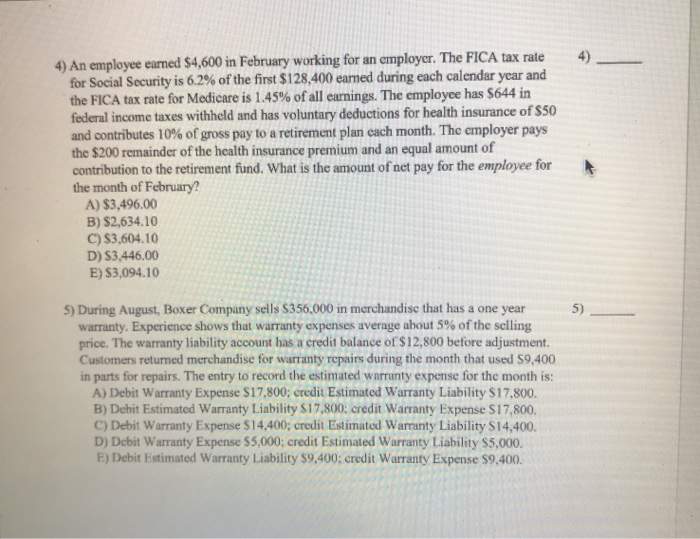

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) Carson Company sells sporting tickets in advance of the event for $500,000. The journal entry to record the sale is: A) Debit Cash $500,000; credit Accounts Payable $500,000. B) Debit Cash $500,000, credit Unearned Ticket Revenue $500,000. C) Debit Prepaid Sales $500,000, credit Sales Revenue $500,000. D) Debit Cost of Sales $500,000, credit Inventory S500,000. E) No journal entry is required. 2) On November 1, Alan Company signed a 120-day, 8% note payable, with a face value of $9,000. What is the maturity value (principal plus interest) of the note on March 1? (Use 360 days a year.) A) 59,120 B) S9,240 C) 5720 S D ) $9,720 E) $9,000 3) 3) Gary Marks is paid on a monthly basis. For the month of January of the current year, he earned a total of 58,288. FICA tax for Social Security is 6.2% on the first $128,400 of camnings each calendar year and the FICA tax for Medicare is 1.45% of all earnings. The FUTA tax rate is 0.6%, and the SUTA tax rate is 5.4%. Both unemployment taxes are applied to the first $7,000 of an employee's pay. The amount of Federal Income Tax withheld from his earnings was $1,375.17. What is the amount of the employer's payroll taxes expenses for this employee? (Round your intermediate calculations to two decimal places.) A) $2,506 48 B) $420,00 C) 51.054.04 D) $2,009.21 E) 51,131.31 4) An employee eamed $4,600 in February working for an employer. The FICA tax rate for Social Security is 6.2% of the first $128,400 earned during each calendar year and the FICA tax rate for Medicare is 1.45% of all earnings. The employee has $644 in federal income taxes withheld and has voluntary deductions for health insurance of $50 and contributes 10% of gross pay to a retirement plan each month. The employer pays the $200 remainder of the health insurance premium and an equal amount of contribution to the retirement fund. What is the amount of net pay for the employee for the month of February? A) $3,496.00 B) $2,634.10 C) $3,604.10 D) $3,446,00 E) $3,094.10 5) During August, Boxer Company sells S356,000 in merchandise that has a one year warranty. Experience shows that warranty expenses average about 5% of the selling price. The warranty liability account has a credit balance of $12,800 before adjustment. Customers returned merchandise for warranty repairs during the month that used 59,400 in parts for repairs. The entry to record the estimated warranty expense for the month is: A) Debit Warranty Expense S17,800; credit Estimated Warranty Liability $17.800. B) Debit Estimated Warranty Liability 517,800: credit Warranty Expense 517,800. c) Debit Warranty Expense $14,400; credit Estimated Warranty Liability S14,400. D) Debit Warranty Expense $5,000; credit Estimated Warranty Liability S5,000. E) Debit Estimated Warranty Liability 59,400: credit Warranty Expense S9,400