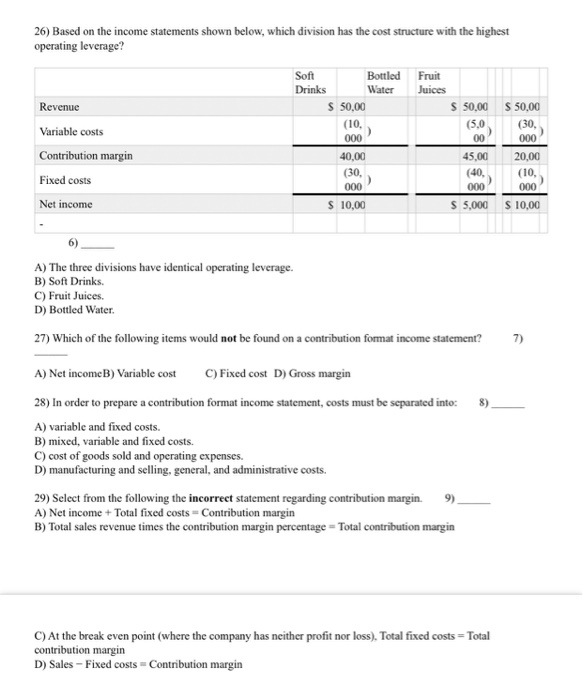

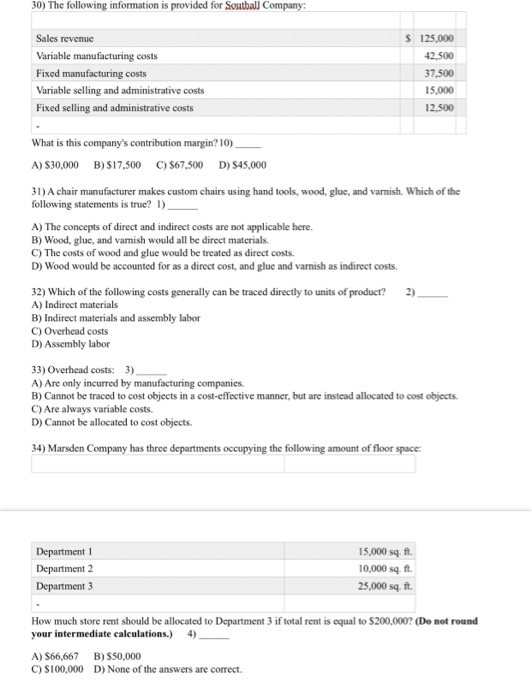

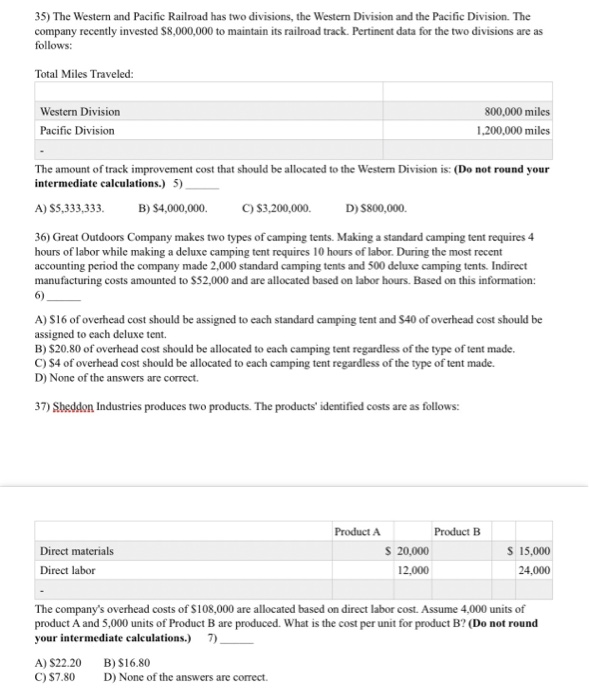

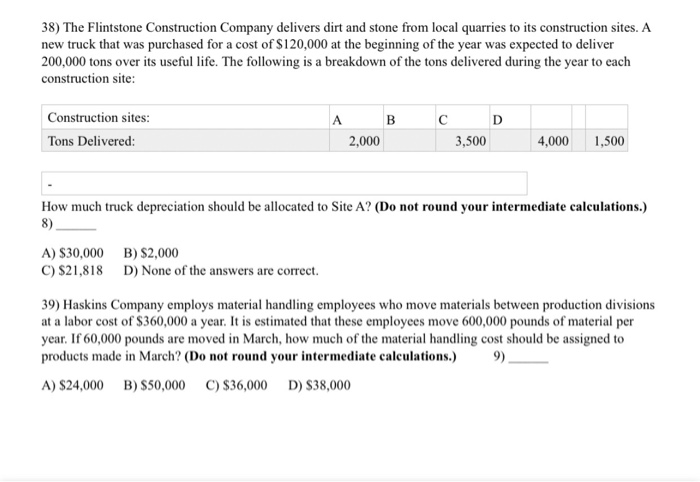

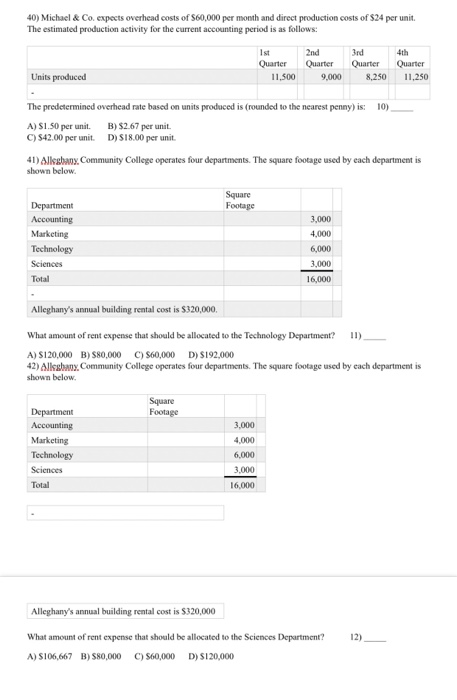

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) All of the following are features of managerial accounting except A) information is provided primarily to insiders such as managers B) information is reported continuously with a present or future orientation C) information is characterized by objectivity, reliability, consistency, and accuracy. D) information includes economic and non-financial data as well as financial data. 2) Choose the answer that is not a distinguishing characteristic of financial accounting information. 2) A) It is focused primarily on the future B) It is more concemed with financial data than physical or economic data. C) It is more highly regulated than managerial accounting information D) It is global information that reflects the performance of the whole company. 3) Which of the following costs would be classified as a direct cost for a company that produces motorcycles? 3) A) Wages of motorcycle assembly workers. B) Rent of manufacturing facility that produces motorcycles. C) Seats used in the motorcycles. D) Both seats used in the motorcycles and wages of motorcycle assembly workers are correct. 4) A company that uses a just in time inventory system: 4) A) adopts a systematic, problem-solving attitude. B) assesses its value chain to create new value-added activities. C) has finished goods inventory on hand at all times in order to speed up shipments of customer orders D) may find that having less inventory actually leads to increased customer satisfaction. 5) Which of the following is not an element that is typically present when fraud occurs? A) Separating duties B) Pressure C) Rationalize D) Opportunity 5) 6) The Sarbanes Oxley Act of 2002: 6) A) requires the CEO and CFO to defer responsibility for internal controls to external auditors. B) requires management to establish a whistleblower policy. C) prohibits D) created Generally Accepted Accounting principles (GAAP) CPA's from becoming managerial accountants. 7) Which of the following items would be reported directly on the income statement as a period cost? 7) A) Cost of lubricant for oiling machinery B) Selling and administrative salaries C) Wages paid to machine operators D) All of these. TRUF/FALSE. Write 'T' if the statement is true and "F if the statement is false. 8) Managerial accounting is designed to satisfy needs of external users including creditors, investors, and governmental agencies.8) 9) Product costs include materials, labor, and selling and administrative costs. 9) 10) Period costs are initially recorded in asset accounts and are later expensed in the period when the related units are sold. 10) 11) Depreciation on manufacturing equipment is an indirect product cost, while depreciation on office equipment is a period cost. 11) 12) Upstream costs are classified as product costs and downstream costs are classified as period costs for financial reporting purposes. 12) 13) A just-in-time system can lower inventory holding costs and increase customer satisfaction. 13 14) Under the terms of the Sarbanes-Oxley Act, a company and its extermal auditor are required to report on the effectiveness of the company's system of internal controls. 14) 15) During its first year of operations, Connor Company paid S50,000 for direct materials and S36,000 in wages for production workers. Lease payments and utilities on the production facilities amounted to $14,000. General, selling, and administrative expenses were S16,000. The company produced 5,000 units and sold 4,000 units for S30.00 a unit. The average cost to produce one unit is which of the following amounts? 15) A) S25.00 B)S18.40 C)S20.00 D) S16.00 16) Why do accountants normally calculate cost per unit as an average? 16 A) Determining the exact cost of a product is virtually impossible. B) Even when producing multiple units of the same product, normal variations occur in the amount of materials and labor used. C) Some manufacturing-related costs cannot be accurately traced to specific units of product. D) All of these are justifications for computing average unit costs. 17) Select the incorrect statement regarding costs and expenses. 17) A) Non-manufacturing costs should be expensed in the period in which they are incurred. B) Some costs are initially recorded as expenses while others are initially recorded as assets. C) Expenses are incurred when assets are used to generate revenue. D) Manufacturing-related costs are initially recorded as expenses. 18) Which of the following costs should not be recorded as an expense? 18) A) Insurance on factory building B) Product shipping costs C) Product advertising D) Sales commissions 19) Which of the following transactions would cause net income for the period to decrease? A) Paid S2,500 cash for raw material cost B) Recorded S5,000 of depreciation on production equipment C) Used $2,000 of office supplies D) Purchased $8,000 of merchandise inventory 19) 20) Which of the following statements is true with regard to product costs versus general, selling, and administrative costs? 20) A) Product costs associated with unsold units appear on the income statement as general expenses. B) Product costs associated with units sold appear on the income statement as cost of goods sold. C) General, selling, and administrative costs appear on the balance sheet. D) None of these is true. 21) Select the correct statement regarding fixed costs. A) The fixed cost per unit does not change when volume decreases. B) The fixed cost per unit increases when volume increases C) Because they do not change, fixed costs should be ignored in decision making. D) The fixed cost per unit decreases when volume increases. 22) Wu Company incurred $40,000 of fixed cost and S50,000 of variable cost when 4,000 units of product were made and sold. If the company's volume doubles, the total cost per unit will: 2) A) double as well. B) increase but will not double. C) decrease. D) stay the same 23) Wu Company incurred $40,000 of fixed cost and S50,000 of variable cost when 4,000 units of product were made and sold If the company's volume doubles, the company's total cost will: 3) A) increase but will not double. C) decrease. D) double as well B)stay the same. 24) In the graph below, which depicts the relationship between units produced and unit cost, the dotted line depicts which type of cost per unit? 4) A) Variable cost B) Mixed cost C) Fixed cost D) None of these 25) Cool Runnings operates a chain of frozen yogurt shops. The company pays S5,000 of rent expense per month for each shop. The managers of each shop are paid a salary of $3,000 per month and all other employees are paid on an hourly basis. Relative to the number of shops, the cost of rent is which kind of cost?5) A) Fixed cost B) Opportunity cost C) Variable cost D) Mixed cost 30) The following information is provided for Soutbal Company: Sales revenue Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative costs Fixed selling and administrative costs S 125,000 42,500 37.500 15,000 12,500 What is this company's contribution margin? 10) A) S30,000 B)S17.500 C) S67,500 D)S45,000 31) A chair manufacturer makes custom chairs using hand tools, wood, glue, and varnish. Which of the following statements is true? I) A) The concepts of direct and indirect costs are not applicable here. B) Wood, glue, and vamish would all be direct materials C) The costs of wood and glue would be treated as direct costs D) Wood would be accounted for as a direct cost, and glue and varnish as indirect costs. 32) Which of the following costs generally can be traced directly to units of product? A) Indirect materials B) Indirect materials and assembly labor C) Overhead costs D) Assembly labor 2) 33) Overhead costs: 3) A) Are only incurred by manufacturing companies. B) Cannot be traced to cost objects in a cost-effective manner, but are instead allocated to cost objects C) Are always variable costs. D) Cannot be allocated to cost objects. 34) Marsden Company has three departments occupying the following amount of floor space 15,000 sq.ft 10,000 sq. ft 25,000 sq. f How much store rent should be allocated to Department 3 if total rent is cqual to $200,000? (Do not round A) S66,667 C) S100,000 B) S50,000 D) None of the answers are correct. 35) The Western and Pacific Railroad has two divisions, the Western Division and the Pacific Division. The company recently invested $8,000,000 to maintain its railroad track. Pertinent data for the two divisions are as follows: Total Miles Traveled: Western Division 800,000 miles 1,200,000 miles Pacific Division The amount of track improvement cost that should be allocated to the Western Division is: (Do not round your intermediate calculations 5) A) S5,333,333. B) $4,000,000. C) S3,200,000. D) $800,000. 36) Great Outdoors Company makes two types of camping tents. Making a standard camping tent requires 4 hours of labor while making a deluxe camping tent requires 10 hours of labor. During the most recent accounting period the company made 2,000 standard camping tents and 500 deluxe camping tents. Indirect manufacturing costs amounted to $52,000 and are allocated based on labor hours. Based on this information: 6) A) S16 of overhead cost should be assigned to each standard camping tent and $40 of overhead cost should be assigned to each deluxe tent. B) $20.80 of overhead cost should be allocated to each camping tent regardless of the type of tent made. C) $4 of overhead cost should be allocated to each camping tent regardless of the type of tent made. D) None of the answers are correct. 37) Sbeddon Industries produces two products. The products' identified costs are as follows: Product A Product B Direct materials S 20,000 S 15,000 Direct labor 12,000 24,000 The company's overhead costs of S108,000 are allocated based on direct labor cost. Assume 4,000 units of product A and 5,000 units of Product B are produced. What is the cost per unit for product B? (Do not round your intermediate calculations.) 7) A) S22.20 BS16.80 C) S7.80 D) None of the answers are correct. 38) The Flintstone Construction Company delivers dirt and stone from local quarries to its construction sites. A new truck that was purchased for a cost of S120,000 at the beginning of the year was expected to deliver 200,000 tons over its useful life. The following is a breakdown of the tons delivered during the year to each construction site: Construction sites: Tons Delivered 2,000 3,500 4,000 1,500 How much truck depreciation should be allocated to Site A? (Do not round your intermediate calculations.) 8) A) $30,000 B) $2,000 S21.818 D) None of the answers are correct 39) Haskins Company employs material handling employees who move materials between production divisions at a labor cost of $360,000 a year. It is estimated that these employees move 600,000 pounds of material per year. If 60,000 pounds are moved in March, how much of the material handling cost should be assigned to products made in March? (Do not round your intermediate calculations.) 9) A) S24,000 B S50,000 C) $36,000 D) S38,000 40) Michael& Co. expects overhead costs of S60,000 per month and direct production costs of $24 per unit The estimated production activity for the current accounting period is as follows: lst Quarter Quarter QuarQuarter 2nd 3rd 4th Units produced The predetermined overhead rate based on units produced is (rounded to the nearest penny) is: A) S1.S0 per unit. B) $2.67 per unit. 11,500 ,000 8,20 11,250 10) C) $42.00 per unit D)S18.00 per unit 1) Allghaox Community College operates four departments. The square footage used by each department is shown below. Footage 3,000 3,000 Total 16,000 Alleghany's annual building rental cost is $320,000. What amount of rent expense that should be allocated to the Technology Department? A) S120,000 B) S80,000 C) $60,000 D) $192,000 42) AllsghaNY.Community College operates four departments. The square footage used by each department is shown below 3,000 4,000 3,000 Total 16,000 Alleghany's annual building rental cost is $320,000 What amount of rent expense that should be allocated to the Sciences Department? A)$106,667 B)$80,000 )$60,000 D) $120,000 12) MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) All of the following are features of managerial accounting except A) information is provided primarily to insiders such as managers B) information is reported continuously with a present or future orientation C) information is characterized by objectivity, reliability, consistency, and accuracy. D) information includes economic and non-financial data as well as financial data. 2) Choose the answer that is not a distinguishing characteristic of financial accounting information. 2) A) It is focused primarily on the future B) It is more concemed with financial data than physical or economic data. C) It is more highly regulated than managerial accounting information D) It is global information that reflects the performance of the whole company. 3) Which of the following costs would be classified as a direct cost for a company that produces motorcycles? 3) A) Wages of motorcycle assembly workers. B) Rent of manufacturing facility that produces motorcycles. C) Seats used in the motorcycles. D) Both seats used in the motorcycles and wages of motorcycle assembly workers are correct. 4) A company that uses a just in time inventory system: 4) A) adopts a systematic, problem-solving attitude. B) assesses its value chain to create new value-added activities. C) has finished goods inventory on hand at all times in order to speed up shipments of customer orders D) may find that having less inventory actually leads to increased customer satisfaction. 5) Which of the following is not an element that is typically present when fraud occurs? A) Separating duties B) Pressure C) Rationalize D) Opportunity 5) 6) The Sarbanes Oxley Act of 2002: 6) A) requires the CEO and CFO to defer responsibility for internal controls to external auditors. B) requires management to establish a whistleblower policy. C) prohibits D) created Generally Accepted Accounting principles (GAAP) CPA's from becoming managerial accountants. 7) Which of the following items would be reported directly on the income statement as a period cost? 7) A) Cost of lubricant for oiling machinery B) Selling and administrative salaries C) Wages paid to machine operators D) All of these. TRUF/FALSE. Write 'T' if the statement is true and "F if the statement is false. 8) Managerial accounting is designed to satisfy needs of external users including creditors, investors, and governmental agencies.8) 9) Product costs include materials, labor, and selling and administrative costs. 9) 10) Period costs are initially recorded in asset accounts and are later expensed in the period when the related units are sold. 10) 11) Depreciation on manufacturing equipment is an indirect product cost, while depreciation on office equipment is a period cost. 11) 12) Upstream costs are classified as product costs and downstream costs are classified as period costs for financial reporting purposes. 12) 13) A just-in-time system can lower inventory holding costs and increase customer satisfaction. 13 14) Under the terms of the Sarbanes-Oxley Act, a company and its extermal auditor are required to report on the effectiveness of the company's system of internal controls. 14) 15) During its first year of operations, Connor Company paid S50,000 for direct materials and S36,000 in wages for production workers. Lease payments and utilities on the production facilities amounted to $14,000. General, selling, and administrative expenses were S16,000. The company produced 5,000 units and sold 4,000 units for S30.00 a unit. The average cost to produce one unit is which of the following amounts? 15) A) S25.00 B)S18.40 C)S20.00 D) S16.00 16) Why do accountants normally calculate cost per unit as an average? 16 A) Determining the exact cost of a product is virtually impossible. B) Even when producing multiple units of the same product, normal variations occur in the amount of materials and labor used. C) Some manufacturing-related costs cannot be accurately traced to specific units of product. D) All of these are justifications for computing average unit costs. 17) Select the incorrect statement regarding costs and expenses. 17) A) Non-manufacturing costs should be expensed in the period in which they are incurred. B) Some costs are initially recorded as expenses while others are initially recorded as assets. C) Expenses are incurred when assets are used to generate revenue. D) Manufacturing-related costs are initially recorded as expenses. 18) Which of the following costs should not be recorded as an expense? 18) A) Insurance on factory building B) Product shipping costs C) Product advertising D) Sales commissions 19) Which of the following transactions would cause net income for the period to decrease? A) Paid S2,500 cash for raw material cost B) Recorded S5,000 of depreciation on production equipment C) Used $2,000 of office supplies D) Purchased $8,000 of merchandise inventory 19) 20) Which of the following statements is true with regard to product costs versus general, selling, and administrative costs? 20) A) Product costs associated with unsold units appear on the income statement as general expenses. B) Product costs associated with units sold appear on the income statement as cost of goods sold. C) General, selling, and administrative costs appear on the balance sheet. D) None of these is true. 21) Select the correct statement regarding fixed costs. A) The fixed cost per unit does not change when volume decreases. B) The fixed cost per unit increases when volume increases C) Because they do not change, fixed costs should be ignored in decision making. D) The fixed cost per unit decreases when volume increases. 22) Wu Company incurred $40,000 of fixed cost and S50,000 of variable cost when 4,000 units of product were made and sold. If the company's volume doubles, the total cost per unit will: 2) A) double as well. B) increase but will not double. C) decrease. D) stay the same 23) Wu Company incurred $40,000 of fixed cost and S50,000 of variable cost when 4,000 units of product were made and sold If the company's volume doubles, the company's total cost will: 3) A) increase but will not double. C) decrease. D) double as well B)stay the same. 24) In the graph below, which depicts the relationship between units produced and unit cost, the dotted line depicts which type of cost per unit? 4) A) Variable cost B) Mixed cost C) Fixed cost D) None of these 25) Cool Runnings operates a chain of frozen yogurt shops. The company pays S5,000 of rent expense per month for each shop. The managers of each shop are paid a salary of $3,000 per month and all other employees are paid on an hourly basis. Relative to the number of shops, the cost of rent is which kind of cost?5) A) Fixed cost B) Opportunity cost C) Variable cost D) Mixed cost 30) The following information is provided for Soutbal Company: Sales revenue Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative costs Fixed selling and administrative costs S 125,000 42,500 37.500 15,000 12,500 What is this company's contribution margin? 10) A) S30,000 B)S17.500 C) S67,500 D)S45,000 31) A chair manufacturer makes custom chairs using hand tools, wood, glue, and varnish. Which of the following statements is true? I) A) The concepts of direct and indirect costs are not applicable here. B) Wood, glue, and vamish would all be direct materials C) The costs of wood and glue would be treated as direct costs D) Wood would be accounted for as a direct cost, and glue and varnish as indirect costs. 32) Which of the following costs generally can be traced directly to units of product? A) Indirect materials B) Indirect materials and assembly labor C) Overhead costs D) Assembly labor 2) 33) Overhead costs: 3) A) Are only incurred by manufacturing companies. B) Cannot be traced to cost objects in a cost-effective manner, but are instead allocated to cost objects C) Are always variable costs. D) Cannot be allocated to cost objects. 34) Marsden Company has three departments occupying the following amount of floor space 15,000 sq.ft 10,000 sq. ft 25,000 sq. f How much store rent should be allocated to Department 3 if total rent is cqual to $200,000? (Do not round A) S66,667 C) S100,000 B) S50,000 D) None of the answers are correct. 35) The Western and Pacific Railroad has two divisions, the Western Division and the Pacific Division. The company recently invested $8,000,000 to maintain its railroad track. Pertinent data for the two divisions are as follows: Total Miles Traveled: Western Division 800,000 miles 1,200,000 miles Pacific Division The amount of track improvement cost that should be allocated to the Western Division is: (Do not round your intermediate calculations 5) A) S5,333,333. B) $4,000,000. C) S3,200,000. D) $800,000. 36) Great Outdoors Company makes two types of camping tents. Making a standard camping tent requires 4 hours of labor while making a deluxe camping tent requires 10 hours of labor. During the most recent accounting period the company made 2,000 standard camping tents and 500 deluxe camping tents. Indirect manufacturing costs amounted to $52,000 and are allocated based on labor hours. Based on this information: 6) A) S16 of overhead cost should be assigned to each standard camping tent and $40 of overhead cost should be assigned to each deluxe tent. B) $20.80 of overhead cost should be allocated to each camping tent regardless of the type of tent made. C) $4 of overhead cost should be allocated to each camping tent regardless of the type of tent made. D) None of the answers are correct. 37) Sbeddon Industries produces two products. The products' identified costs are as follows: Product A Product B Direct materials S 20,000 S 15,000 Direct labor 12,000 24,000 The company's overhead costs of S108,000 are allocated based on direct labor cost. Assume 4,000 units of product A and 5,000 units of Product B are produced. What is the cost per unit for product B? (Do not round your intermediate calculations.) 7) A) S22.20 BS16.80 C) S7.80 D) None of the answers are correct. 38) The Flintstone Construction Company delivers dirt and stone from local quarries to its construction sites. A new truck that was purchased for a cost of S120,000 at the beginning of the year was expected to deliver 200,000 tons over its useful life. The following is a breakdown of the tons delivered during the year to each construction site: Construction sites: Tons Delivered 2,000 3,500 4,000 1,500 How much truck depreciation should be allocated to Site A? (Do not round your intermediate calculations.) 8) A) $30,000 B) $2,000 S21.818 D) None of the answers are correct 39) Haskins Company employs material handling employees who move materials between production divisions at a labor cost of $360,000 a year. It is estimated that these employees move 600,000 pounds of material per year. If 60,000 pounds are moved in March, how much of the material handling cost should be assigned to products made in March? (Do not round your intermediate calculations.) 9) A) S24,000 B S50,000 C) $36,000 D) S38,000 40) Michael& Co. expects overhead costs of S60,000 per month and direct production costs of $24 per unit The estimated production activity for the current accounting period is as follows: lst Quarter Quarter QuarQuarter 2nd 3rd 4th Units produced The predetermined overhead rate based on units produced is (rounded to the nearest penny) is: A) S1.S0 per unit. B) $2.67 per unit. 11,500 ,000 8,20 11,250 10) C) $42.00 per unit D)S18.00 per unit 1) Allghaox Community College operates four departments. The square footage used by each department is shown below. Footage 3,000 3,000 Total 16,000 Alleghany's annual building rental cost is $320,000. What amount of rent expense that should be allocated to the Technology Department? A) S120,000 B) S80,000 C) $60,000 D) $192,000 42) AllsghaNY.Community College operates four departments. The square footage used by each department is shown below 3,000 4,000 3,000 Total 16,000 Alleghany's annual building rental cost is $320,000 What amount of rent expense that should be allocated to the Sciences Department? A)$106,667 B)$80,000 )$60,000 D) $120,000 12)