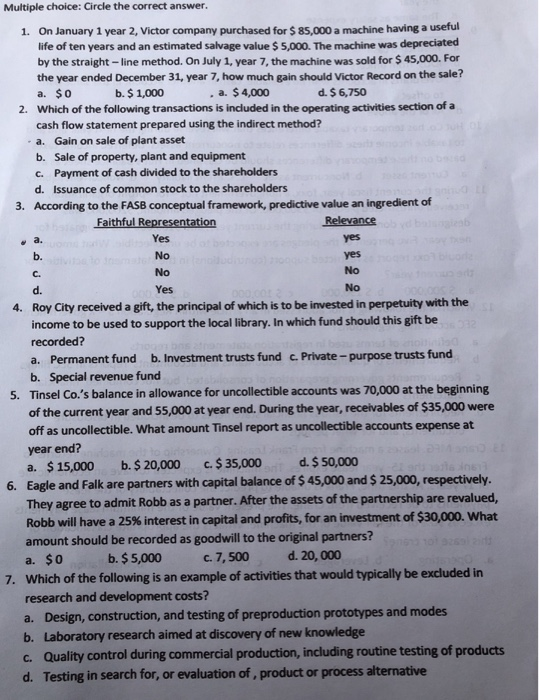

Multiple choice: Circle the correct answer. On January 1 year 2, Victor company purchased for $ 85,000 a machine having a useful life of ten years and an estimated salvage value $ 5,000. The machine was depreciated by the straight - line method. On July 1, year 7, the machine was sold for $ 45,000. For the year ended December 31, year 7, how much gain should Victor Record on the sale? a. $O Which of the following transactions is included in the operating activities section of a cash flow statement prepared using the indirect method? 1. b. $ 1,000 a. $4,000 d. $ 6,750 2. a. Gain on sale of plant asset b. Sale of property, plant and equipment c. Payment of cash divided to the shareholders d. Issuance of common stock to the shareholders According to the FASB conceptual framework, predictive value an ingredient of 3. Faithful Representation Yes No No Yes b. C. d. Roy City received a gift, the principal of which is to be invested in perpetuity with the income to be used to support the local library. In which fund should this gift be recorded? yes No No 4. a. Permanent fund b. Investment trusts fund c. Private-purpose trusts fund b. Special revenue fund Tinsel Co.'s balance in allowance for uncollectible accounts was 70,000 at the beginning of the current year and 55,000 at year end. During the year, receivables of $35,000 were off as uncollectible. What amount Tinsel report as uncollectible accounts expense at year end? a. $15,000b.$20,000c.$ 35,000d.$ 50,000 Eagle and Falk are partners with capital balance of $ 45,000 and $ 25,000, respectively They agree to admit Robb as a partner. After the assets of the partnership are revalued, Robb will have a 25% interest in capital and profits, for an investment of $30,000, what amount should be recorded as goodwill to the original partners? a. $0 5. 6. b. $ 5,000 c. 7, 500 d. 20, 000 typically be excluded in research and development costs? a. Design, construction, and testing of preproduction prototypes and modes b. Laboratory research aimed at discovery of new knowledge c. Quality control during commercial production, including routine testing of products d. Testing in search for, or evaluation of, product or process alternative