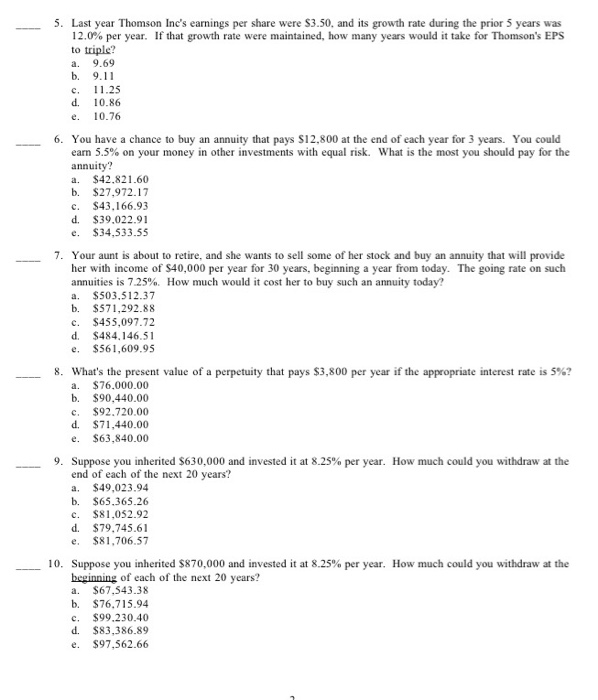

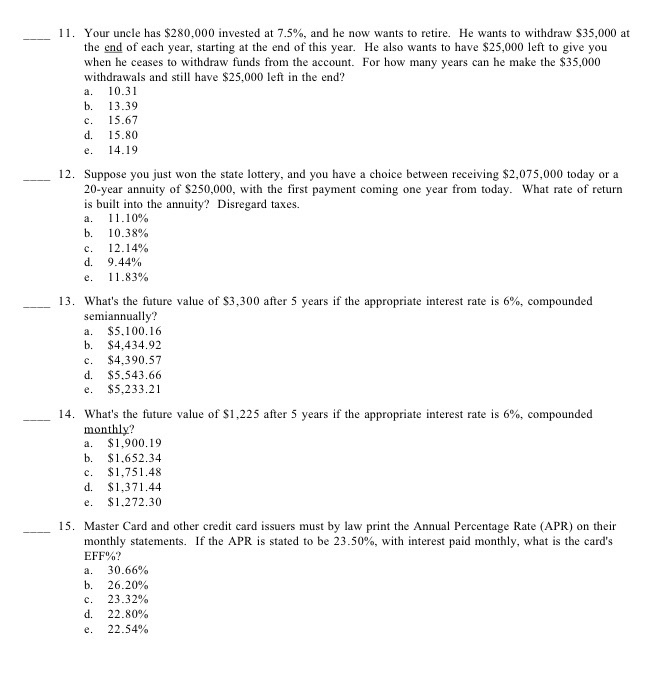

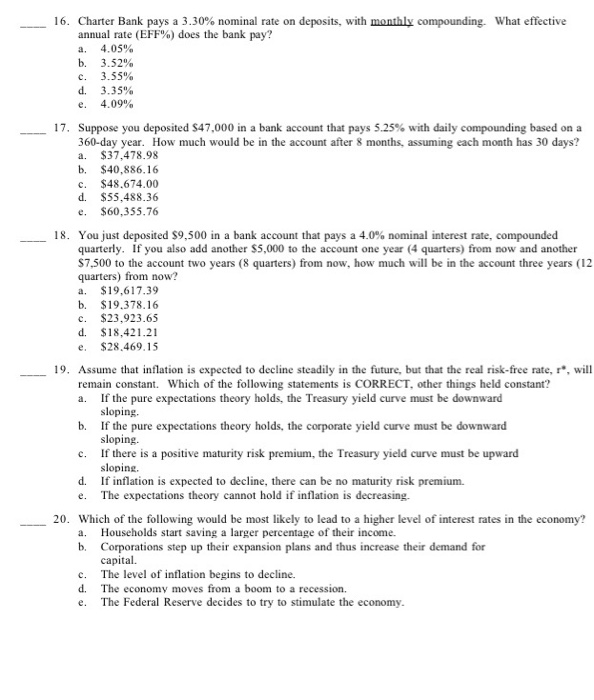

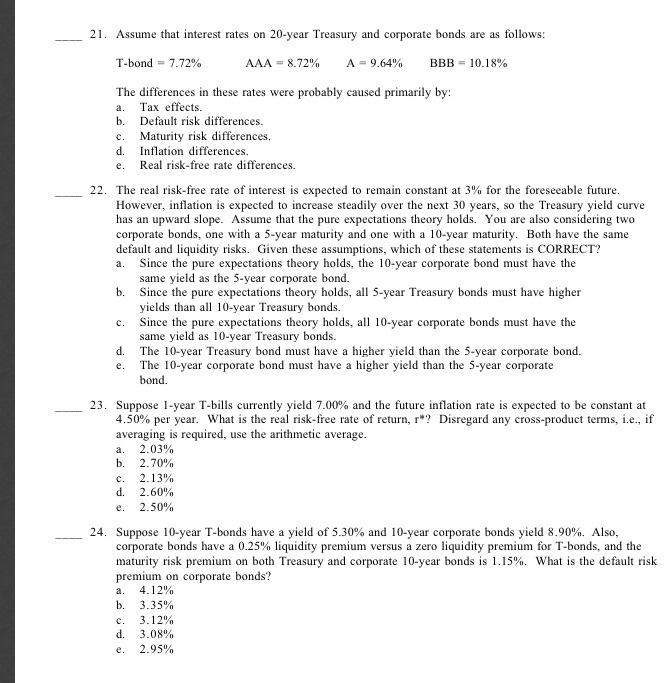

Multiple Choice Identify the choice that best completes the statement or answers the question. a. c. e. a. 1. Your bank account pays a 6% nominal rate of interest. The interest is compounded quarterly. Which of the following statements is CORRECT? The periodic rate of interest is 1.5% and the effective rate of interest is 3%. b. The periodic rate of interest is 6% and the effective rate of interest is greater than 6%. The periodic rate of interest is 1.5% and the effective rate of interest is greater than 6%. d. The periodic rate of interest is 3% and the effective rate of interest is 6%. The periodic rate of interest is 6% and the effective rate of interest is also 6%. 2. A $50,000 loan is to be amortized over 7 years, with annual end-of-year payments. Which of these statements is CORRECT? The annual payments would be larger if the interest rate were lower. b. If the loan were amortized over 10 years rather than 7 years, and if the interest rate were the same in either case, the first payment would include more dollars of interest under the 7-year amortization plan. c. The proportion of each payment that represents interest as opposed to repayment of principal would be lower if the interest rate were lower. d. The last payment would have a higher proportion of interest than the first payment. e. The proportion of interest versus principal repayment would be the same for each of the 7 payments. 3. Which of the following statements regarding a 30-year monthly payment amortized mortgage with a nominal interest rate of 10% is CORRECT? The monthly payments will decline over time. b. A smaller proportion of the last monthly payment will be interest, and a larger proportion will be principal, than for the first monthly payment. The total dollar amount of principal being paid off each month gets smaller as the loan approaches maturity. d. The amount representing interest in the first payment would be higher if the nominal interest rate were 7% rather than 10%. e. Exactly 10% of the first monthly payment represents interest. 4. Janice has $5,000 invested in a bank that pays 5.2% annually. How long will it take for her funds to triple? 25.36 years b. 21.67 years 26.22 years d. 19.72 years 20.59 years c. a. c. e. d. 5. Last year Thomson Inc's earnings per share were $3.50, and its growth rate during the prior 5 years was 12.0% per year. If that growth rate were maintained, how many years would it take for Thomson's EPS to triple? a. 9.69 b. 9.11 c. 11.25 d. 10.86 e. 10.76 6. You have a chance to buy an annuity that pays $12,800 at the end of each year for 3 years. You could earn 5.5% on your money in other investments with equal risk. What is the most you should pay for the annuity? a. $42.821.60 b. $27,972.17 c. $43.166.93 $39.022.91 e. $34,533.55 7. Your aunt is about to retire, and she wants to sell some of her stock and buy an annuity that will provide her with income of $40,000 per year for 30 years, beginning a year from today. The going rate on such annuities is 7.25% How much would it cost her to buy such an annuity today? a. $503.512.37 b. $571,292.88 c. $455,097.72 d. $484.146.51 $561,609.95 8. What's the present value of a perpetuity that pays $3,800 per year if the appropriate interest rate is 5%? $ 76,000.00 b. $90,440.00 $92.720.00 d. $71,440.00 e. $63,840.00 9. Suppose you inherited $630,000 and invested it at 8.25% per year. How much could you withdraw at the end of each of the next 20 years? $49,023.94 b. $65.365.26 c. $81,052.92 d. $79,745.61 e. $81,706.57 10. Suppose you inherited $870,000 and invested it at 8.25% per year. How much could you withdraw at the beginning of each of the next 20 years? $67.543.38 b. $76,715.94 $99.230.40 d. $83,386.89 e. $97.562.66 e. a. c. a. c. 11. Your uncle has $280,000 invested at 7.5%, and he now wants to retire. He wants to withdraw $35,000 at the end of each year, starting at the end of this year. He also wants to have $25,000 left to give you when he ceases to withdraw funds from the account. For how many years can he make the $35,000 withdrawals and still have $25,000 left in the end? 10.31 b. 13.39 15.67 d. 15.80 14.19 a. c. 12. Suppose you just won the state lottery, and you have a choice between receiving $2,075,000 today or a 20-year annuity of $250,000, with the first payment coming one year from today. What rate of return is built into the annuity? Disregard taxes. 11.10% 10.38% a. b. c. d. 12.14% 9.44% 11.83% e. c. e. 13. What's the future value of $3,300 after 5 years if the appropriate interest rate is 6%, compounded semiannually? a. $5.100.16 b. $4,434.92 $4,390.57 d. $5.543.66 $5,233.21 14. What's the future value of $1,225 after 5 years if the appropriate interest rate is 6%, compounded monthly? a. $1,900,19 b. $1.652.34 $1,751.48 d. $1,371.44 $1.272.30 15. Master Card and other credit card issuers must by law print the Annual Percentage Rate (APR) on their monthly statements. If the APR is stated to be 23.50%, with interest paid monthly, what is the card's EFF%? 30.66% b. 26.20% 23.32% d. 22.80% 22.54% c. e. c. e. b. c. d. e. d. 16. Charter Bank pays a 3.30% nominal rate on deposits, with monthly compounding. What effective annual rate (EFF%) does the bank pay? a. 4.05% 3.52% 3.55% 3.35% 4.09% 17. Suppose you deposited 47,000 in a bank account that pays 5.25% with daily compounding based on a 360-day year. How much would be in the account after 8 months, assuming each month has 30 days? a. $37,478.98 b. $40,886.16 c. $48.674.00 $55,488.36 e. $60,355.76 18. You just deposited $9,500 in a bank account that pays a 4.0% nominal interest rate, compounded quarterly. if you also add another $5,000 to the account one year (4 quarters) from now and another $7,500 to the account two years (8 quarters) from now, how much will be in the account three years (12 quarters) from now? a. $19,617.39 b. $19,378.16 c. $23,923.65 d. $18,421.21 $28.469.15 19. Assume that inflation is expected to decline steadily in the future, but that the real risk-free rate, r*, will remain constant. Which of the following statements is CORRECT, other things held constant? a. If the pure expectations theory holds, the Treasury yield curve must be downward sloping, b. If the pure expectations theory holds, the corporate yield curve must be downward sloping. If there is a positive maturity risk premium, the Treasury yield curve must be upward sloping. d. If inflation is expected to decline, there can be no maturity risk premium. e. The expectations theory cannot hold if inflation is decreasing 20. Which of the following would be most likely to lead to a higher level of interest rates in the economy? a. Households start saving a larger percentage of their income. b. Corporations step up their expansion plans and thus increase their demand for capital. c. The level of inflation begins to decline. d. The economy moves from a boom to a recession. e. The Federal Reserve decides to try to stimulate the economy. e. c. 21. Assume that interest rates on 20-year Treasury and corporate bonds are as follows: T-bond = 7.72% AAA = 8.72% A = 9.64% BBB = 10.18% e. The differences in these rates were probably caused primarily by: a. Tax effects. b. Default risk differences. C. Maturity risk differences. d. Inflation differences. Real risk-free rate differences. 22. The real risk-free rate of interest is expected to remain constant at 3% for the foreseeable future. However, inflation is expected to increase steadily over the next 30 years, so the Treasury yield curve has an upward slope. Assume that the pure expectations theory holds. You are also considering two corporate bonds, one with a 5-year maturity and one with a 10-year maturity. Both have the same default and liquidity risks. Given these assumptions, which of these statements is CORRECT? a. Since the pure expectations theory holds, the 10-year corporate bond must have the same yield as the 5-year corporate bond. b. Since the pure expectations theory holds, all 5-year Treasury bonds must have higher yields than all 10-year Treasury bonds. c. Since the pure expectations theory holds, all 10-year corporate bonds must have the same yield as 10-year Treasury bonds. d. The 10-year Treasury bond must have a higher yield than the 5-year corporate bond. The 10-year corporate bond must have a higher yield than the 5-year corporate bond. 23. Suppose 1-year T-bills currently yield 7.00% and the future inflation rate is expected to be constant at 4.50% per year. What is the real risk-free rate of return, r*? Disregard any cross-product terms, i.e., if averaging is required, use the arithmetic average. 2.03% b. 2.70% 2.13% d. 2.60% 2.50% 24. Suppose 10-year T-bonds have a yield of 5.30% and 10-year corporate bonds yield 8.90%. Also, corporate bonds have a 0.25% liquidity premium versus a zero liquidity premium for T-bonds, and the maturity risk premium on both Treasury and corporate 10-year bonds is 1.15%. What is the default risk premium on corporate bonds? 4.12% b. 3.35% 3.12% d. 2.95% e. c. e. c. 3.08% e. a. 25. If 10-year T-bonds have a yield of 6.2%, 10-year corporate bonds yield 7.4%, the maturity risk premium on all 10-year bonds is 1.3%, and corporate bonds have a 0.4% liquidity premium versus a zero liquidity premium for T-bonds, what is the default risk premium on the corporate bond? 0.67% b. 0.80% 0.69% 0.70% 0.66% c. d. e