Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Multiple Choice Indicate the answer choice that best completes the statement or answers the question. - - 1. An international draft is an order

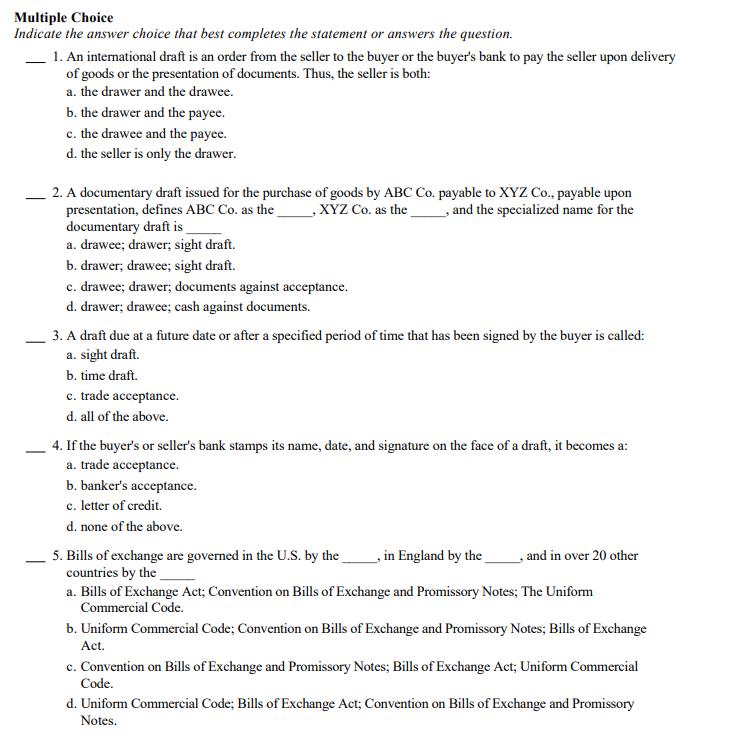

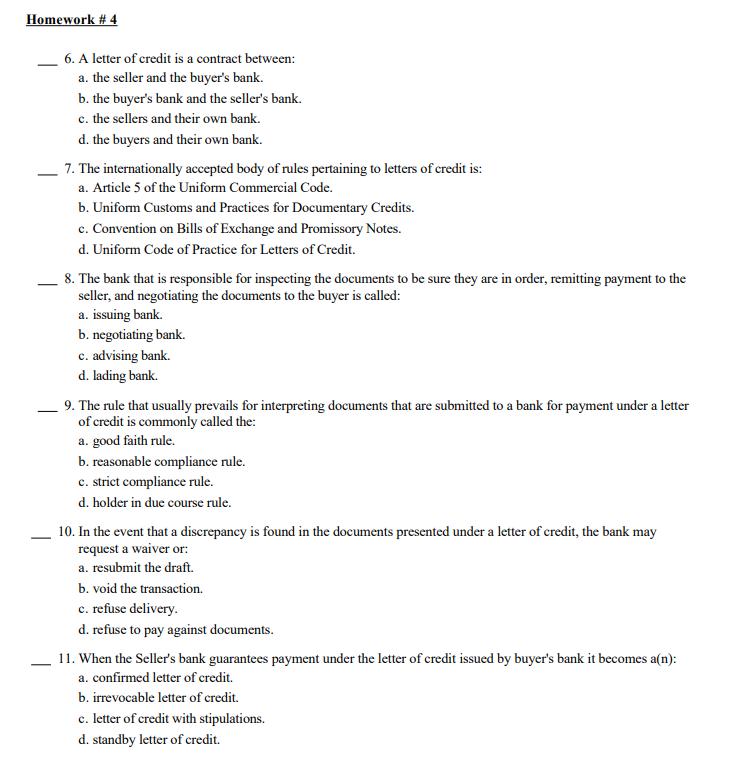

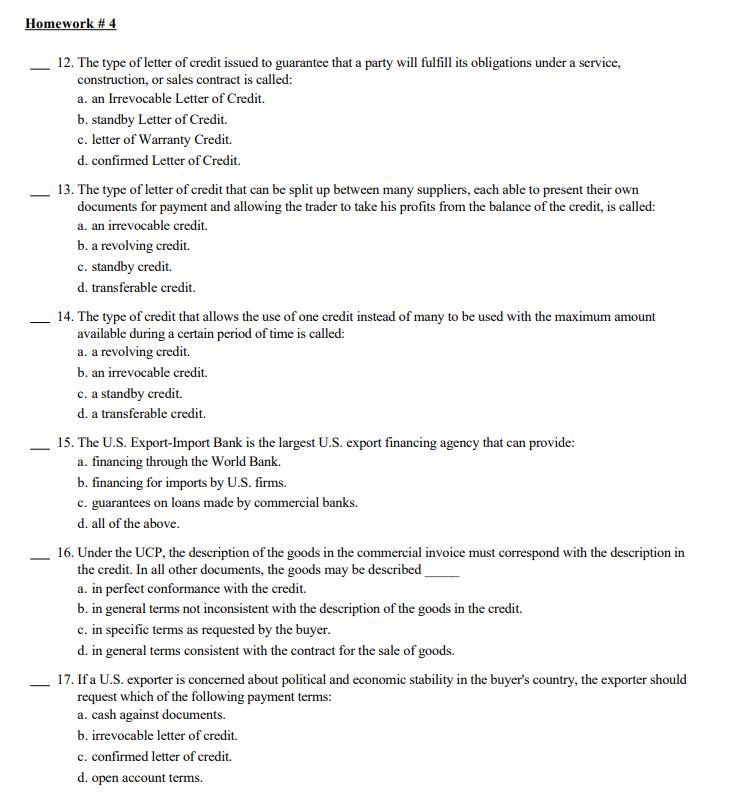

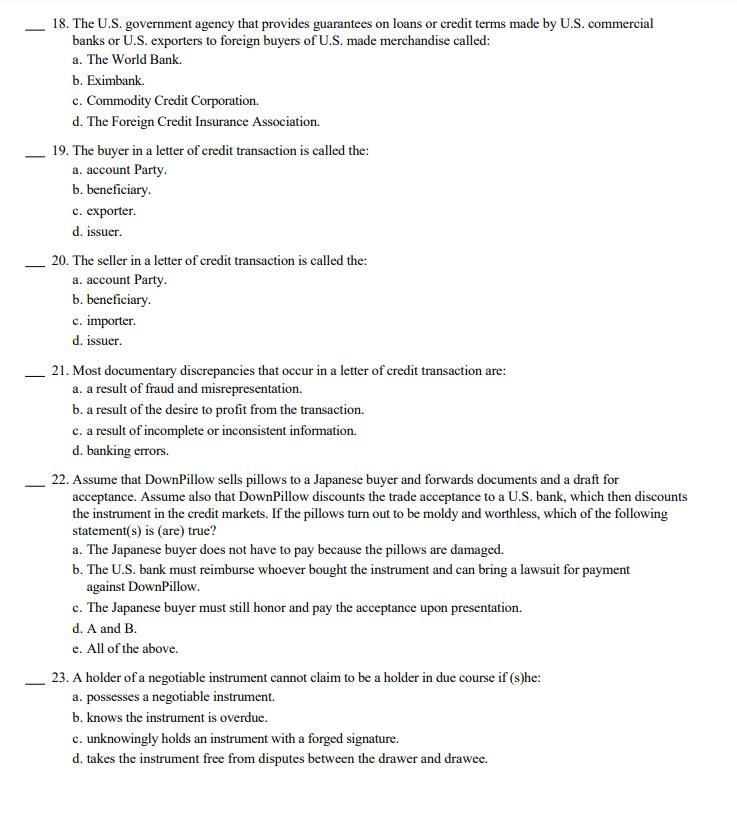

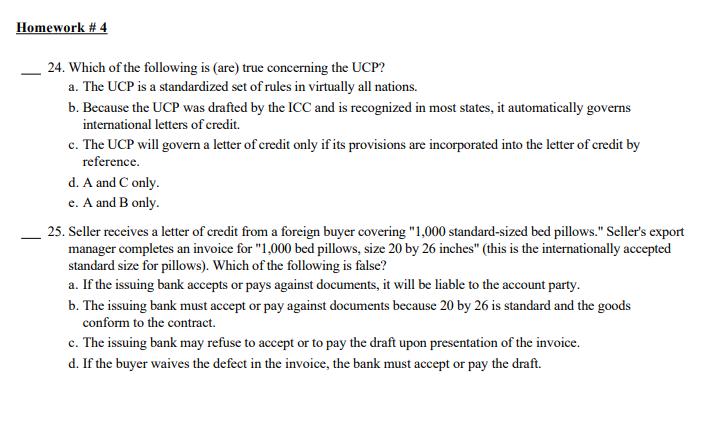

Multiple Choice Indicate the answer choice that best completes the statement or answers the question. - - 1. An international draft is an order from the seller to the buyer or the buyer's bank to pay the seller upon delivery of goods or the presentation of documents. Thus, the seller is both: a. the drawer and the drawee. b. the drawer and the payee. c. the drawee and the payee. d. the seller is only the drawer. 2. A documentary draft issued for the purchase of goods by ABC Co. payable to XYZ Co., payable upon and the specialized name for the presentation, defines ABC Co. as the XYZ Co. as the draft is documentary a. drawee; drawer; sight draft. b. drawer; drawee; sight draft. c. drawee; drawer; documents against acceptance. d. drawer; drawee; cash against documents. 3. A draft due at a future date or after a specified period of time that has been signed by the buyer is called: a. sight draft. b. time draft. c. trade acceptance. d. all of the above. 4. If the buyer's or seller's bank stamps its name, date, and signature on the face of a draft, it becomes a: a. trade acceptance. b. banker's acceptance. c. letter of credit. d. none of the above. 5. Bills of exchange are governed in the U.S. by the countries by the in England by the ,and in over 20 other a. Bills of Exchange Act; Convention on Bills of Exchange and Promissory Notes; The Uniform Commercial Code. b. Uniform Commercial Code; Convention on Bills of Exchange and Promissory Notes; Bills of Exchange Act. c. Convention on Bills of Exchange and Promissory Notes; Bills of Exchange Act; Uniform Commercial Code. d. Uniform Commercial Code; Bills of Exchange Act; Convention on Bills of Exchange and Promissory Notes. Homework # 4 - 6. A letter of credit is a contract between: a. the seller and the buyer's bank. b. the buyer's bank and the seller's bank. c. the sellers and their own bank. d. the buyers and their own bank. 7. The internationally accepted body of rules pertaining to letters of credit is: a. Article 5 of the Uniform Commercial Code. b. Uniform Customs and Practices for Documentary Credits. c. Convention on Bills of Exchange and Promissory Notes. d. Uniform Code of Practice for Letters of Credit. 8. The bank that is responsible for inspecting the documents to be sure they are in order, remitting payment to the seller, and negotiating the documents to the buyer is called: a. issuing bank. b. negotiating bank. c. advising bank. d. lading bank. 9. The rule that usually prevails for interpreting documents that are submitted to a bank for payment under a letter of credit is commonly called the: a. good faith rule. b. reasonable compliance rule. c. strict compliance rule. d. holder in due course rule. 10. In the event that a discrepancy is found in the documents presented under a letter of credit, the bank may request a waiver or: a. resubmit the draft. b. void the transaction. c. refuse delivery. d. refuse to pay against documents. 11. When the Seller's bank guarantees payment under the letter of credit issued by buyer's bank it becomes a(n): a. confirmed letter of credit. b. irrevocable letter of credit. c. letter of credit with stipulations. d. standby letter of credit. Homework # 4 12. The type of letter of credit issued to guarantee that a party will fulfill its obligations under a service, construction, or sales contract is called: a. an Irrevocable Letter of Credit. b. standby Letter of Credit. c. letter of Warranty Credit. d. confirmed Letter of Credit. 13. The type of letter of credit that can be split up between many suppliers, each able to present their own documents for payment and allowing the trader to take his profits from the balance of the credit, is called: a. an irrevocable credit. b. a revolving credit. c. standby credit. d. transferable credit. 14. The type of credit that allows the use of one credit instead of many to be used with the maximum amount available during a certain period of time is called: a. a revolving credit. b. an irrevocable credit. c. a standby credit. d. a transferable credit. 15. The U.S. Export-Import Bank is the largest U.S. export financing agency that can provide: a. financing through the World Bank. b. financing for imports by U.S. firms. c. guarantees on loans made by commercial banks. d. all of the above. 16. Under the UCP, the description of the goods in the commercial invoice must correspond with the description in the credit. In all other documents, the goods may be described_ a. in perfect conformance with the credit. b. in general terms not inconsistent with the description of the goods in the credit. c. in specific terms as requested by the buyer. d. in general terms consistent with the contract for the sale of goods. 17. If a U.S. exporter is concerned about political and economic stability in the buyer's country, the exporter should request which of the following payment terms: a. cash against documents. b. irrevocable letter of credit. c. confirmed letter of credit. d. open account terms. - - - 18. The U.S. government agency that provides guarantees on loans or credit terms made by U.S. commercial banks or U.S. exporters to foreign buyers of U.S. made merchandise called: a. The World Bank. b. Eximbank. c. Commodity Credit Corporation. d. The Foreign Credit Insurance Association. 19. The buyer in a letter of credit transaction is called the: a. account Party. b. beneficiary. c. exporter. d. issuer. 20. The seller in a letter of credit transaction is called the: a. account Party. b. beneficiary. c. importer. d. issuer. 21. Most documentary discrepancies that occur in a letter of credit transaction are: a. a result of fraud and misrepresentation. b. a result of the desire to profit from the transaction. c. a result of incomplete or inconsistent information. d. banking errors. 22. Assume that DownPillow sells pillows to a Japanese buyer and forwards documents and a draft for acceptance. Assume also that DownPillow discounts the trade acceptance to a U.S. bank, which then discounts the instrument in the credit markets. If the pillows turn out to be moldy and worthless, which of the following statement(s) is (are) true? a. The Japanese buyer does not have to pay because the pillows are damaged. b. The U.S. bank must reimburse whoever bought the instrument and can bring a lawsuit for payment against DownPillow. c. The Japanese buyer must still honor and pay the acceptance upon presentation. d. A and B. e. All of the above. 23. A holder of a negotiable instrument cannot claim to be a holder in due course if (s)he: a. possesses a negotiable instrument. b. knows the instrument is overdue. c. unknowingly holds an instrument with a forged signature. d. takes the instrument free from disputes between the drawer and drawee. Homework # 4 24. Which of the following is (are) true concerning the UCP? a. The UCP is a standardized set of rules in virtually all nations. b. Because the UCP was drafted by the ICC and is recognized in most states, it automatically governs international letters of credit. c. The UCP will govern a letter of credit only if its provisions are incorporated into the letter of credit by reference. d. A and C only. e. A and B only. 25. Seller receives a letter of credit from a foreign buyer covering "1,000 standard-sized bed pillows." Seller's export manager completes an invoice for "1,000 bed pillows, size 20 by 26 inches" (this is the internationally accepted standard size for pillows). Which of the following is false? a. If the issuing bank accepts or pays against documents, it will be liable to the account party. b. The issuing bank must accept or pay against documents because 20 by 26 is standard and the goods conform to the contract. c. The issuing bank may refuse to accept or to pay the draft upon presentation of the invoice. d. If the buyer waives the defect in the invoice, the bank must accept or pay the draft. Multiple Choice Indicate the answer choice that best completes the statement or answers the question. - - 1. An international draft is an order from the seller to the buyer or the buyer's bank to pay the seller upon delivery of goods or the presentation of documents. Thus, the seller is both: a. the drawer and the drawee. b. the drawer and the payee. c. the drawee and the payee. d. the seller is only the drawer. 2. A documentary draft issued for the purchase of goods by ABC Co. payable to XYZ Co., payable upon and the specialized name for the presentation, defines ABC Co. as the XYZ Co. as the draft is documentary a. drawee; drawer; sight draft. b. drawer; drawee; sight draft. c. drawee; drawer; documents against acceptance. d. drawer; drawee; cash against documents. 3. A draft due at a future date or after a specified period of time that has been signed by the buyer is called: a. sight draft. b. time draft. c. trade acceptance. d. all of the above. 4. If the buyer's or seller's bank stamps its name, date, and signature on the face of a draft, it becomes a: a. trade acceptance. b. banker's acceptance. c. letter of credit. d. none of the above. 5. Bills of exchange are governed in the U.S. by the countries by the in England by the ,and in over 20 other a. Bills of Exchange Act; Convention on Bills of Exchange and Promissory Notes; The Uniform Commercial Code. b. Uniform Commercial Code; Convention on Bills of Exchange and Promissory Notes; Bills of Exchange Act. c. Convention on Bills of Exchange and Promissory Notes; Bills of Exchange Act; Uniform Commercial Code. d. Uniform Commercial Code; Bills of Exchange Act; Convention on Bills of Exchange and Promissory Notes. Homework # 4 - 6. A letter of credit is a contract between: a. the seller and the buyer's bank. b. the buyer's bank and the seller's bank. c. the sellers and their own bank. d. the buyers and their own bank. 7. The internationally accepted body of rules pertaining to letters of credit is: a. Article 5 of the Uniform Commercial Code. b. Uniform Customs and Practices for Documentary Credits. c. Convention on Bills of Exchange and Promissory Notes. d. Uniform Code of Practice for Letters of Credit. 8. The bank that is responsible for inspecting the documents to be sure they are in order, remitting payment to the seller, and negotiating the documents to the buyer is called: a. issuing bank. b. negotiating bank. c. advising bank. d. lading bank. 9. The rule that usually prevails for interpreting documents that are submitted to a bank for payment under a letter of credit is commonly called the: a. good faith rule. b. reasonable compliance rule. c. strict compliance rule. d. holder in due course rule. 10. In the event that a discrepancy is found in the documents presented under a letter of credit, the bank may request a waiver or: a. resubmit the draft. b. void the transaction. c. refuse delivery. d. refuse to pay against documents. 11. When the Seller's bank guarantees payment under the letter of credit issued by buyer's bank it becomes a(n): a. confirmed letter of credit. b. irrevocable letter of credit. c. letter of credit with stipulations. d. standby letter of credit. Homework # 4 12. The type of letter of credit issued to guarantee that a party will fulfill its obligations under a service, construction, or sales contract is called: a. an Irrevocable Letter of Credit. b. standby Letter of Credit. c. letter of Warranty Credit. d. confirmed Letter of Credit. 13. The type of letter of credit that can be split up between many suppliers, each able to present their own documents for payment and allowing the trader to take his profits from the balance of the credit, is called: a. an irrevocable credit. b. a revolving credit. c. standby credit. d. transferable credit. 14. The type of credit that allows the use of one credit instead of many to be used with the maximum amount available during a certain period of time is called: a. a revolving credit. b. an irrevocable credit. c. a standby credit. d. a transferable credit. 15. The U.S. Export-Import Bank is the largest U.S. export financing agency that can provide: a. financing through the World Bank. b. financing for imports by U.S. firms. c. guarantees on loans made by commercial banks. d. all of the above. 16. Under the UCP, the description of the goods in the commercial invoice must correspond with the description in the credit. In all other documents, the goods may be described_ a. in perfect conformance with the credit. b. in general terms not inconsistent with the description of the goods in the credit. c. in specific terms as requested by the buyer. d. in general terms consistent with the contract for the sale of goods. 17. If a U.S. exporter is concerned about political and economic stability in the buyer's country, the exporter should request which of the following payment terms: a. cash against documents. b. irrevocable letter of credit. c. confirmed letter of credit. d. open account terms. - - - 18. The U.S. government agency that provides guarantees on loans or credit terms made by U.S. commercial banks or U.S. exporters to foreign buyers of U.S. made merchandise called: a. The World Bank. b. Eximbank. c. Commodity Credit Corporation. d. The Foreign Credit Insurance Association. 19. The buyer in a letter of credit transaction is called the: a. account Party. b. beneficiary. c. exporter. d. issuer. 20. The seller in a letter of credit transaction is called the: a. account Party. b. beneficiary. c. importer. d. issuer. 21. Most documentary discrepancies that occur in a letter of credit transaction are: a. a result of fraud and misrepresentation. b. a result of the desire to profit from the transaction. c. a result of incomplete or inconsistent information. d. banking errors. 22. Assume that DownPillow sells pillows to a Japanese buyer and forwards documents and a draft for acceptance. Assume also that DownPillow discounts the trade acceptance to a U.S. bank, which then discounts the instrument in the credit markets. If the pillows turn out to be moldy and worthless, which of the following statement(s) is (are) true? a. The Japanese buyer does not have to pay because the pillows are damaged. b. The U.S. bank must reimburse whoever bought the instrument and can bring a lawsuit for payment against DownPillow. c. The Japanese buyer must still honor and pay the acceptance upon presentation. d. A and B. e. All of the above. 23. A holder of a negotiable instrument cannot claim to be a holder in due course if (s)he: a. possesses a negotiable instrument. b. knows the instrument is overdue. c. unknowingly holds an instrument with a forged signature. d. takes the instrument free from disputes between the drawer and drawee. Homework # 4 24. Which of the following is (are) true concerning the UCP? a. The UCP is a standardized set of rules in virtually all nations. b. Because the UCP was drafted by the ICC and is recognized in most states, it automatically governs international letters of credit. c. The UCP will govern a letter of credit only if its provisions are incorporated into the letter of credit by reference. d. A and C only. e. A and B only. 25. Seller receives a letter of credit from a foreign buyer covering "1,000 standard-sized bed pillows." Seller's export manager completes an invoice for "1,000 bed pillows, size 20 by 26 inches" (this is the internationally accepted standard size for pillows). Which of the following is false? a. If the issuing bank accepts or pays against documents, it will be liable to the account party. b. The issuing bank must accept or pay against documents because 20 by 26 is standard and the goods conform to the contract. c. The issuing bank may refuse to accept or to pay the draft upon presentation of the invoice. d. If the buyer waives the defect in the invoice, the bank must accept or pay the draft. Multiple Choice Indicate the answer choice that best completes the statement or answers the question. - - 1. An international draft is an order from the seller to the buyer or the buyer's bank to pay the seller upon delivery of goods or the presentation of documents. Thus, the seller is both: a. the drawer and the drawee. b. the drawer and the payee. c. the drawee and the payee. d. the seller is only the drawer. 2. A documentary draft issued for the purchase of goods by ABC Co. payable to XYZ Co., payable upon and the specialized name for the presentation, defines ABC Co. as the XYZ Co. as the draft is documentary a. drawee; drawer; sight draft. b. drawer; drawee; sight draft. c. drawee; drawer; documents against acceptance. d. drawer; drawee; cash against documents. 3. A draft due at a future date or after a specified period of time that has been signed by the buyer is called: a. sight draft. b. time draft. c. trade acceptance. d. all of the above. 4. If the buyer's or seller's bank stamps its name, date, and signature on the face of a draft, it becomes a: a. trade acceptance. b. banker's acceptance. c. letter of credit. d. none of the above. 5. Bills of exchange are governed in the U.S. by the countries by the in England by the ,and in over 20 other a. Bills of Exchange Act; Convention on Bills of Exchange and Promissory Notes; The Uniform Commercial Code. b. Uniform Commercial Code; Convention on Bills of Exchange and Promissory Notes; Bills of Exchange Act. c. Convention on Bills of Exchange and Promissory Notes; Bills of Exchange Act; Uniform Commercial Code. d. Uniform Commercial Code; Bills of Exchange Act; Convention on Bills of Exchange and Promissory Notes. Homework # 4 - 6. A letter of credit is a contract between: a. the seller and the buyer's bank. b. the buyer's bank and the seller's bank. c. the sellers and their own bank. d. the buyers and their own bank. 7. The internationally accepted body of rules pertaining to letters of credit is: a. Article 5 of the Uniform Commercial Code. b. Uniform Customs and Practices for Documentary Credits. c. Convention on Bills of Exchange and Promissory Notes. d. Uniform Code of Practice for Letters of Credit. 8. The bank that is responsible for inspecting the documents to be sure they are in order, remitting payment to the seller, and negotiating the documents to the buyer is called: a. issuing bank. b. negotiating bank. c. advising bank. d. lading bank. 9. The rule that usually prevails for interpreting documents that are submitted to a bank for payment under a letter of credit is commonly called the: a. good faith rule. b. reasonable compliance rule. c. strict compliance rule. d. holder in due course rule. 10. In the event that a discrepancy is found in the documents presented under a letter of credit, the bank may request a waiver or: a. resubmit the draft. b. void the transaction. c. refuse delivery. d. refuse to pay against documents. 11. When the Seller's bank guarantees payment under the letter of credit issued by buyer's bank it becomes a(n): a. confirmed letter of credit. b. irrevocable letter of credit. c. letter of credit with stipulations. d. standby letter of credit. Homework # 4 12. The type of letter of credit issued to guarantee that a party will fulfill its obligations under a service, construction, or sales contract is called: a. an Irrevocable Letter of Credit. b. standby Letter of Credit. c. letter of Warranty Credit. d. confirmed Letter of Credit. 13. The type of letter of credit that can be split up between many suppliers, each able to present their own documents for payment and allowing the trader to take his profits from the balance of the credit, is called: a. an irrevocable credit. b. a revolving credit. c. standby credit. d. transferable credit. 14. The type of credit that allows the use of one credit instead of many to be used with the maximum amount available during a certain period of time is called: a. a revolving credit. b. an irrevocable credit. c. a standby credit. d. a transferable credit. 15. The U.S. Export-Import Bank is the largest U.S. export financing agency that can provide: a. financing through the World Bank. b. financing for imports by U.S. firms. c. guarantees on loans made by commercial banks. d. all of the above. 16. Under the UCP, the description of the goods in the commercial invoice must correspond with the description in the credit. In all other documents, the goods may be described_ a. in perfect conformance with the credit. b. in general terms not inconsistent with the description of the goods in the credit. c. in specific terms as requested by the buyer. d. in general terms consistent with the contract for the sale of goods. 17. If a U.S. exporter is concerned about political and economic stability in the buyer's country, the exporter should request which of the following payment terms: a. cash against documents. b. irrevocable letter of credit. c. confirmed letter of credit. d. open account terms. - - - 18. The U.S. government agency that provides guarantees on loans or credit terms made by U.S. commercial banks or U.S. exporters to foreign buyers of U.S. made merchandise called: a. The World Bank. b. Eximbank. c. Commodity Credit Corporation. d. The Foreign Credit Insurance Association. 19. The buyer in a letter of credit transaction is called the: a. account Party. b. beneficiary. c. exporter. d. issuer. 20. The seller in a letter of credit transaction is called the: a. account Party. b. beneficiary. c. importer. d. issuer. 21. Most documentary discrepancies that occur in a letter of credit transaction are: a. a result of fraud and misrepresentation. b. a result of the desire to profit from the transaction. c. a result of incomplete or inconsistent information. d. banking errors. 22. Assume that DownPillow sells pillows to a Japanese buyer and forwards documents and a draft for acceptance. Assume also that DownPillow discounts the trade acceptance to a U.S. bank, which then discounts the instrument in the credit markets. If the pillows turn out to be moldy and worthless, which of the following statement(s) is (are) true? a. The Japanese buyer does not have to pay because the pillows are damaged. b. The U.S. bank must reimburse whoever bought the instrument and can bring a lawsuit for payment against DownPillow. c. The Japanese buyer must still honor and pay the acceptance upon presentation. d. A and B. e. All of the above. 23. A holder of a negotiable instrument cannot claim to be a holder in due course if (s)he: a. possesses a negotiable instrument. b. knows the instrument is overdue. c. unknowingly holds an instrument with a forged signature. d. takes the instrument free from disputes between the drawer and drawee. Homework # 4 24. Which of the following is (are) true concerning the UCP? a. The UCP is a standardized set of rules in virtually all nations. b. Because the UCP was drafted by the ICC and is recognized in most states, it automatically governs international letters of credit. c. The UCP will govern a letter of credit only if its provisions are incorporated into the letter of credit by reference. d. A and C only. e. A and B only. 25. Seller receives a letter of credit from a foreign buyer covering "1,000 standard-sized bed pillows." Seller's export manager completes an invoice for "1,000 bed pillows, size 20 by 26 inches" (this is the internationally accepted standard size for pillows). Which of the following is false? a. If the issuing bank accepts or pays against documents, it will be liable to the account party. b. The issuing bank must accept or pay against documents because 20 by 26 is standard and the goods conform to the contract. c. The issuing bank may refuse to accept or to pay the draft upon presentation of the invoice. d. If the buyer waives the defect in the invoice, the bank must accept or pay the draft. Multiple Choice Indicate the answer choice that best completes the statement or answers the question. - - 1. An international draft is an order from the seller to the buyer or the buyer's bank to pay the seller upon delivery of goods or the presentation of documents. Thus, the seller is both: a. the drawer and the drawee. b. the drawer and the payee. c. the drawee and the payee. d. the seller is only the drawer. 2. A documentary draft issued for the purchase of goods by ABC Co. payable to XYZ Co., payable upon and the specialized name for the presentation, defines ABC Co. as the XYZ Co. as the draft is documentary a. drawee; drawer; sight draft. b. drawer; drawee; sight draft. c. drawee; drawer; documents against acceptance. d. drawer; drawee; cash against documents. 3. A draft due at a future date or after a specified period of time that has been signed by the buyer is called: a. sight draft. b. time draft. c. trade acceptance. d. all of the above. 4. If the buyer's or seller's bank stamps its name, date, and signature on the face of a draft, it becomes a: a. trade acceptance. b. banker's acceptance. c. letter of credit. d. none of the above. 5. Bills of exchange are governed in the U.S. by the countries by the in England by the ,and in over 20 other a. Bills of Exchange Act; Convention on Bills of Exchange and Promissory Notes; The Uniform Commercial Code. b. Uniform Commercial Code; Convention on Bills of Exchange and Promissory Notes; Bills of Exchange Act. c. Convention on Bills of Exchange and Promissory Notes; Bills of Exchange Act; Uniform Commercial Code. d. Uniform Commercial Code; Bills of Exchange Act; Convention on Bills of Exchange and Promissory Notes. Homework # 4 - 6. A letter of credit is a contract between: a. the seller and the buyer's bank. b. the buyer's bank and the seller's bank. c. the sellers and their own bank. d. the buyers and their own bank. 7. The internationally accepted body of rules pertaining to letters of credit is: a. Article 5 of the Uniform Commercial Code. b. Uniform Customs and Practices for Documentary Credits. c. Convention on Bills of Exchange and Promissory Notes. d. Uniform Code of Practice for Letters of Credit. 8. The bank that is responsible for inspecting the documents to be sure they are in order, remitting payment to the seller, and negotiating the documents to the buyer is called: a. issuing bank. b. negotiating bank. c. advising bank. d. lading bank. 9. The rule that usually prevails for interpreting documents that are submitted to a bank for payment under a letter of credit is commonly called the: a. good faith rule. b. reasonable compliance rule. c. strict compliance rule. d. holder in due course rule. 10. In the event that a discrepancy is found in the documents presented under a letter of credit, the bank may request a waiver or: a. resubmit the draft. b. void the transaction. c. refuse delivery. d. refuse to pay against documents. 11. When the Seller's bank guarantees payment under the letter of credit issued by buyer's bank it becomes a(n): a. confirmed letter of credit. b. irrevocable letter of credit. c. letter of credit with stipulations. d. standby letter of credit. Homework # 4 12. The type of letter of credit issued to guarantee that a party will fulfill its obligations under a service, construction, or sales contract is called: a. an Irrevocable Letter of Credit. b. standby Letter of Credit. c. letter of Warranty Credit. d. confirmed Letter of Credit. 13. The type of letter of credit that can be split up between many suppliers, each able to present their own documents for payment and allowing the trader to take his profits from the balance of the credit, is called: a. an irrevocable credit. b. a revolving credit. c. standby credit. d. transferable credit. 14. The type of credit that allows the use of one credit instead of many to be used with the maximum amount available during a certain period of time is called: a. a revolving credit. b. an irrevocable credit. c. a standby credit. d. a transferable credit. 15. The U.S. Export-Import Bank is the largest U.S. export financing agency that can provide: a. financing through the World Bank. b. financing for imports by U.S. firms. c. guarantees on loans made by commercial banks. d. all of the above. 16. Under the UCP, the description of the goods in the commercial invoice must correspond with the description in the credit. In all other documents, the goods may be described_ a. in perfect conformance with the credit. b. in general terms not inconsistent with the description of the goods in the credit. c. in specific terms as requested by the buyer. d. in general terms consistent with the contract for the sale of goods. 17. If a U.S. exporter is concerned about political and economic stability in the buyer's country, the exporter should request which of the following payment terms: a. cash against documents. b. irrevocable letter of credit. c. confirmed letter of credit. d. open account terms. - - - 18. The U.S. government agency that provides guarantees on loans or credit terms made by U.S. commercial banks or U.S. exporters to foreign buyers of U.S. made merchandise called: a. The World Bank. b. Eximbank. c. Commodity Credit Corporation. d. The Foreign Credit Insurance Association. 19. The buyer in a letter of credit transaction is called the: a. account Party. b. beneficiary. c. exporter. d. issuer. 20. The seller in a letter of credit transaction is called the: a. account Party. b. beneficiary. c. importer. d. issuer. 21. Most documentary discrepancies that occur in a letter of credit transaction are: a. a result of fraud and misrepresentation. b. a result of the desire to profit from the transaction. c. a result of incomplete or inconsistent information. d. banking errors. 22. Assume that DownPillow sells pillows to a Japanese buyer and forwards documents and a draft for acceptance. Assume also that DownPillow discounts the trade acceptance to a U.S. bank, which then discounts the instrument in the credit markets. If the pillows turn out to be moldy and worthless, which of the following statement(s) is (are) true? a. The Japanese buyer does not have to pay because the pillows are damaged. b. The U.S. bank must reimburse whoever bought the instrument and can bring a lawsuit for payment against DownPillow. c. The Japanese buyer must still honor and pay the acceptance upon presentation. d. A and B. e. All of the above. 23. A holder of a negotiable instrument cannot claim to be a holder in due course if (s)he: a. possesses a negotiable instrument. b. knows the instrument is overdue. c. unknowingly holds an instrument with a forged signature. d. takes the instrument free from disputes between the drawer and drawee. Homework # 4 24. Which of the following is (are) true concerning the UCP? a. The UCP is a standardized set of rules in virtually all nations. b. Because the UCP was drafted by the ICC and is recognized in most states, it automatically governs international letters of credit. c. The UCP will govern a letter of credit only if its provisions are incorporated into the letter of credit by reference. d. A and C only. e. A and B only. 25. Seller receives a letter of credit from a foreign buyer covering "1,000 standard-sized bed pillows." Seller's export manager completes an invoice for "1,000 bed pillows, size 20 by 26 inches" (this is the internationally accepted standard size for pillows). Which of the following is false? a. If the issuing bank accepts or pays against documents, it will be liable to the account party. b. The issuing bank must accept or pay against documents because 20 by 26 is standard and the goods conform to the contract. c. The issuing bank may refuse to accept or to pay the draft upon presentation of the invoice. d. If the buyer waives the defect in the invoice, the bank must accept or pay the draft. Multiple Choice Indicate the answer choice that best completes the statement or answers the question. - - 1. An international draft is an order from the seller to the buyer or the buyer's bank to pay the seller upon delivery of goods or the presentation of documents. Thus, the seller is both: a. the drawer and the drawee. b. the drawer and the payee. c. the drawee and the payee. d. the seller is only the drawer. 2. A documentary draft issued for the purchase of goods by ABC Co. payable to XYZ Co., payable upon and the specialized name for the presentation, defines ABC Co. as the XYZ Co. as the draft is documentary a. drawee; drawer; sight draft. b. drawer; drawee; sight draft. c. drawee; drawer; documents against acceptance. d. drawer; drawee; cash against documents. 3. A draft due at a future date or after a specified period of time that has been signed by the buyer is called: a. sight draft. b. time draft. c. trade acceptance. d. all of the above. 4. If the buyer's or seller's bank stamps its name, date, and signature on the face of a draft, it becomes a: a. trade acceptance. b. banker's acceptance. c. letter of credit. d. none of the above. 5. Bills of exchange are governed in the U.S. by the countries by the in England by the ,and in over 20 other a. Bills of Exchange Act; Convention on Bills of Exchange and Promissory Notes; The Uniform Commercial Code. b. Uniform Commercial Code; Convention on Bills of Exchange and Promissory Notes; Bills of Exchange Act. c. Convention on Bills of Exchange and Promissory Notes; Bills of Exchange Act; Uniform Commercial Code. d. Uniform Commercial Code; Bills of Exchange Act; Convention on Bills of Exchange and Promissory Notes. Homework # 4 - 6. A letter of credit is a contract between: a. the seller and the buyer's bank. b. the buyer's bank and the seller's bank. c. the sellers and their own bank. d. the buyers and their own bank. 7. The internationally accepted body of rules pertaining to letters of credit is: a. Article 5 of the Uniform Commercial Code. b. Uniform Customs and Practices for Documentary Credits. c. Convention on Bills of Exchange and Promissory Notes. d. Uniform Code of Practice for Letters of Credit. 8. The bank that is responsible for inspecting the documents to be sure they are in order, remitting payment to the seller, and negotiating the documents to the buyer is called: a. issuing bank. b. negotiating bank. c. advising bank. d. lading bank. 9. The rule that usually prevails for interpreting documents that are submitted to a bank for payment under a letter of credit is commonly called the: a. good faith rule. b. reasonable compliance rule. c. strict compliance rule. d. holder in due course rule. 10. In the event that a discrepancy is found in the documents presented under a letter of credit, the bank may request a waiver or: a. resubmit the draft. b. void the transaction. c. refuse delivery. d. refuse to pay against documents. 11. When the Seller's bank guarantees payment under the letter of credit issued by buyer's bank it becomes a(n): a. confirmed letter of credit. b. irrevocable letter of credit. c. letter of credit with stipulations. d. standby letter of credit. Homework # 4 12. The type of letter of credit issued to guarantee that a party will fulfill its obligations under a service, construction, or sales contract is called: a. an Irrevocable Letter of Credit. b. standby Letter of Credit. c. letter of Warranty Credit. d. confirmed Letter of Credit. 13. The type of letter of credit that can be split up between many suppliers, each able to present their own documents for payment and allowing the trader to take his profits from the balance of the credit, is called: a. an irrevocable credit. b. a revolving credit. c. standby credit. d. transferable credit. 14. The type of credit that allows the use of one credit instead of many to be used with the maximum amount available during a certain period of time is called: a. a revolving credit. b. an irrevocable credit. c. a standby credit. d. a transferable credit. 15. The U.S. Export-Import Bank is the largest U.S. export financing agency that can provide: a. financing through the World Bank. b. financing for imports by U.S. firms. c. guarantees on loans made by commercial banks. d. all of the above. 16. Under the UCP, the description of the goods in the commercial invoice must correspond with the description in the credit. In all other documents, the goods may be described_ a. in perfect conformance with the credit. b. in general terms not inconsistent with the description of the goods in the credit. c. in specific terms as requested by the buyer. d. in general terms consistent with the contract for the sale of goods. 17. If a U.S. exporter is concerned about political and economic stability in the buyer's country, the exporter should request which of the following payment terms: a. cash against documents. b. irrevocable letter of credit. c. confirmed letter of credit. d. open account terms. - - - 18. The U.S. government agency that provides guarantees on loans or credit terms made by U.S. commercial banks or U.S. exporters to foreign buyers of U.S. made merchandise called: a. The World Bank. b. Eximbank. c. Commodity Credit Corporation. d. The Foreign Credit Insurance Association. 19. The buyer in a letter of credit transaction is called the: a. account Party. b. beneficiary. c. exporter. d. issuer. 20. The seller in a letter of credit transaction is called the: a. account Party. b. beneficiary. c. importer. d. issuer. 21. Most documentary discrepancies that occur in a letter of credit transaction are: a. a result of fraud and misrepresentation. b. a result of the desire to profit from the transaction. c. a result of incomplete or inconsistent information. d. banking errors. 22. Assume that DownPillow sells pillows to a Japanese buyer and forwards documents and a draft for acceptance. Assume also that DownPillow discounts the trade acceptance to a U.S. bank, which then discounts the instrument in the credit markets. If the pillows turn out to be moldy and worthless, which of the following statement(s) is (are) true? a. The Japanese buyer does not have to pay because the pillows are damaged. b. The U.S. bank must reimburse whoever bought the instrument and can bring a lawsuit for payment against DownPillow. c. The Japanese buyer must still honor and pay the acceptance upon presentation. d. A and B. e. All of the above. 23. A holder of a negotiable instrument cannot claim to be a holder in due course if (s)he: a. possesses a negotiable instrument. b. knows the instrument is overdue. c. unknowingly holds an instrument with a forged signature. d. takes the instrument free from disputes between the drawer and drawee. Homework # 4 24. Which of the following is (are) true concerning the UCP? a. The UCP is a standardized set of rules in virtually all nations. b. Because the UCP was drafted by the ICC and is recognized in most states, it automatically governs international letters of credit. c. The UCP will govern a letter of credit only if its provisions are incorporated into the letter of credit by reference. d. A and C only. e. A and B only. 25. Seller receives a letter of credit from a foreign buyer covering "1,000 standard-sized bed pillows." Seller's export manager completes an invoice for "1,000 bed pillows, size 20 by 26 inches" (this is the internationally accepted standard size for pillows). Which of the following is false? a. If the issuing bank accepts or pays against documents, it will be liable to the account party. b. The issuing bank must accept or pay against documents because 20 by 26 is standard and the goods conform to the contract. c. The issuing bank may refuse to accept or to pay the draft upon presentation of the invoice. d. If the buyer waives the defect in the invoice, the bank must accept or pay the draft. Multiple Choice Indicate the answer choice that best completes the statement or answers the question. - - 1. An international draft is an order from the seller to the buyer or the buyer's bank to pay the seller upon delivery of goods or the presentation of documents. Thus, the seller is both: a. the drawer and the drawee. b. the drawer and the payee. c. the drawee and the payee. d. the seller is only the drawer. 2. A documentary draft issued for the purchase of goods by ABC Co. payable to XYZ Co., payable upon and the specialized name for the presentation, defines ABC Co. as the XYZ Co. as the draft is documentary a. drawee; drawer; sight draft. b. drawer; drawee; sight draft. c. drawee; drawer; documents against acceptance. d. drawer; drawee; cash against documents. 3. A draft due at a future date or after a specified period of time that has been signed by the buyer is called: a. sight draft. b. time draft. c. trade acceptance. d. all of the above. 4. If the buyer's or seller's bank stamps its name, date, and signature on the face of a draft, it becomes a: a. trade acceptance. b. banker's acceptance. c. letter of credit. d. none of the above. 5. Bills of exchange are governed in the U.S. by the countries by the in England by the ,and in over 20 other a. Bills of Exchange Act; Convention on Bills of Exchange and Promissory Notes; The Uniform Commercial Code. b. Uniform Commercial Code; Convention on Bills of Exchange and Promissory Notes; Bills of Exchange Act. c. Convention on Bills of Exchange and Promissory Notes; Bills of Exchange Act; Uniform Commercial Code. d. Uniform Commercial Code; Bills of Exchange Act; Convention on Bills of Exchange and Promissory Notes. Homework # 4 - 6. A letter of credit is a contract between: a. the seller and the buyer's bank. b. the buyer's bank and the seller's bank. c. the sellers and their own bank. d. the buyers and their own bank. 7. The internationally accepted body of rules pertaining to letters of credit is: a. Article 5 of the Uniform Commercial Code. b. Uniform Customs and Practices for Documentary Credits. c. Convention on Bills of Exchange and Promissory Notes. d. Uniform Code of Practice for Letters of Credit. 8. The bank that is responsible for inspecting the documents to be sure they are in order, remitting payment to the seller, and negotiating the documents to the buyer is called: a. issuing bank. b. negotiating bank. c. advising bank. d. lading bank. 9. The rule that usually prevails for interpreting documents that are submitted to a bank for payment under a letter of credit is commonly called the: a. good faith rule. b. reasonable compliance rule. c. strict compliance rule. d. holder in due course rule. 10. In the event that a discrepancy is found in the documents presented under a letter of credit, the bank may request a waiver or: a. resubmit the draft. b. void the transaction. c. refuse delivery. d. refuse to pay against documents. 11. When the Seller's bank guarantees payment under the letter of credit issued by buyer's bank it becomes a(n): a. confirmed letter of credit. b. irrevocable letter of credit. c. letter of credit with stipulations. d. standby letter of credit. Homework # 4 12. The type of letter of credit issued to guarantee that a party will fulfill its obligations under a service, construction, or sales contract is called: a. an Irrevocable Letter of Credit. b. standby Letter of Credit. c. letter of Warranty Credit. d. confirmed Letter of Credit. 13. The type of letter of credit that can be split up between many suppliers, each able to present their own documents for payment and allowing the trader to take his profits from the balance of the credit, is called: a. an irrevocable credit. b. a revolving credit. c. standby credit. d. transferable credit. 14. The type of credit that allows the use of one credit instead of many to be used with the maximum amount available during a certain period of time is called: a. a revolving credit. b. an irrevocable credit. c. a standby credit. d. a transferable credit. 15. The U.S. Export-Import Bank is the largest U.S. export financing agency that can provide: a. financing through the World Bank. b. financing for imports by U.S. firms. c. guarantees on loans made by commercial banks. d. all of the above. 16. Under the UCP, the description of the goods in the commercial invoice must correspond with the description in the credit. In all other documents, the goods may be described_ a. in perfect conformance with the credit. b. in general terms not inconsistent with the description of the goods in the credit. c. in specific terms as requested by the buyer. d. in general terms consistent with the contract for the sale of goods. 17. If a U.S. exporter is concerned about political and economic stability in the buyer's country, the exporter should request which of the following payment terms: a. cash against documents. b. irrevocable letter of credit. c. confirmed letter of credit. d. open account terms. - - - 18. The U.S. government agency that provides guarantees on loans or credit terms made by U.S. commercial banks or U.S. exporters to foreign buyers of U.S. made merchandise called: a. The World Bank. b. Eximbank. c. Commodity Credit Corporation. d. The Foreign Credit Insurance Association. 19. The buyer in a letter of credit transaction is called the: a. account Party. b. beneficiary. c. exporter. d. issuer. 20. The seller in a letter of credit transaction is called the: a. account Party. b. beneficiary. c. importer. d. issuer. 21. Most documentary discrepancies that occur in a letter of credit transaction are: a. a result of fraud and misrepresentation. b. a result of the desire to profit from the transaction. c. a result of incomplete or inconsistent information. d. banking errors. 22. Assume that DownPillow sells pillows to a Japanese buyer and forwards documents and a draft for acceptance. Assume also that DownPillow discounts the trade acceptance to a U.S. bank, which then discounts the instrument in the credit markets. If the pillows turn out to be moldy and worthless, which of the following statement(s) is (are) true? a. The Japanese buyer does not have to pay because the pillows are damaged. b. The U.S. bank must reimburse whoever bought the instrument and can bring a lawsuit for payment against DownPillow. c. The Japanese buyer must still honor and pay the acceptance upon presentation. d. A and B. e. All of the above. 23. A holder of a negotiable instrument cannot claim to be a holder in due course if (s)he: a. possesses a negotiable instrument. b. knows the instrument is overdue. c. unknowingly holds an instrument with a forged signature. d. takes the instrument free from disputes between the drawer and drawee. Homework # 4 24. Which of the following is (are) true concerning the UCP? a. The UCP is a standardized set of rules in virtually all nations. b. Because the UCP was drafted by the ICC and is recognized in most states, it automatically governs international letters of credit. c. The UCP will govern a letter of credit only if its provisions are incorporated into the letter of credit by reference. d. A and C only. e. A and B only. 25. Seller receives a letter of credit from a foreign buyer covering "1,000 standard-sized bed pillows." Seller's export manager completes an invoice for "1,000 bed pillows, size 20 by 26 inches" (this is the internationally accepted standard size for pillows). Which of the following is false? a. If the issuing bank accepts or pays against documents, it will be liable to the account party. b. The issuing bank must accept or pay against documents because 20 by 26 is standard and the goods conform to the contract. c. The issuing bank may refuse to accept or to pay the draft upon presentation of the invoice. d. If the buyer waives the defect in the invoice, the bank must accept or pay the draft. Multiple Choice Indicate the answer choice that best completes the statement or answers the question. - - 1. An international draft is an order from the seller to the buyer or the buyer's bank to pay the seller upon delivery of goods or the presentation of documents. Thus, the seller is both: a. the drawer and the drawee. b. the drawer and the payee. c. the drawee and the payee. d. the seller is only the drawer. 2. A documentary draft issued for the purchase of goods by ABC Co. payable to XYZ Co., payable upon and the specialized name for the presentation, defines ABC Co. as the XYZ Co. as the draft is documentary a. drawee; drawer; sight draft. b. drawer; drawee; sight draft. c. drawee; drawer; documents against acceptance. d. drawer; drawee; cash against documents. 3. A draft due at a future date or after a specified period of time that has been signed by the buyer is called: a. sight draft. b. time draft. c. trade acceptance. d. all of the above. 4. If the buyer's or seller's bank stamps its name, date, and signature on the face of a draft, it becomes a: a. trade acceptance. b. banker's acceptance. c. letter of credit. d. none of the above. 5. Bills of exchange are governed in the U.S. by the countries by the in England by the ,and in over 20 other a. Bills of Exchange Act; Convention on Bills of Exchange and Promissory Notes; The Uniform Commercial Code. b. Uniform Commercial Code; Convention on Bills of Exchange and Promissory Notes; Bills of Exchange Act. c. Convention on Bills of Exchange and Promissory Notes; Bills of Exchange Act; Uniform Commercial Code. d. Uniform Commercial Code; Bills of Exchange Act; Convention on Bills of Exchange and Promissory Notes. Homework # 4 - 6. A letter of credit is a contract between: a. the seller and the buyer's bank. b. the buyer's bank and the seller's bank. c. the sellers and their own bank. d. the buyers and their own bank. 7. The internationally accepted body of rules pertaining to letters of credit is: a. Article 5 of the Uniform Commercial Code. b. Uniform Customs and Practices for Documentary Credits. c. Convention on Bills of Exchange and Promissory Notes. d. Uniform Code of Practice for Letters of Credit. 8. The bank that is responsible for inspecting the documents to be sure they are in order, remitting payment to the seller, and negotiating the documents to the buyer is called: a. issuing bank. b. negotiating bank. c. advising bank. d. lading bank. 9. The rule that usually prevails for interpreting documents that are submitted to a bank for payment under a letter of credit is commonly called the: a. good faith rule. b. reasonable compliance rule. c. strict compliance rule. d. holder in due course rule. 10. In the event that a discrepancy is found in the documents presented under a letter of credit, the bank may request a waiver or: a. resubmit the draft. b. void the transaction. c. refuse delivery. d. refuse to pay against documents. 11. When the Seller's bank guarantees payment under the letter of credit issued by buyer's bank it becomes a(n): a. confirmed letter of credit. b. irrevocable letter of credit. c. letter of credit with stipulations. d. standby letter of credit. Homework # 4 12. The type of letter of credit issued to guarantee that a party will fulfill its obligations under a service, construction, or sales contract is called: a. an Irrevocable Letter of Credit. b. standby Letter of Credit. c. letter of Warranty Credit. d. confirmed Letter of Credit. 13. The type of letter of credit that can be split up between many suppliers, each able to present their own documents for payment and allowing the trader to take his profits from the balance of the credit, is called: a. an irrevocable credit. b. a revolving credit. c. standby credit. d. transferable credit. 14. The type of credit that allows the use of one credit instead of many to be used with the maximum amount available during a certain period of time is called: a. a revolving credit. b. an irrevocable credit. c. a standby credit. d. a transferable credit. 15. The U.S. Export-Import Bank is the largest U.S. export financing agency that can provide: a. financing through the World Bank. b. financing for imports by U.S. firms. c. guarantees on loans made by commercial banks. d. all of the above. 16. Under the UCP, the description of the goods in the commercial invoice must correspond with the description in the credit. In all other documents, the goods may be described_ a. in perfect conformance with the credit. b. in general terms not inconsistent with the description of the goods in the credit. c. in specific terms as requested by the buyer. d. in general terms consistent with the contract for the sale of goods. 17. If a U.S. exporter is concerned about political and economic stability in the buyer's country, the exporter should request which of the following payment terms: a. cash against documents. b. irrevocable letter of credit. c. confirmed letter of credit. d. open account terms. - - - 18. The U.S. government agency that provides guarantees on loans or credit terms made by U.S. commercial banks or U.S. exporters to foreign buyers of U.S. made merchandise called: a. The World Bank. b. Eximbank. c. Commodity Credit Corporation. d. The Foreign Credit Insurance Association. 19. The buyer in a letter of credit transaction is called the: a. account Party. b. beneficiary. c. exporter. d. issuer. 20. The seller in a letter of credit transaction is called the: a. account Party. b. beneficiary. c. importer. d. issuer. 21. Most documentary discrepancies that occur in a letter of credit transaction are: a. a result of fraud and misrepresentation. b. a result of the desire to profit from the transaction. c. a result of incomplete or inconsistent information. d. banking errors. 22. Assume that DownPillow sells pillows to a Japanese buyer and forwards documents and a draft for acceptance. Assume also that DownPillow discounts the trade acceptance to a U.S. bank, which then discounts the instrument in the credit markets. If the pillows turn out to be moldy and worthless, which of the following statement(s) is (are) true? a. The Japanese buyer does not have to pay because the pillows are damaged. b. The U.S. bank must reimburse whoever bought the instrument and can bring a lawsuit for payment against DownPillow. c. The Japanese buyer must still honor and pay the acceptance upon presentation. d. A and B. e. All of the above. 23. A holder of a negotiable instrument cannot claim to be a holder in due course if (s)he: a. possesses a negotiable instrument. b. knows the instrument is overdue. c. unknowingly holds an instrument with a forged signature. d. takes the instrument free from disputes between the drawer and drawee. Homework # 4 24. Which of the following is (are) true concerning the UCP? a. The UCP is a standardized set of rules in virtually all nations. b. Because the UCP was drafted by the ICC and is recognized in most states, it automatically governs international letters of credit. c. The UCP will govern a letter of credit only if its provisions are incorporated into the letter of credit by reference. d. A and C only. e. A and B only. 25. Seller receives a letter of credit from a foreign buyer covering "1,000 standard-sized bed pillows." Seller's export manager completes an invoice for "1,000 bed pillows, size 20 by 26 inches" (this is the internationally accepted standard size for pillows). Which of the following is false? a. If the issuing bank accepts or pays against documents, it will be liable to the account party. b. The issuing bank must accept or pay against documents because 20 by 26 is standard and the goods conform to the contract. c. The issuing bank may refuse to accept or to pay the draft upon presentation of the invoice. d. If the buyer waives the defect in the invoice, the bank must accept or pay the draft.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 c the drawee and the payee The seller is the drawee because they are the party who is being asked to pay the buyer upon delivery The sell...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started