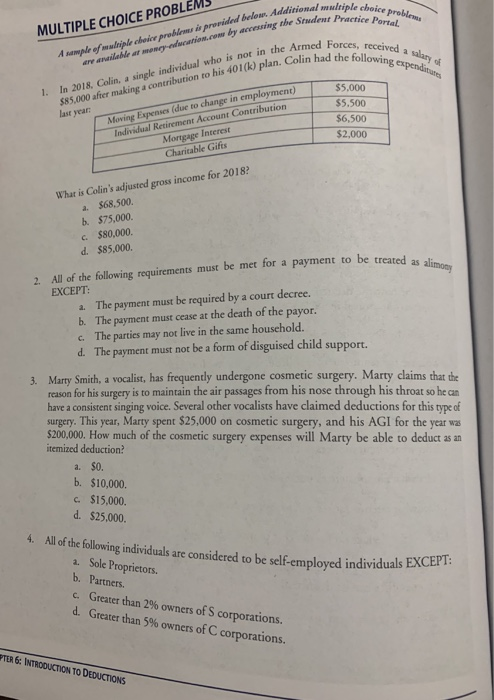

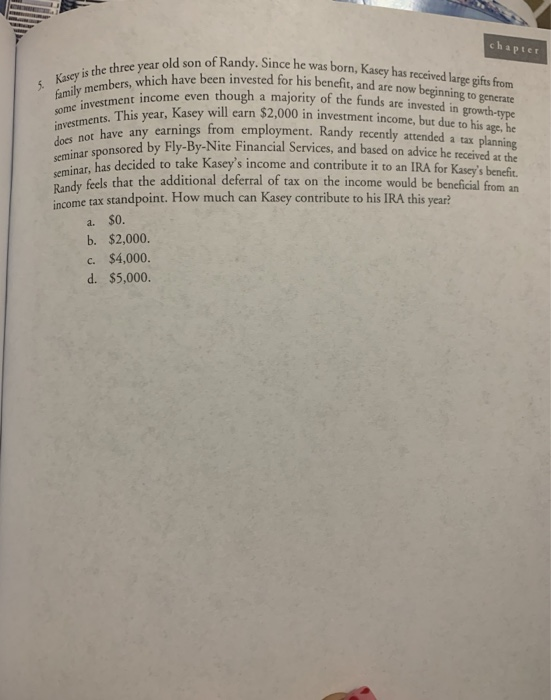

MULTIPLE CHOICE PROBLE A sample of muliple choice problesms is provided below. Additional multiple choice problems are anailable ar moncy-education.com by accessing the Student Practice Portal salary o 1. In 2018, Colin, a single individual who is not in the Armed Forces, received as $85,000 after making a contribution to his 401(k) plan. Colin had the following expenditures Moving Expenses (due to change in employment) Individual Retirement Account Contribution Mortgage Interest Charitable Gifts $5,000 $5.500 last year $6,500 $2,000 What is Colin's adjusted gross income for 2018? a. $68,500. b. $75,000. c. $80,000. d. $85,000. alimony 2. All of the following requirements must be met for a payment to be treated as a EXCEPT: The payment must be required by a court decree. b. The payment must cease at the death of the payor. c The parties may not live in the same household. d. The payment must not be a form of disguised child support. a. 3. Marty Smith, a vocalist, has frequently undergone cosmetic surgery. Marty claims that the reason for his surgery is to maintain the air passages from his nose through his throat so he an have a consistent singing voice. Several other vocalists have claimed deductions for this type of This year, Marty spent $25,000 on cosmetic surgery, and his AGI for the year was surgery. $200,000. How much of the cosmetic surgery expenses will Marty be able to deduct as an itemized deduction? a. $0. b. $10,000. c. $15,000. d. $25,000. 4. All of the following individuals are considered to be self-employed individuals EXCEPT: a. Sole Proprietors b. Partners. c.Greater than 2 % owners of S corporations. d. Greater than 5% owners of C corporations. TER 6: INTRODUCTION TO DEDUCTIONS chapter 5 Kasey is the three year old son of Randy. Since he was born, Kasey has received large gifts from family members, which have been invested for his benefit, and are now beginning to generate some investment income even though a majority of the funds are invested in growth-type investments. This year, Kasey will earn $2,000 in investment income, but due to his age, he does not have any earnings from employment. Randy recently attended a tax planning seminar sponsored by Fly-By-Nite Financial Services, and based on advice he received at the seminar, has decided to take Kasey's income and contribute it to an IRA for Kasey's benefit. Randy feels that the additional deferral of tax on the income would be beneficial from an income tax standpoint. How much can Kasey contribute to his IRA this year? $0. a. b. $2,000 $4,000. C. d. $5,000. MULTIPLE CHOICE PROBLE A sample of muliple choice problesms is provided below. Additional multiple choice problems are anailable ar moncy-education.com by accessing the Student Practice Portal salary o 1. In 2018, Colin, a single individual who is not in the Armed Forces, received as $85,000 after making a contribution to his 401(k) plan. Colin had the following expenditures Moving Expenses (due to change in employment) Individual Retirement Account Contribution Mortgage Interest Charitable Gifts $5,000 $5.500 last year $6,500 $2,000 What is Colin's adjusted gross income for 2018? a. $68,500. b. $75,000. c. $80,000. d. $85,000. alimony 2. All of the following requirements must be met for a payment to be treated as a EXCEPT: The payment must be required by a court decree. b. The payment must cease at the death of the payor. c The parties may not live in the same household. d. The payment must not be a form of disguised child support. a. 3. Marty Smith, a vocalist, has frequently undergone cosmetic surgery. Marty claims that the reason for his surgery is to maintain the air passages from his nose through his throat so he an have a consistent singing voice. Several other vocalists have claimed deductions for this type of This year, Marty spent $25,000 on cosmetic surgery, and his AGI for the year was surgery. $200,000. How much of the cosmetic surgery expenses will Marty be able to deduct as an itemized deduction? a. $0. b. $10,000. c. $15,000. d. $25,000. 4. All of the following individuals are considered to be self-employed individuals EXCEPT: a. Sole Proprietors b. Partners. c.Greater than 2 % owners of S corporations. d. Greater than 5% owners of C corporations. TER 6: INTRODUCTION TO DEDUCTIONS chapter 5 Kasey is the three year old son of Randy. Since he was born, Kasey has received large gifts from family members, which have been invested for his benefit, and are now beginning to generate some investment income even though a majority of the funds are invested in growth-type investments. This year, Kasey will earn $2,000 in investment income, but due to his age, he does not have any earnings from employment. Randy recently attended a tax planning seminar sponsored by Fly-By-Nite Financial Services, and based on advice he received at the seminar, has decided to take Kasey's income and contribute it to an IRA for Kasey's benefit. Randy feels that the additional deferral of tax on the income would be beneficial from an income tax standpoint. How much can Kasey contribute to his IRA this year? $0. a. b. $2,000 $4,000. C. d. $5,000