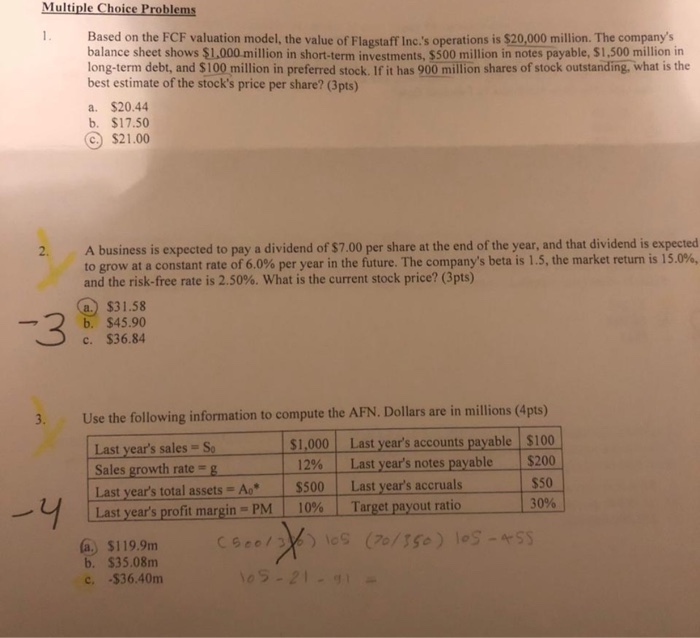

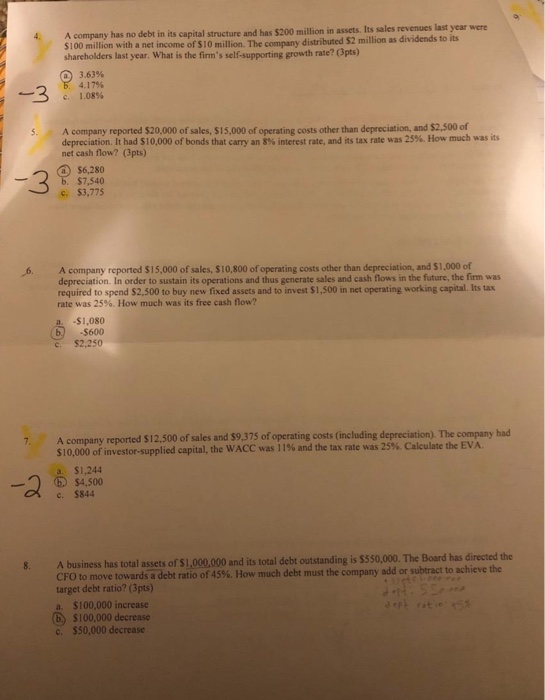

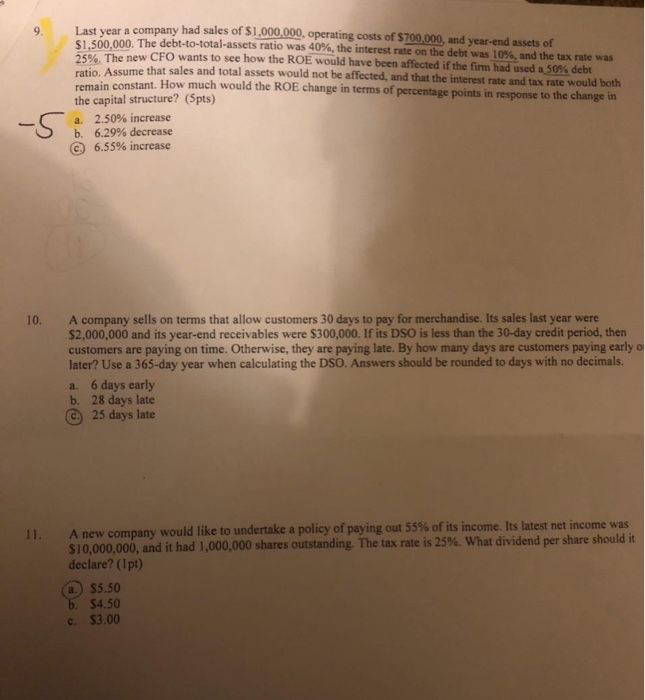

Multiple Choice Problems Based on the FCF valuation model, the value of Flagstaff Ine's operations is $20,000 million. The company balance sheet shows $1.000 million in short-term investments, $500 million in notes payable, $1.500 million in long-term debt, and $100 million in preferred stock. If it has 900 million shares of stock outstanding, what is the best estimate of the stock's price per share? (3pts) a. $20.44 b. $17.50 $21.00 A business is expected to pay a dividend of $7.00 per share at the end of the year, and that dividend is expected to grow at a constant rate of 6.0% per year in the future. The company's beta is 1.5, the market return is 15.0%, and the risk-free rate is 2.50%. What is the current stock price? (3pts) a.) $31.58 b. $45.90 c. $36.84 -Y Use the following information to compute the AFN. Dollars are in millions (4pts) Last year's sales - So $1,000 Last year's accounts payable $100 Sales growth rate = 8 12% Last year's notes payable $200 Last year's total assets = A.* $500 Last year's accruals $50 Last year's profit margin - PM 10% Target payout ratio 30% (a. $119.9m (Bool ) 105 (20/350) los-455 b. $35.08m c. -$36.40m 105-21-91 = A company has no debt in its capital structure and has $200 million in assets. Its sales revenues last year were $100 million with a net income of $10 million. The company distributed $2 million as dividends to its shareholders last year. What is the firm's self-supporting growth rate? (3pts) @ 3.63% 54.1796 c. 1.08% - 1-39 A company reported $20,000 of sales, S15,000 of operating costs other than depreciation, and $2,500 of depreciation. It had $10,000 of bonds that carry an 8% interest rate, and its tax rate was 25%. How much was its net cash flow? (3pts) @ $6,280 b. $7,540 c. 53,775 A company reported S15,000 of sales, $10,800 of operating costs other than depreciation, and 51.000 of depreciation. In order to sustain its operations and thus generate sales and cash flows in the future, the firm was required to spend $2,500 to buy new fixed assets and to invest $1,500 in net operating working capital. Its tax rate was 25%. How much was its free cash flow? a $1,080 (b) 5600 c. $2,250 A company reported $12.500 of sales and 59.375 of operating costs (including depreciation). The company had $10,000 of investor-supplied capital, the WACC was 11% and the tax rate was 25%. Calculate the EVA a $1,244 ( $4,500 c. $844 A business has total assets of $1,000,000 and its total debt outstanding is $550,000. The Board has directed the CFO to move towards a debt ratio of 45%. How much debt must the company add or subtract to achieve the target debt ratio? (3pts) a $100,000 increase b. $100,000 decrease c. $50,000 decrease Last vear a company had sales of $1,000,000, operating costs of $700,000, and year-end assets of 000. The debt-to-total-assets ratio was 40%, the interest rate on the debt was 10% and the tax rate was 6602 The new CFO wants to see how the ROE would have been affected if the firm had used a 50% debt Assume that sales and total assets would not be affected, and that the interest rate and tax rate would both in constant. How much would the ROE change in terms of percentage points in response to the change in the capital structure? (5pts) a. 2.50% increase b. 6.29% decrease C 6.55% increase -5 : 3 10. A company sells on terms that allow customers 30 days to pay for merchandise. Its sales last year were $2,000,000 and its year-end receivables were $300,000. If its DSO is less than the 30-day credit period, then customers are paying on time. Otherwise, they are paying late. By how many days are customers paying early later? Use a 365-day year when calculating the DSD. Answers should be rounded to days with no decimals. a. 6 days early b. 28 days late 25 days late A new company would like to undertake a policy of paying out 55% of its income. Its latest net income was $10,000,000, and it had 1,000,000 shares outstanding. The tax rate is 25%. What dividend per share should it declare? (1 pt) a. 55.50 b. $4.50 c. $3.00