Answered step by step

Verified Expert Solution

Question

1 Approved Answer

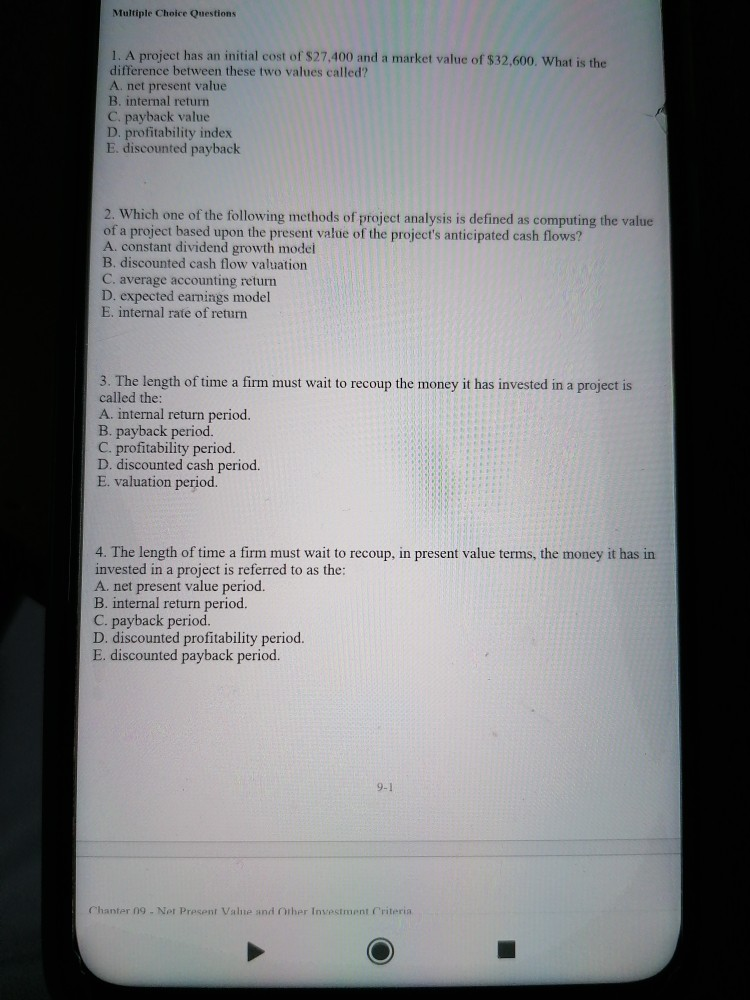

Multiple Choice Questions 1. A project has an initial cost of $27.400 and a market value of $32,600. What is the difference between these two

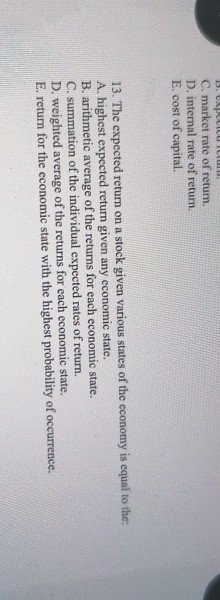

Multiple Choice Questions 1. A project has an initial cost of $27.400 and a market value of $32,600. What is the difference between these two values called? A. net present value B. internal return C. payback value D. profitability index E. discounted payback 2. Which one of the following methods of project analysis is defined as computing the value of a project based upon the present value of the project's anticipated cash flows? A. constant dividend growth model B. discounted cash flow valuation C. average accounting return D. expected earnings model E. internal rate of return 3. The length of time a firm must wait to recoup the money it has invested in a project is called the: A. internal return period. B. payback period. C. profitability period. D. discounted cash period. E. valuation period. 4. The length of time a firm must wait to recoup, in present value terms, the money it has in invested in a project is referred to as the: A. net present value period. B. internal return period. C. payback period. D. discounted profitability period. E. discounted payback period. 9-1 Chanter n9. Ner Present Value and Other Investment Criteria D. UN C market rate of return. D. internal rate of return E. cost of capital. 13. The expected return on a stock given various states of the economy is equal to the: A. highest expected return given any economic state. B. arithmetic average of the returns for each economic state. C. summation of the individual expected rates of return. D. weighted average of the returns for each economic state. E. return for the economic state with the highest probability of occurrence

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started